Question: answer within 1 hour for thumbs up :) Poutine Cheez Company has yearly sales of $450.000 and an average collection period of 30 days. A

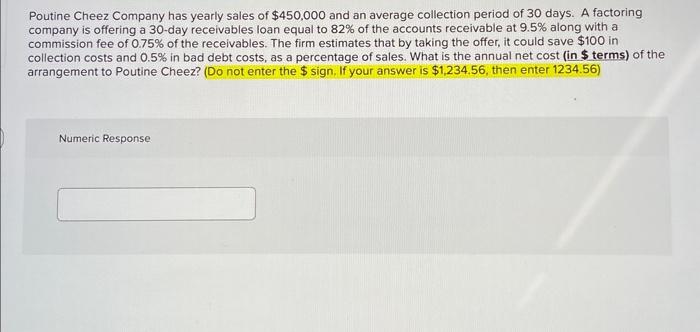

Poutine Cheez Company has yearly sales of $450.000 and an average collection period of 30 days. A factoring company is offering a 30-day receivables loan equal to 82% of the accounts receivable at 9.5% along with a commission fee of 0.75% of the receivables. The firm estimates that by taking the offer, it could save $100 in collection costs and 0.5% in bad debt costs, as a percentage of sales. What is the annual net cost (in $ terms) of the arrangement to Poutine Cheez? (Do not enter the $ sign. If your answer is $1,234.56, then enter 1234.56) Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts