Question: Answer with good explanation. 1. Google and Facebook face the following interest rates per annum on a $500 million threeyear loan. They are currently exploring

Answer with good explanation.

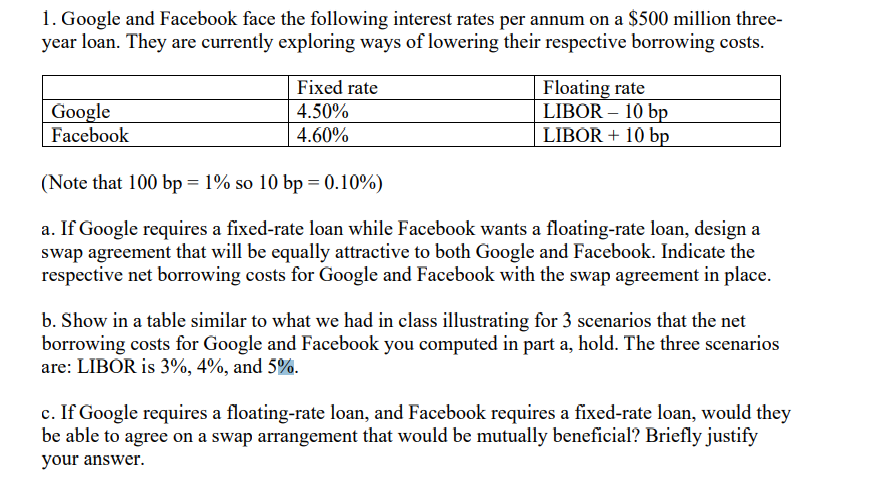

1. Google and Facebook face the following interest rates per annum on a $500 million threeyear loan. They are currently exploring ways of lowering their respective borrowing costs. (Note that 100bp=1% so 10bp=0.10% ) a. If Google requires a fixed-rate loan while Facebook wants a floating-rate loan, design a swap agreement that will be equally attractive to both Google and Facebook. Indicate the respective net borrowing costs for Google and Facebook with the swap agreement in place. b. Show in a table similar to what we had in class illustrating for 3 scenarios that the net borrowing costs for Google and Facebook you computed in part a, hold. The three scenarios are: LIBOR is 3%,4%, and 5%. c. If Google requires a floating-rate loan, and Facebook requires a fixed-rate loan, would they be able to agree on a swap arrangement that would be mutually beneficial? Briefly justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts