Question: Answer within 30 mins please needed urgently III. A manager of a reputed electronics store, wants to offer credit to his customers. The terms require

Answer within 30 mins please needed urgently

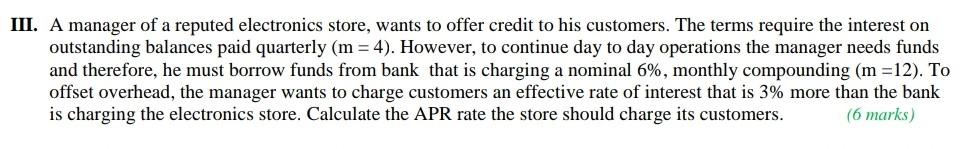

III. A manager of a reputed electronics store, wants to offer credit to his customers. The terms require the interest on outstanding balances paid quarterly (m = 4). However, to continue day to day operations the manager needs funds and therefore, he must borrow funds from bank that is charging a nominal 6%, monthly compounding (m =12). To offset overhead, the manager wants to charge customers an effective rate of interest that is 3% more than the bank is charging the electronics store. Calculate the APR rate the store should charge its customers. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts