Question: Answer within 20 minutes. Answer must be correct. If you answer within 20 minutes I will give you 3 upvote. Do not use any excel

Answer within 20 minutes. Answer must be correct. If you answer within 20 minutes I will give you 3 upvote. Do not use any excel file for answer. Use word file/Hand written. Please fast.

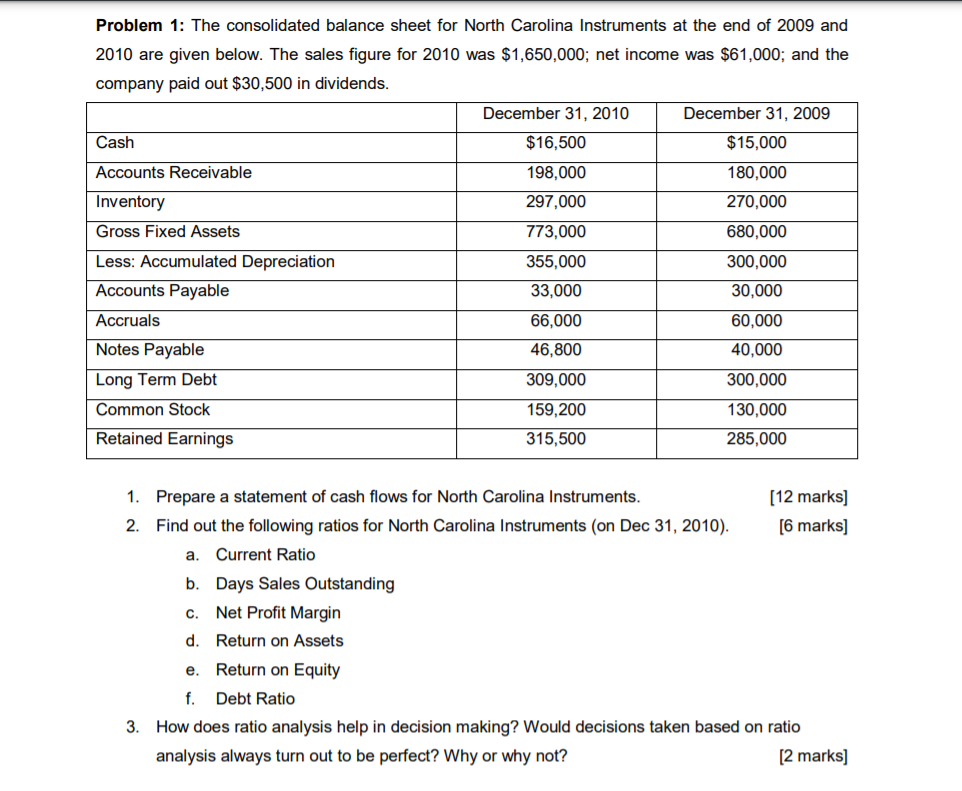

Problem 1: The consolidated balance sheet for North Carolina Instruments at the end of 2009 and 2010 are given below. The sales figure for 2010 was $1,650,000; net income was $61,000; and the company paid out $30,500 in dividends. December 31, 2010 December 31, 2009 Cash $16,500 $15,000 Accounts Receivable 198,000 180,000 Inventory 297,000 270,000 Gross Fixed Assets 773,000 680,000 Less: Accumulated Depreciation 355,000 300,000 Accounts Payable 33,000 30,000 Accruals 66,000 60,000 Notes Payable 46,800 40,000 Long Term Debt 309,000 300,000 Common Stock 159,200 130,000 Retained Earnings 315,500 285,000 a 1. Prepare a statement of cash flows for North Carolina Instruments. [12 marks] 2. Find out the following ratios for North Carolina Instruments (on Dec 31, 2010). [6 marks] Current Ratio b. Days Sales Outstanding c. Net Profit Margin d. Return on Assets e. Return on Equity f. Debt Ratio 3. How does ratio analysis help in decision making? Would decisions taken based on ratio analysis always turn out to be perfect? Why or why not? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts