Question: answer with graph Mars Car Company has a capital structure made up of 30% debt and 70% equity and a tax rate of 35%. A

answer with graph

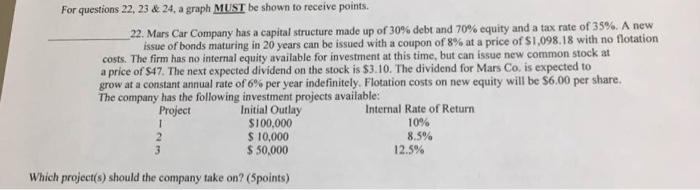

answer with graph Mars Car Company has a capital structure made up of 30% debt and 70% equity and a tax rate of 35%. A new issue of bonds maturing in 20 years can be issued with a coupon of 8% at a price of $1, 098.18 with no flotation costs. The firm has no internal equity available for investment at this time, but can issue new common stock at a price of $47. The next expected dividend on the stock is $3.10. The dividend for Mars Co. is expected to grow at a constant annual rate of 6% per year indefinitely. Flotation costs on new equity will be $6.00 per share. The company has the following investment projects available: Which project(s) should the company take on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts