Question: answer with excel formulas please You are given with two equity options. i) Southern Bakeries just paid its annual dividend of $.56 a share. The

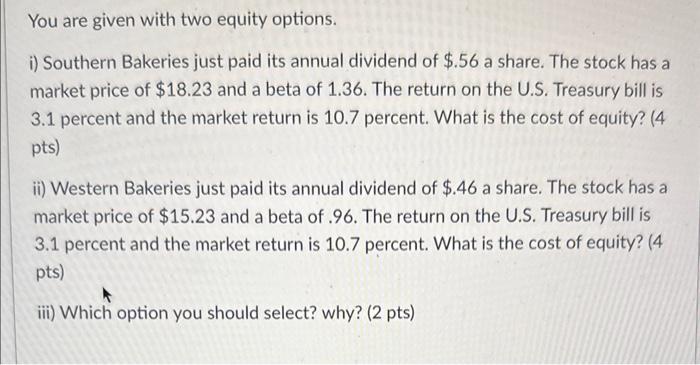

You are given with two equity options. i) Southern Bakeries just paid its annual dividend of $.56 a share. The stock has a market price of $18.23 and a beta of 1.36. The return on the U.S. Treasury bill is 3.1 percent and the market return is 10.7 percent. What is the cost of equity? (4 pts) ii) Western Bakeries just paid its annual dividend of $.46 a share. The stock has a market price of $15.23 and a beta of .96. The return on the U.S. Treasury bill is 3.1 percent and the market return is 10.7 percent. What is the cost of equity? (4 pts) iii) Which option you should select? why? (2 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts