Question: ANSWER WITH EXCEL A real estate agents tool Task #1 (spreadsheet 1): John walked into your office asking for $300,000 to buy a house. Your

ANSWER WITH EXCEL

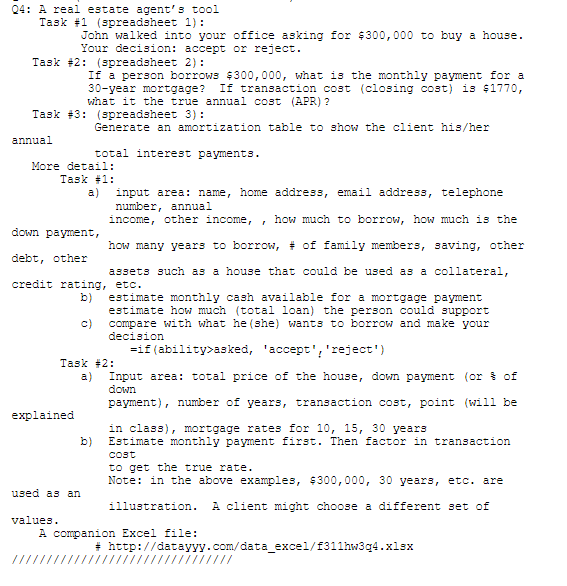

A real estate agents tool Task #1 (spreadsheet 1): John walked into your office asking for $300,000 to buy a house. Your decision: accept or reject. Task #2: (spreadsheet 2): If a person borrows $300,000, what is the monthly payment for a 30-year mortgage? If transaction cost (closing cost) is $1770, what it the true annual cost (APR)? Task #3: (spreadsheet 3): Generate an amortization table to show the client his/her annual total interest payments.

Here is the excel link mentioned at the end

http://datayyy.com/data_excel/f311hw3q4.xlsx

04: A real estate agent's tool Task #1 (spreadsheet 1): John walked into your office asking for $300,000 to buy a house. Your decision: accept or reject. Task #2: (spreadsheet 2): If a person borrows $300,000, what is the monthly payment for a 30-year mortgage? If transaction cost (closing cost) is $1770, what it the true annual cost (APR)? Task #3: (spreadsheet 3): Generate an amortization table to show the client his/her annual total interest payments. More detail: Task #1: a) input area: name, home address, email address, telephone number, annual income, other income, how much to borrow, how much is the down payment, how many years to borrow, # of family members, saving, other debt, other assets such as a house that could be used as a collateral, credit rating, etc. b) estimate monthly cash available for a mortgage payment estimate how much (total loan) the person could support c) compare with what he (she) wants to borrow and make your decision =if (ability>asked, 'accept', 'reject') Task #2: a) Input area: total price of the house, down payment (or of down payment), number of years, transaction cost, point (will be explained in class), mortgage rates for 10, 15, 30 years b) Estimate monthly payment first. Then factor in transaction cost to get the true rate. Note: in the above examples, $300,000, 30 years, etc. are used as an illustration. A client might choose a different set of values. A companion Excel file: # http://datayyy.com/data_excel/f311h394.xlsx 04: A real estate agent's tool Task #1 (spreadsheet 1): John walked into your office asking for $300,000 to buy a house. Your decision: accept or reject. Task #2: (spreadsheet 2): If a person borrows $300,000, what is the monthly payment for a 30-year mortgage? If transaction cost (closing cost) is $1770, what it the true annual cost (APR)? Task #3: (spreadsheet 3): Generate an amortization table to show the client his/her annual total interest payments. More detail: Task #1: a) input area: name, home address, email address, telephone number, annual income, other income, how much to borrow, how much is the down payment, how many years to borrow, # of family members, saving, other debt, other assets such as a house that could be used as a collateral, credit rating, etc. b) estimate monthly cash available for a mortgage payment estimate how much (total loan) the person could support c) compare with what he (she) wants to borrow and make your decision =if (ability>asked, 'accept', 'reject') Task #2: a) Input area: total price of the house, down payment (or of down payment), number of years, transaction cost, point (will be explained in class), mortgage rates for 10, 15, 30 years b) Estimate monthly payment first. Then factor in transaction cost to get the true rate. Note: in the above examples, $300,000, 30 years, etc. are used as an illustration. A client might choose a different set of values. A companion Excel file: # http://datayyy.com/data_excel/f311h394.xlsx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts