Question: Answer within 30 mins please it is urgently needed pleaseeee Question 2 (15 marks) The financial information for Roger Inc. is given below: Ratio Current

Answer within 30 mins please it is urgently needed pleaseeee

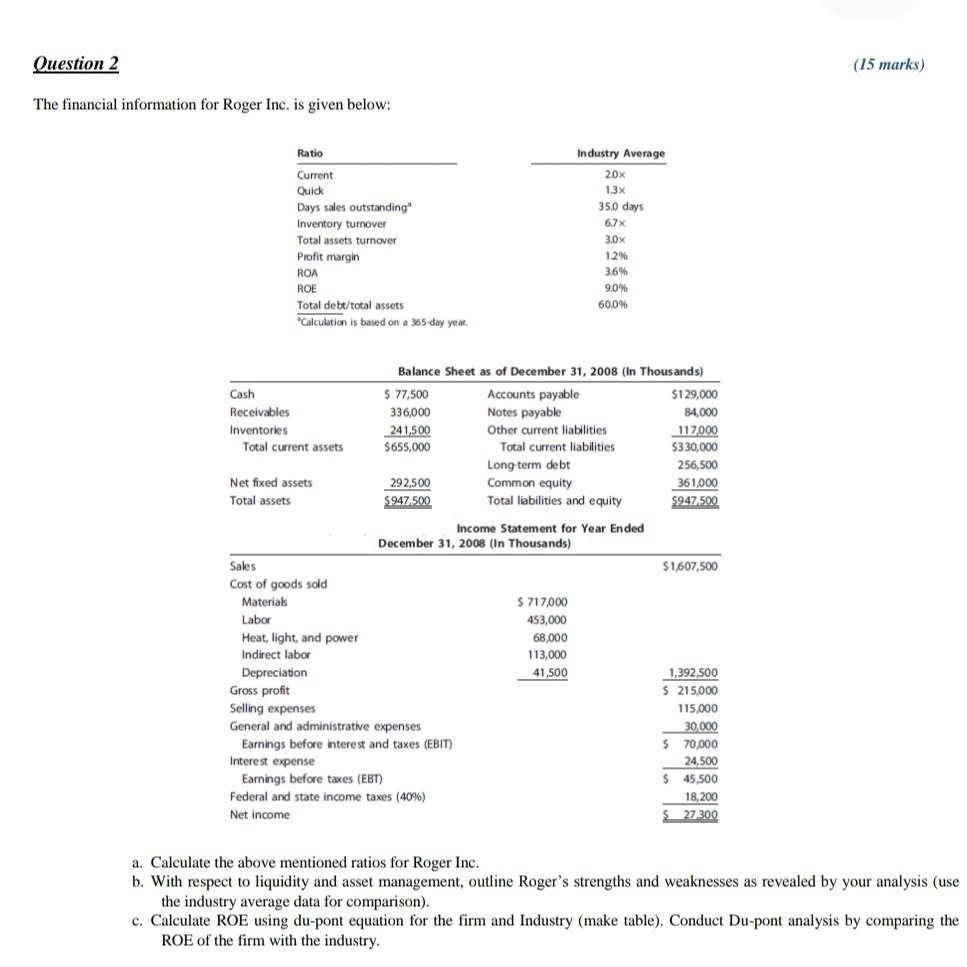

Question 2 (15 marks) The financial information for Roger Inc. is given below: Ratio Current Quick Days sales outstanding Inventory turnover Total assets turnover Profit margin ROA ROA ROE Total debt/total assets Calculation is based on a 365-day year. Industry Average 20% 13x 350 days 67x 3.0x 1.2% 3.6% 9.0% 60.0% Cash Receivables Inventories Total current assets Balance Sheet as of December 31, 2008 (In Thousands) $ 77,500 Accounts payable $129.000 336,000 Notes payable 84,000 241,500 Other current liabilities 117000 $655,000 Total current liabilities $330,000 Long-term debt 256,500 292,500 Common equity 361,000 $947.500 Total liabilities and equity $947.500 Net fixed assets Total assets $1,607,500 Income Statement for Year Ended December 31, 2008 (In Thousands) Sales Cost of goods sold Materials $ 717,000 Labor 453,000 Heat, light, and power 68,000 Indirect labor 113,000 Depreciation 41.500 Gross profit Selling expenses General and administrative expenses Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Federal and state income taxes (40%) Net income 1,392,500 $ 215,000 115,000 $ 30.000 70,000 24,500 45,500 18,200 27300 $ a. Calculate the above mentioned ratios for Roger Inc. b. With respect to liquidity and asset management, outline Roger's strengths and weaknesses as revealed by your analysis (use the industry average data for comparison). c. Calculate ROE using du-pont equation for the firm and Industry (make table). Conduct Du-pont analysis by comparing the ROE of the firm with the industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts