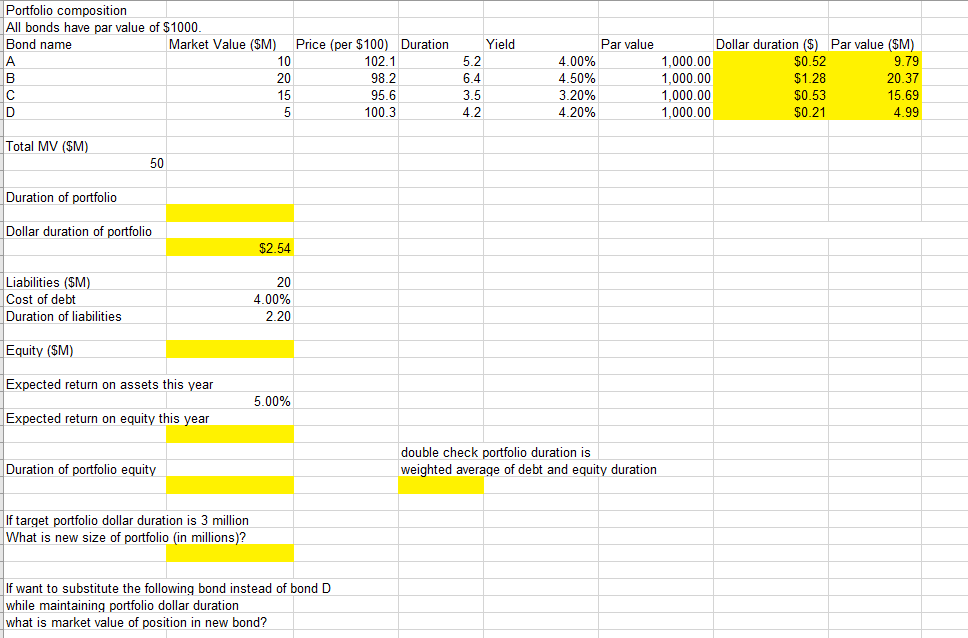

Question: Answer with excel formulas please Portfolio composition All bonds have par value of $1000. Total MV ($M) 50 Duration of portfolio Dollar duration of portfolio

Answer with excel formulas please

Portfolio composition All bonds have par value of $1000. Total MV (\$M) 50 Duration of portfolio Dollar duration of portfolio \begin{tabular}{|lr|} \hline Liabilities ($M) & 20 \\ \hline Cost of debt & 4.00% \\ \hline Duration of liabilities & 2.20 \\ \hline \end{tabular} Equity (\$M) Expected return on assets this year Expected return on equity this year double check portfolio duration is Duration of portfolio equity weighted average of debt and equity duration If target portfolio dollar duration is 3 million What is new size of portfolio (in millions)? If want to substitute the following bond instead of bond D while maintaining portfolio dollar duration what is market value of position in new bond? Portfolio composition All bonds have par value of $1000. Total MV (\$M) 50 Duration of portfolio Dollar duration of portfolio \begin{tabular}{|lr|} \hline Liabilities ($M) & 20 \\ \hline Cost of debt & 4.00% \\ \hline Duration of liabilities & 2.20 \\ \hline \end{tabular} Equity (\$M) Expected return on assets this year Expected return on equity this year double check portfolio duration is Duration of portfolio equity weighted average of debt and equity duration If target portfolio dollar duration is 3 million What is new size of portfolio (in millions)? If want to substitute the following bond instead of bond D while maintaining portfolio dollar duration what is market value of position in new bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts