Question: answer with an explanation please 4. The direct material budget is prepared on the basis of the d. cash budget b. master budget. C. capital

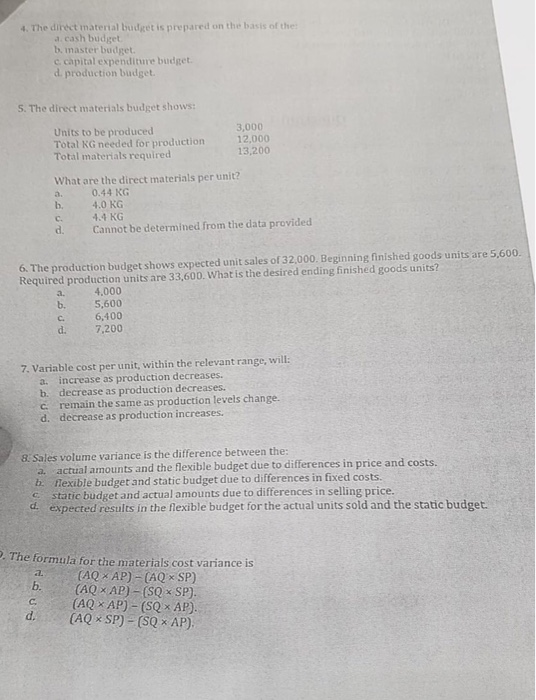

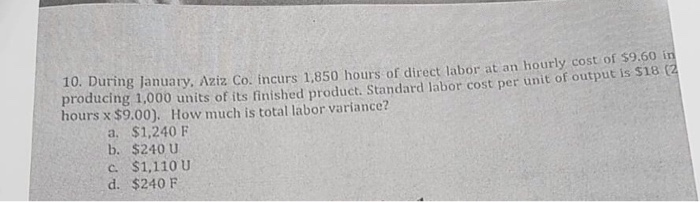

4. The direct material budget is prepared on the basis of the d. cash budget b. master budget. C. capital expenditure budget. d. production budget. 5. The direct materials budget shows: Units to be produced Total RG needed for production Total materials required 3,000 12,000 13,200 What are the direct materials per unit? 0.44 KG 4.0 KG 4.4 KG Cannot be determined from the data provided 6. The production budget shows expected unit sales of 32,000. Beginning finished goods units are 5,600. Required production units are 33.600. What is the desired ending finished goods units? 4.000 5,600 6,400 7,200 7. Variable cost per unit, within the relevant range, will: a increase as production decreases. b. decrease as production decreases. c remain the same as production levels change. d. decrease as production increases. 8. Sales volume variance is the difference between the: a actual amounts and the flexible budget due to differences in price and costs. h flexible budget and static budget due to differences in fixed costs. c static budget and actual amounts due to differences in selling price. d. expected results in the flexible budget for the actual units sold and the static budget. 2. The formula for the materials cost variance is (AQ XAP) - (AQ SP) (AQ X AP) - (SQ * SP). (AQ X AP) - (SQ AP). (AQ - SP) - (SQ x AP). ng January, Aziz Co. Incurs 1,850 hours of direct labor at an hourly cost of $9.60 in ducing 1,000 units of its finished product. Standard labor cost per unit of output is $18.4 hours x $9.00). How much is total labor variance? a $1,240 F b. $240 U c. $1,110 U d. $240 F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts