Question: answer with explaination and solution Problem 4Capitalization of interest. On March 1, Mocl Co. began construction of a small building. The following expenditures were incurred

answer with explaination and solution

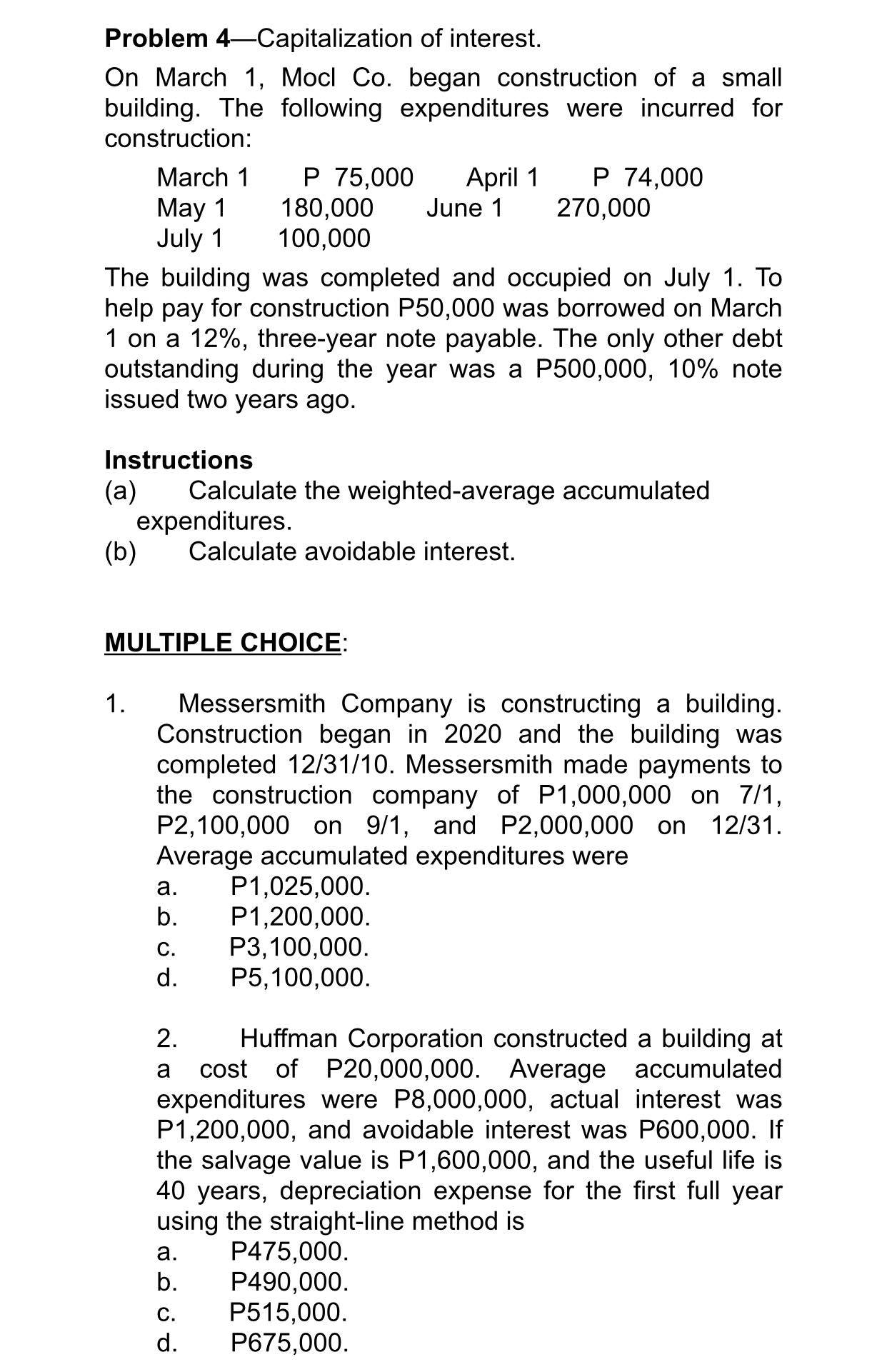

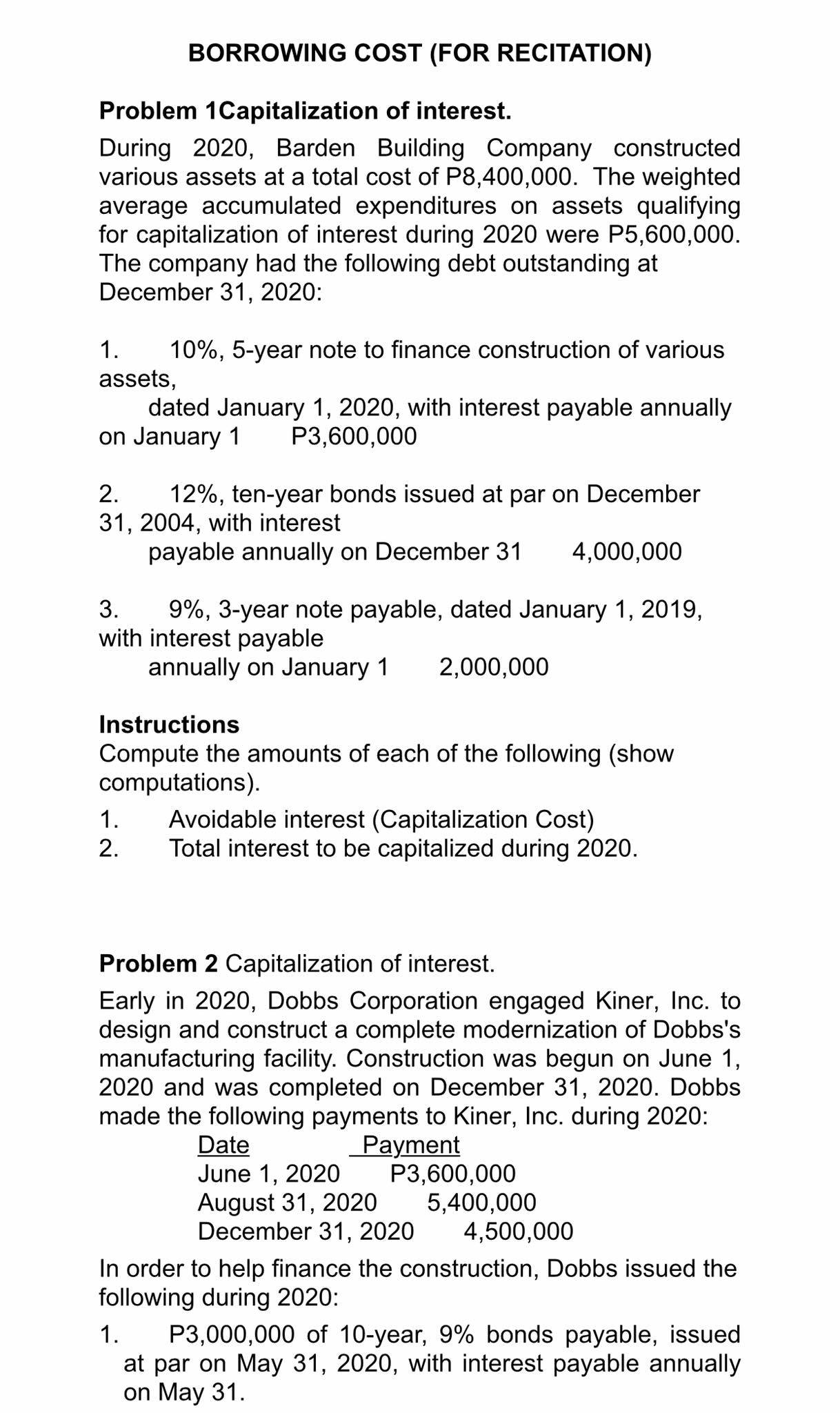

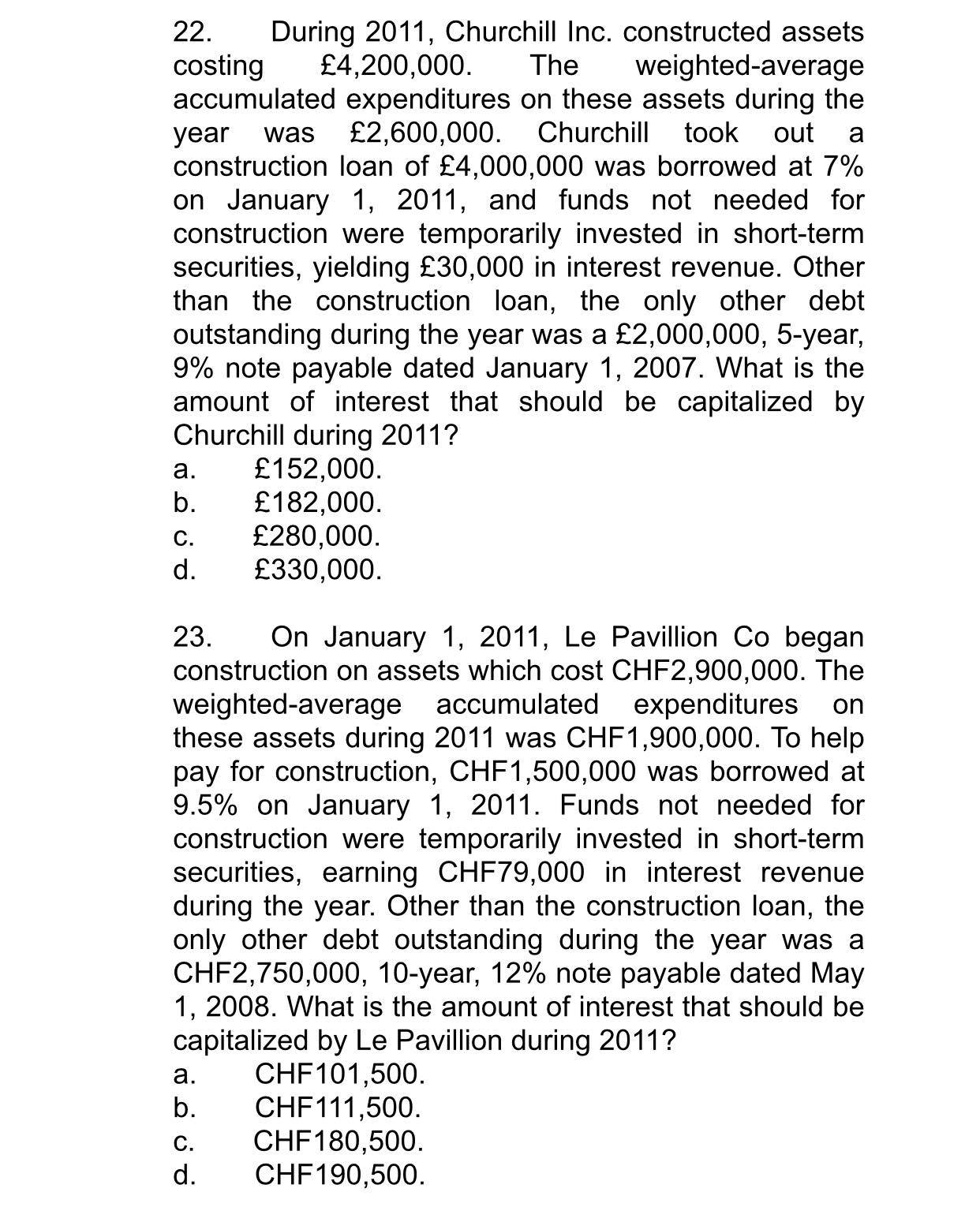

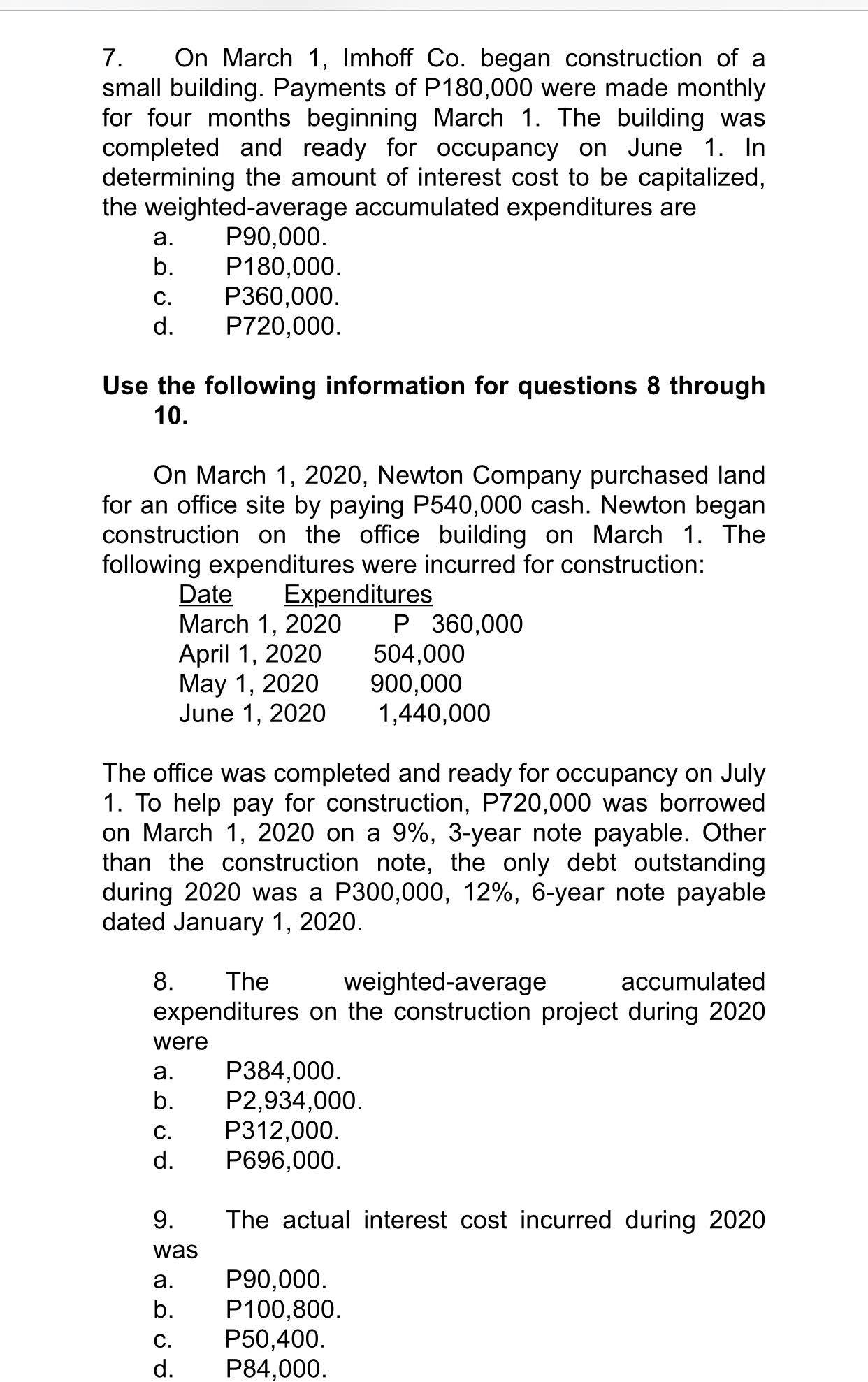

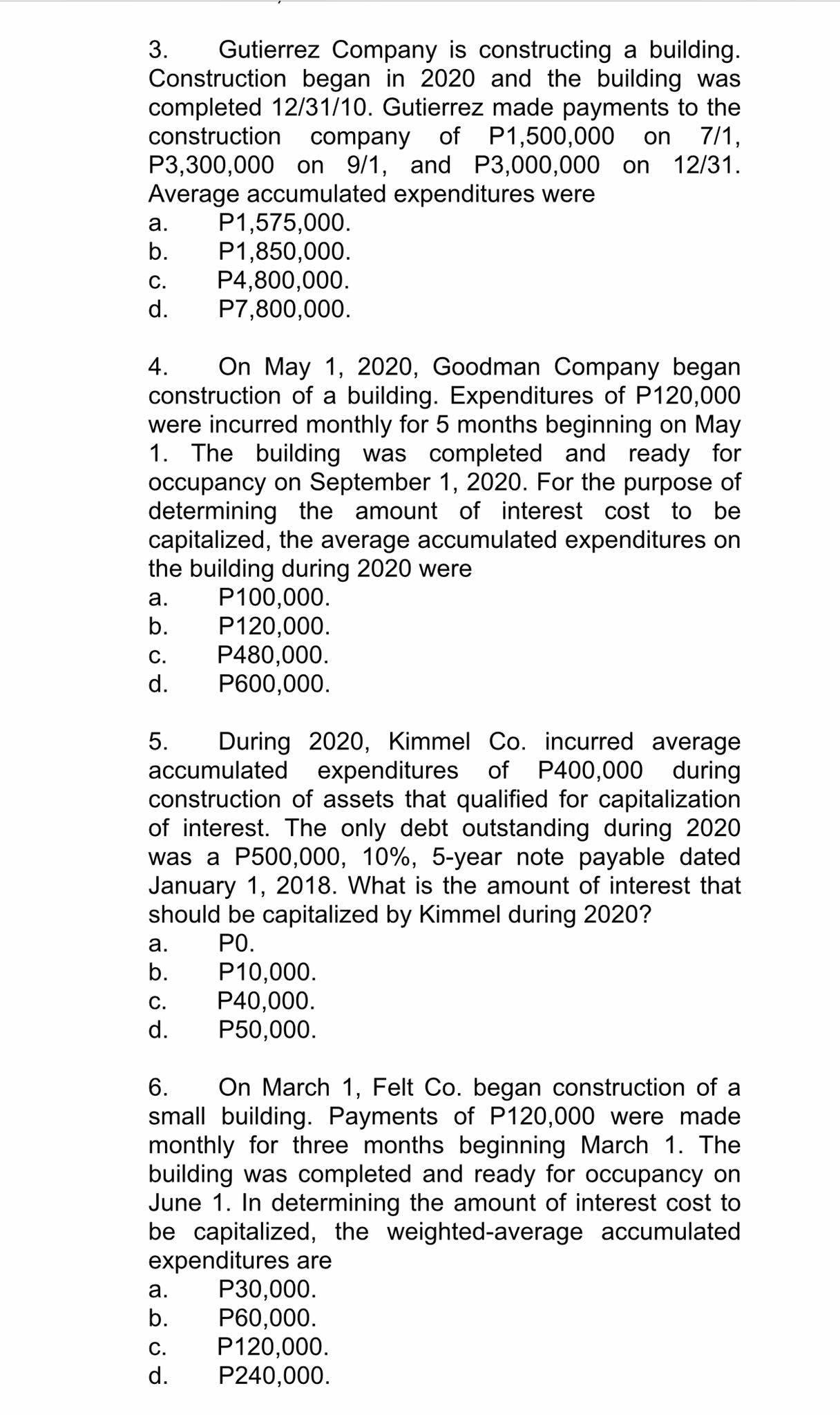

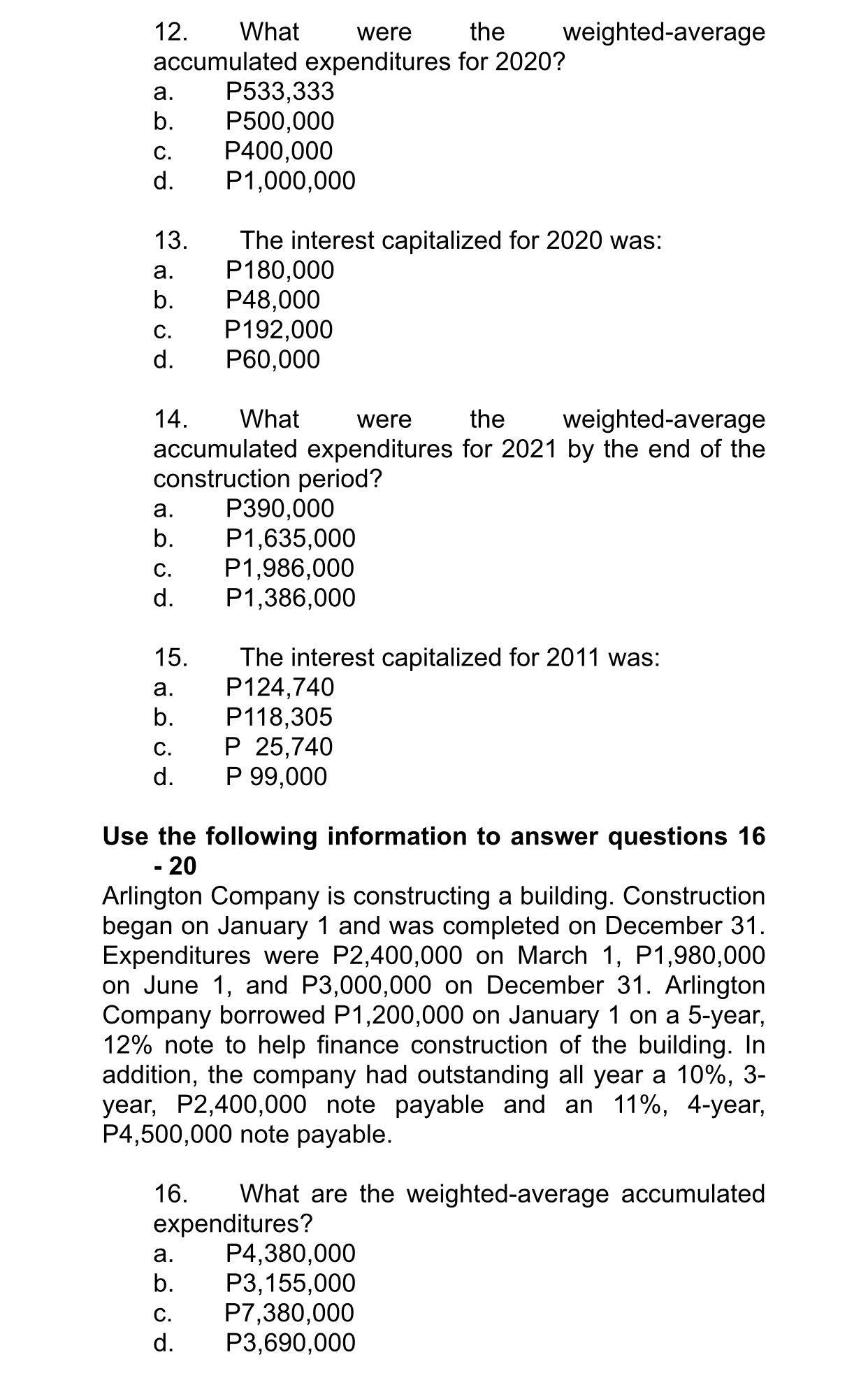

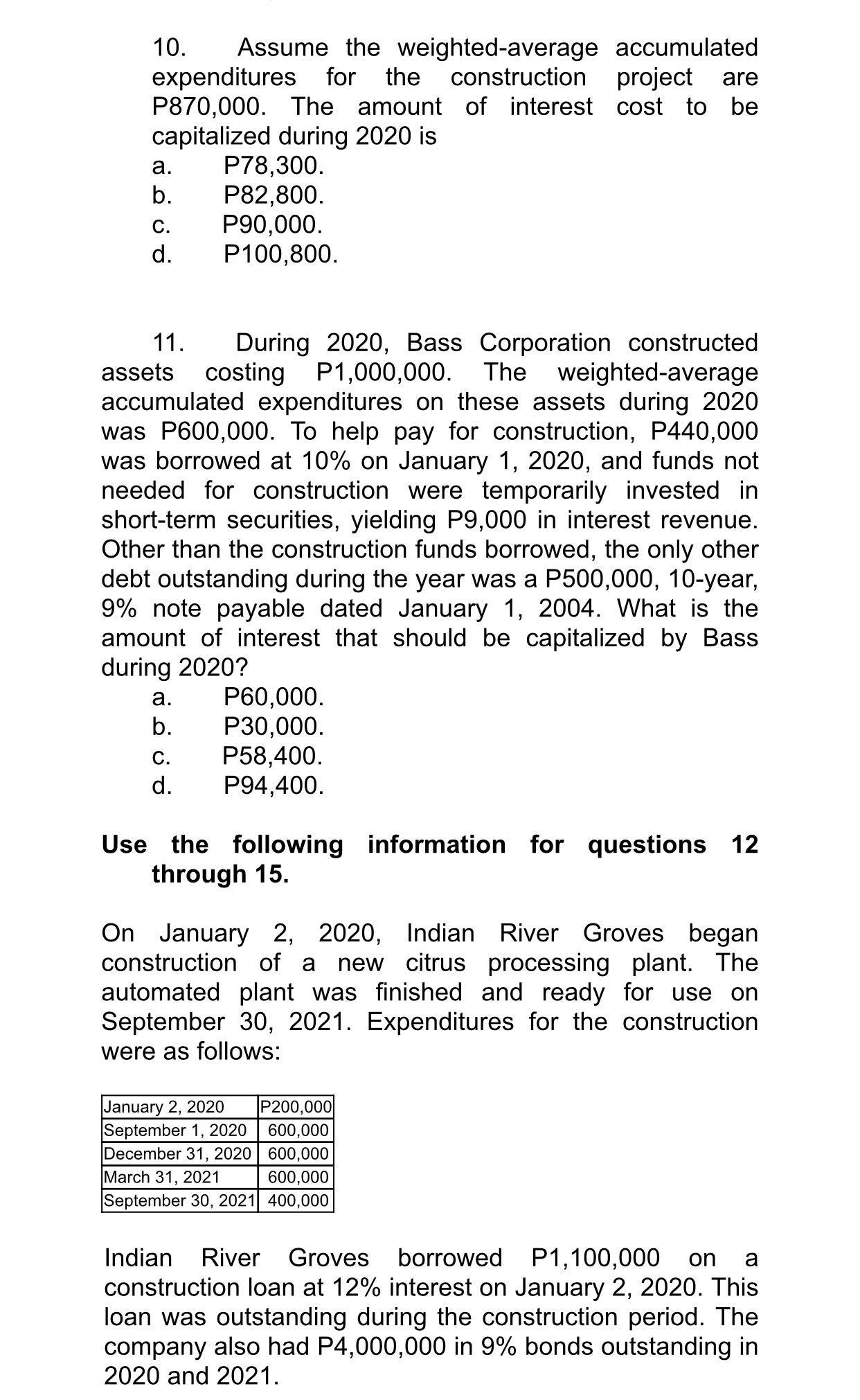

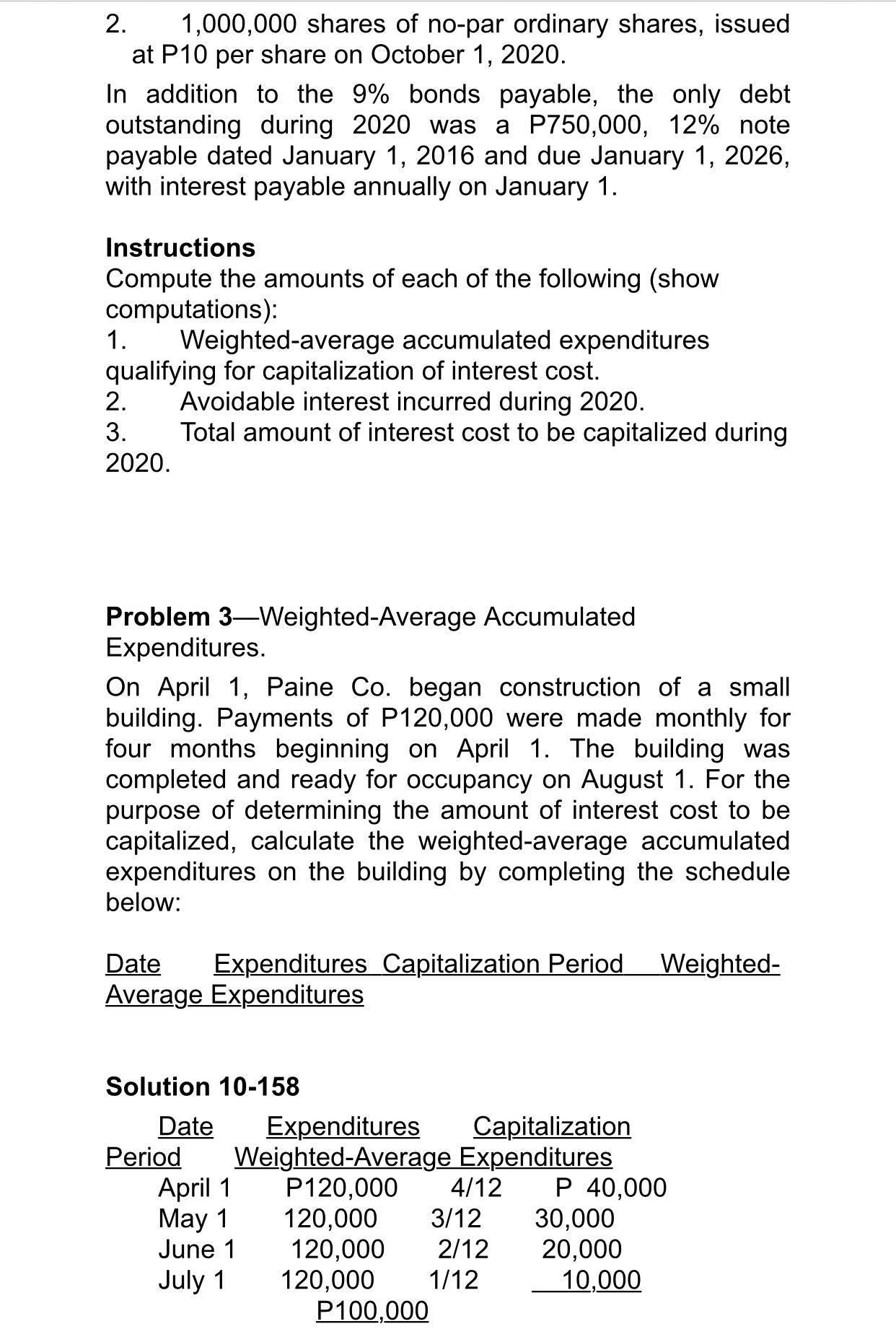

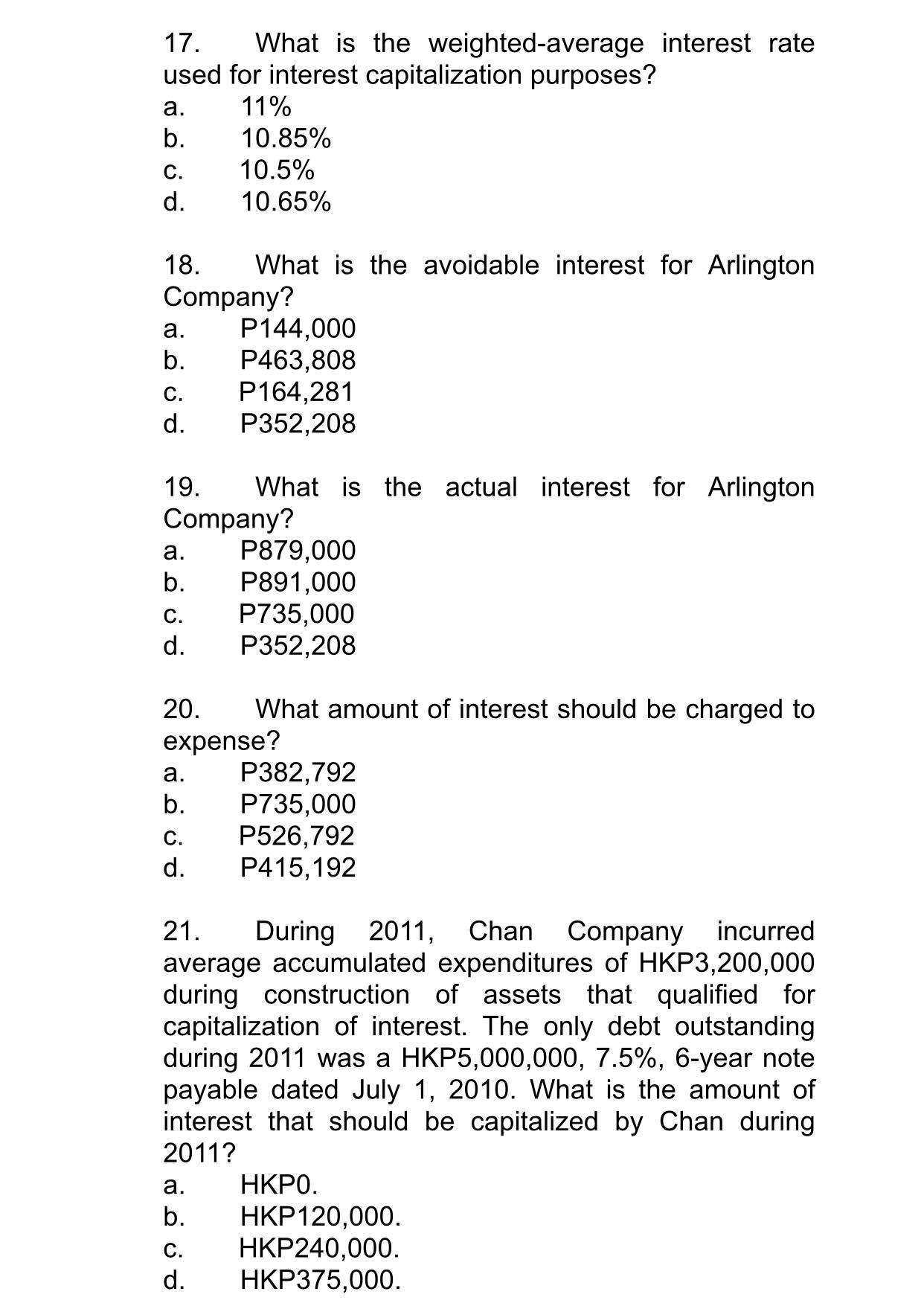

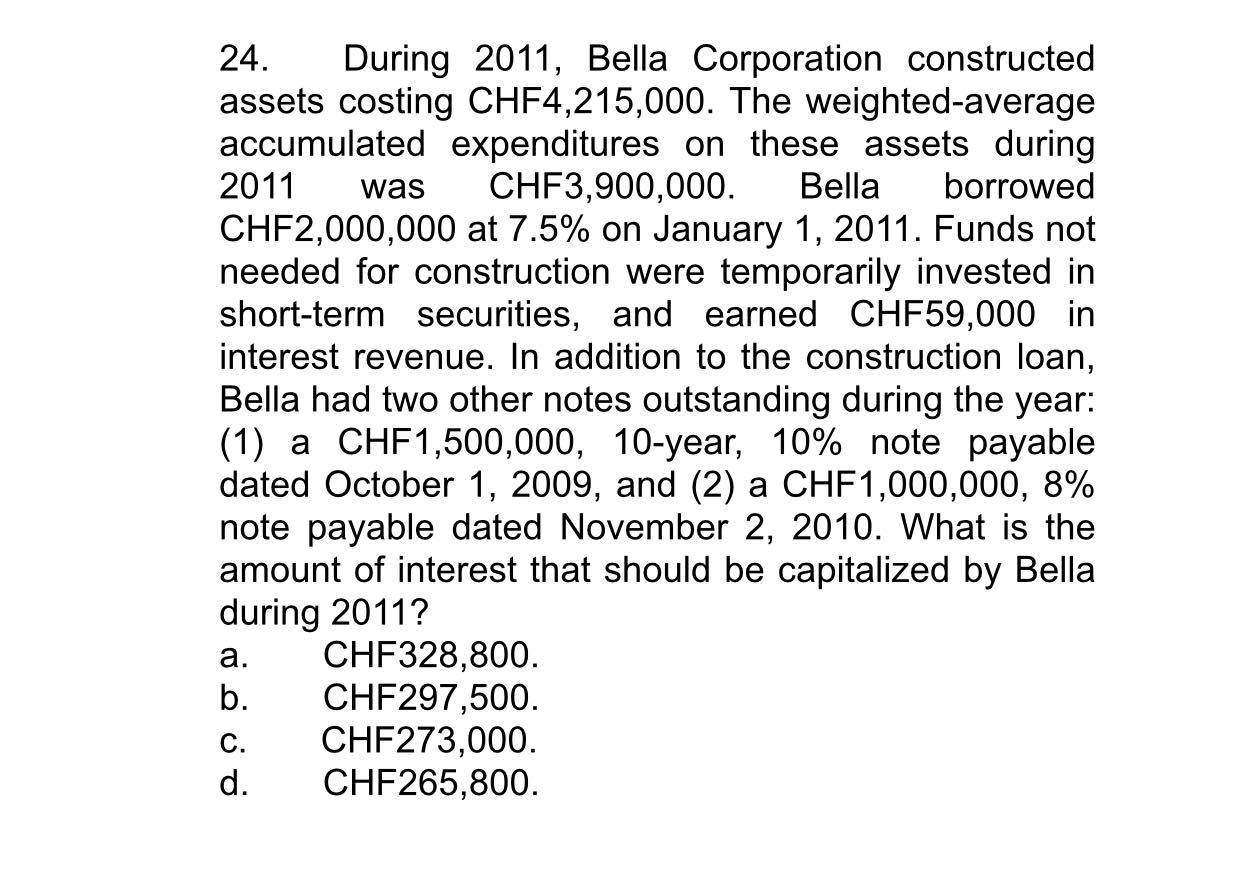

Problem 4Capitalization of interest. On March 1, Mocl Co. began construction of a small building. The following expenditures were incurred for construction: March 1 P 75,000 April 1 P 74,000 May 1 180,000 June 1 270,000 July 1 100,000 The building was completed and occupied on July 1. To help pay for construction P50,000 was borrowed on March 1 on a 12%, three-year note payable. The only other debt outstanding during the year was a P500,000, 10% note issued two years ago. Instructions (a) Calculate the weighted-average accumulated expenditures. (b) Calculate avoidable interest. MULTIPLE CHOICE: 1. Messersmith Company is constructing a building. Construction began in 2020 and the building was completed 12l31/10. Messersmith made payments to the construction company of P1,000,000 on 7/1, P2,100,000 on 9/1, and P2,000,000 on 12/31. Average accumulated expenditures were a. P1,025,000. b. P1,200,000. c. P3,100,000. d P5,100,000. 2. Huffman Corporation constructed a building at a cost of P20,000,000. Average accumulated expenditures were P8,000,000, actual interest was P1,200,000, and avoidable interest was P600,000. If the salvage value is P1,600,000, and the useful life is 40 years, depreciation expense for the first full year using the straight-line method is a. P475,000. b. P490,000. c. P515,000. d. P675,000. BORROWING COST (FOR RECITATION) Problem 1Capitalization of interest. During 2020, Barden Building Company constructed various assets at a total cost of P8,400,000. The weighted average accumulated expenditures on assets qualifying for capitalization of interest during 2020 were P5,600,000. The company had the following debt outstanding at December 31, 2020: 1. 10%, 5-year note to finance construction of various assets, dated January 1, 2020, with interest payable annually on January 1 P3,600,000 2. 12%, ten-year bonds issued at par on December 31, 2004, with interest payable annually on December 31 4,000,000 3. 9%, 3-year note payable, dated January 1, 2019, with interest payable annually on January 1 2,000,000 Instructions Compute the amounts of each of the following (show computations). 1 . Avoidable interest (Capitalization Cost) 2. Total interest to be capitalized during 2020. Problem 2 Capitalization of interest. Early in 2020, Dobbs Corporation engaged Kiner, Inc. to design and construct a complete modernization of Dobbs's manufacturing facility. Construction was begun on June 1, 2020 and was completed on December 31, 2020. Dobbs made the following payments to Kiner, Inc. during 2020: Date Payment June 1, 2020 P3,600,000 August 31, 2020 5,400,000 December 31, 2020 4,500,000 In order to help finance the construction, Dobbs issued the following during 2020: 1. P3,000,000 of 10-year, 9% bonds payable, issued at par on May 31, 2020, with interest payable annually on May 31.22. During 2011, Churchill Inc. constructed assets costing 14,200,000. The weighted-average accumulated expenditures on these assets during the year was $2,600,000. Churchill took out a construction loan of $4,000,000 was borrowed at 7% on January 1, 2011, and funds not needed for construction were temporarily invested in short-term securities, yielding $30,000 in interest revenue. Other than the construction loan, the only other debt outstanding during the year was a $2,000,000, 5-year, 9% note payable dated January 1, 2007. What is the amount of interest that should be capitalized by Churchill during 2011? a. $152,000. b . E182,000. C . E280,000. d. E330,000. 23. On January 1, 2011, Le Pavillion Co began construction on assets which cost CHF2,900,000. The weighted-average accumulated expenditures on these assets during 2011 was CHF1,900,000. To help pay for construction, CHF1,500,000 was borrowed at 9.5% on January 1, 2011. Funds not needed for construction were temporarily invested in short-term securities, earning CHF79,000 in interest revenue during the year. Other than the construction loan, the only other debt outstanding during the year was a CHF2,750,000, 10-year, 12% note payable dated May 1, 2008. What is the amount of interest that should be capitalized by Le Pavillion during 2011? a. CHF 101,500. b. CHF 111,500. C. CHF180,500. CHF 190,500.7. On March 1, Imhoff Co. began construction of a small building. Payments of P180,000 were made monthly for four months beginning March 1. The building was completed and ready for occupancy on June 1. In determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures are a. P90,000. b. P180,000. c. P360,000. d P720,000. Use the following information for questions 8 through 10. On March 1, 2020, Newton Company purchased land for an ofce site by paying P540,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction: m Qpenditures March 1, 2020 P 360,000 April 1, 2020 504,000 May 1, 2020 900,000 June 1, 2020 1,440,000 The ofce was completed and ready for occupancy on July 1. To help pay for construction, P720000 was borrowed on March 1, 2020 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2020 was a P300,000, 12%, 6-year note payable dated January 1, 2020. 8. The weighted-average accumulated expenditures on the construction project during 2020 were a. P384,000. b. P2,934,000. c. P312,000. d P696,000. 9. The actual interest cost incurred during 2020 was a. P90,000. b. P100,800. c. P50,400. d. P84,000. 3. Gutierrez Company is constructing a building. Construction began in 2020 and the building was completed 12/31/10. Gutierrez made payments to the construction company of P1,500,000 on 7/1, P3,300,000 on 9/1, and P3,000,000 on 12/31. Average accumulated expenditures were a. P1,575,000. b. P1,850,000. c. P4,800,000. d P7,800,000. 4. On May 1, 2020, Goodman Company began construction of a building. Expenditures of P120,000 were incurred monthly for 5 months beginning on May 1. The building was completed and ready for occupancy on September 1, 2020. For the purpose of determining the amount of interest cost to be capitalized, the average accumulated expenditures on the building during 2020 were a. P100,000. b. P120,000. c. P480,000. d P600,000. 5. During 2020, Kimmel Co. incurred average accumulated expenditures of P400,000 during construction of assets that qualied for capitalization of interest. The only debt outstanding during 2020 was a P500,000, 10%, 5-year note payable dated January 1, 2018. What is the amount of interest that should be capitalized by Kimmel during 2020? a. P0. b. P10,000. c. P40,000. d P50,000. 6. On March 1, Felt Co. began construction of a small building. Payments of P120,000 were made monthly for three months beginning March 1. The building was completed and ready for occupancy on June 1. In determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures are a. P30,000. b. P60,000. c. P120,000. d P240,000. 12. What were the weighted-average accumulated expenditures for 2020? a. P533,333 b. P500,000 C. P400,000 d. P1,000,000 13. The interest capitalized for 2020 was: a. P180,000 b. P48,000 C. P192,000 d. P60,000 14. What were the weighted-average accumulated expenditures for 2021 by the end of the construction period? a. P390,000 b. P1,635,000 C. P1,986,000 d. P1,386,000 15. The interest capitalized for 2011 was: a. P124,740 b. P118,305 C. P 25,740 d. P 99,000 Use the following information to answer questions 16 - 20 Arlington Company is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were P2,400,000 on March 1, P1,980,000 on June 1, and P3,000,000 on December 31. Arlington Company borrowed P1,200,000 on January 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 3- year, P2,400,000 note payable and an 11%, 4-year, P4,500,000 note payable. 16. What are the weighted-average accumulated expenditures? a. P4,380,000 b. P3, 155,000 C. P7,380,000 d. P3,690,00010. Assume the weighted-average accumulated expenditures for the construction project are P870000. The amount of interest cost to be capitalized during 2020 is a. P78,300. b. P82,800. c. P90,000. d. P100,800. 11. During 2020, Bass Corporation constructed assets costing P1,000,000. The weighted-average accumulated expenditures on these assets during 2020 was P600,000. To help pay for construction, P440,000 was borrowed at 10% on January 1, 2020, and funds not needed for construction were temporarily invested in short-term securities, yielding P9,000 in interest revenue. Other than the construction funds borrowed, the only other debt outstanding during the year was a P500,000, 10-year, 9% note payable dated January 1, 2004. What is the amount of interest that should be capitalized by Bass during 2020? a. P60,000. b. P30,000. c. P58,400. d P94,400. Use the following information for questions 12 through 15. On January 2, 2020, Indian River Groves began construction of a new citrus processing plant. The automated plant was finished and ready for use on September 30, 2021. Expenditures for the construction were as follows: January 2, 2020 P200,000 September 1, 2020 600,000 December 31, 2020 600,000 March 31, 2021 600,000 September 30, 2021 400,000 Indian River Groves borrowed P1 ,100,000 on a construction loan at 12% interest on January 2, 2020. This loan was outstanding during the construction period. The company also had P4,000,000 in 9% bonds outstanding in 2020 and 2021. 2. 1,000,000 shares of no-par ordinary shares, issued at P10 per share on October 1, 2020. In addition to the 9% bonds payable, the only debt outstanding during 2020 was a P750,000, 12% note payable dated January 1, 2016 and due January 1, 2026, with interest payable annually on January 1. Instructions Compute the amounts of each of the following (show computations): 1 . Weighted-average accumulated expenditures qualifying for capitalization of interest cost. 2. Avoidable interest incurred during 2020. 3. Total amount of interest cost to be capitalized during 2020. Problem 3-Weighted-Average Accumulated Expenditures. On April 1, Paine Co. began construction of a small building. Payments of P120,000 were made monthly for four months beginning on April 1. The building was completed and ready for occupancy on August 1. For the purpose of determining the amount of interest cost to be capitalized, calculate the weighted-average accumulated expenditures on the building by completing the schedule below: Date Expenditures Capitalization Period Weighted- Average Expenditures Solution 10-158 Date Expenditures Capitalization Period Weighted-Average Expenditures April 1 P120,000 4/12 P 40,000 May 1 120,000 3/12 30,000 June 1 120,000 2/12 20,000 July 1 120,000 1/12 10,000 P100,00017. What is the weighted-average interest rate used for interest capitalization purposes? a. 11% b. 10.85% C. 10.5% d. 10.65% 18. What is the avoidable interest for Arlington Company? a. P144,000 b. P463,808 C. P164,281 d. P352,208 19. What is the actual interest for Arlington Company? a. P879,000 b. P891,000 C. P735,000 d. P352,208 20. What amount of interest should be charged to expense? a. P382,792 b. P735,000 C. P526,792 d. P415, 192 21. During 2011, Chan Company incurred average accumulated expenditures of HKP3,200,000 during construction of assets that qualified for capitalization of interest. The only debt outstanding during 2011 was a HKP5,000,000, 7.5%, 6-year note payable dated July 1, 2010. What is the amount of interest that should be capitalized by Chan during 2011? a. HKPO. b. HKP120,000. C. HKP240,000. d. HKP 375,000.24. During 2011, Bella Corporation constructed assets costing CHF4,215,000. The weighted-average accumulated expenditures on these assets during 2011 was CHF3,900,000. Bella borrowed CHF2,000,000 at 7.5% on January 1, 2011. Funds not needed for construction were temporarily invested in short-term securities, and earned CHF59,000 in interest revenue. In addition to the construction loan, Bella had two other notes outstanding during the year: (1) a CHF1,500,000, 10-year, 10% note payable dated October 1, 2009, and (2) a CHF1,000,000, 8% note payable dated November 2, 2010. What is the amount of interest that should be capitalized by Bella during 2011? a. CHF328,800. b. CHF297,500. C. CHF273,000. d. CHF265,800