Question: answer with calculations pls Betsy Strand's regular hourly wage rate is $16, and she receives an hourly rate of $24 for work in excess of

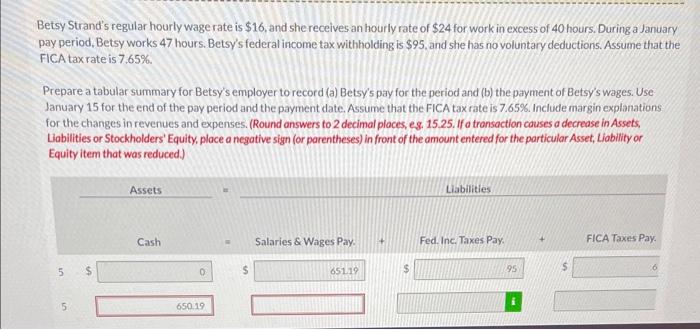

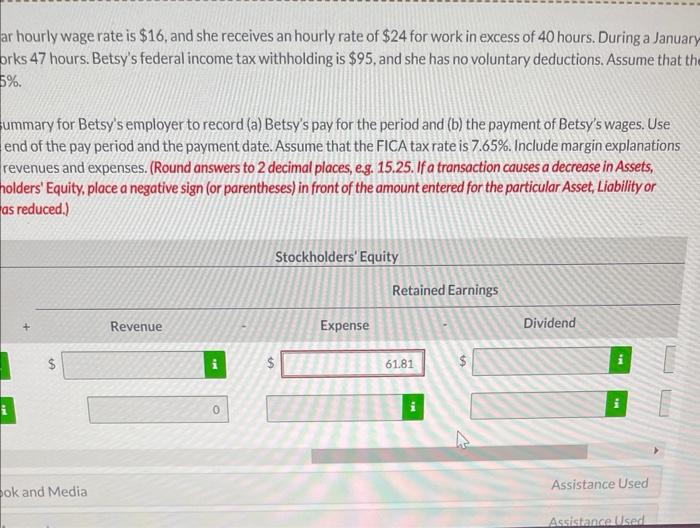

Betsy Strand's regular hourly wage rate is $16, and she receives an hourly rate of $24 for work in excess of 40 hours. During a January pay period, Betsy works 47 hours. Betsy's federal income tax withholding is $95, and she has no voluntary deductions. Assume that the FICA tax rate is 7.65%. Prepare a tabular summary for Betsy's employer to record (a) Betsy's pay for the period and (b) the payment of Betsy's wages. Use January 15 for the end of the pay period and the payment date. Assume that the FICA tax rate is 7.65%. Include margin explanations for the changes in revenues and expenses. (Round answers to 2 decimal places, eg. 15.25. If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) 5 s Assets Cash 0 650.19 Salaries & Wages Pay. 651.19 14 Liabilities Fed. Inc. Taxes Pay. 95 $ FICA Taxes Pay. ar hourly wage rate is $16, and she receives an hourly rate of $24 for work in excess of 40 hours. During a January orks 47 hours. Betsy's federal income tax withholding is $95, and she has no voluntary deductions. Assume that the 5%. summary for Betsy's employer to record (a) Betsy's pay for the period and (b) the payment of Betsy's wages. Use end of the pay period and the payment date. Assume that the FICA tax rate is 7.65%. Include margin explanations revenues and expenses. (Round answers to 2 decimal places, e.g. 15.25. If a transaction causes a decrease in Assets, holders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or as reduced.) 10 ok and Media Revenue i 0 Stockholders' Equity Expense Retained Earnings 61.81 IM Dividend M IM Assistance Used Assistance Used LEM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts