Question: Answer without excel; the answer is included at the bottom using excel but I want to know how to do it without Review Problems 1.

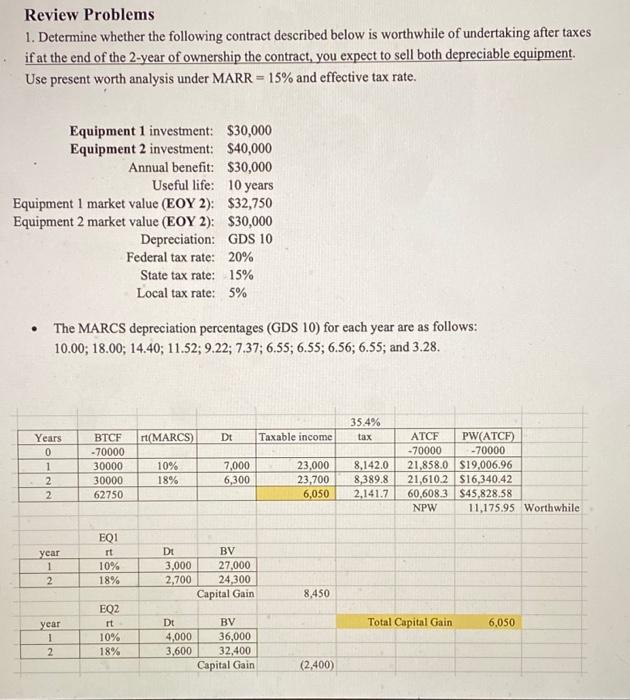

Review Problems 1. Determine whether the following contract described below is worthwhile of undertaking after taxes if at the end of the 2-year of ownership the contract, you expect to sell both depreciable equipment. Use present worth analysis under MARR =15% and effective tax rate. - The MARCS depreciation percentages (GDS 10) for each year are as follows: 10.00;18.00;14.40;11.52;9.22;7.37;6.55;6.55;6.56;6.55; and 3.28 . Review Problems 1. Determine whether the following contract described below is worthwhile of undertaking after taxes if at the end of the 2-year of ownership the contract, you expect to sell both depreciable equipment. Use present worth analysis under MARR =15% and effective tax rate. - The MARCS depreciation percentages (GDS 10) for each year are as follows: 10.00;18.00;14.40;11.52;9.22;7.37;6.55;6.55;6.56;6.55; and 3.28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts