Question: answer with necessary solution pls 3. A company has determined that its optimal; capital structure consists of 40% debt and 60% equity. Assume the firm

answer with necessary solution pls

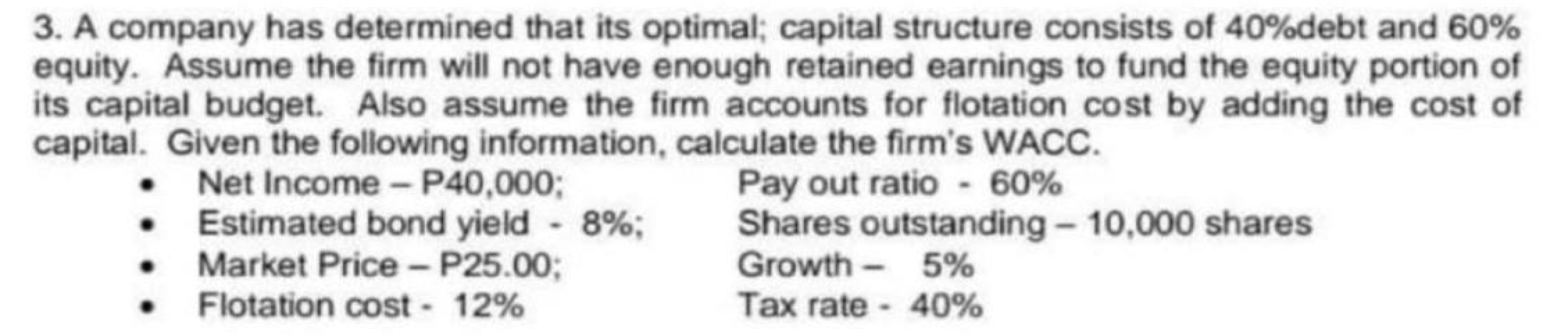

3. A company has determined that its optimal; capital structure consists of 40% debt and 60% equity. Assume the firm will not have enough retained earnings to fund the equity portion of its capital budget. Also assume the firm accounts for flotation cost by adding the cost of capital. Given the following information, calculate the firm's WACC. - Net Income - P40,000; Pay out ratio - 60\% - Estimated bond yield - 8\%; Shares outstanding - 10,000 shares - Market Price - P25.00; Growth - 5\% - Flotation cost - 12% Tax rate 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts