Question: answeres these in 2 hours please Jamil is purchasing a new truck and financing $27,000. Jamil will make 60 monthly payments of $500 each. What

answeres these in 2 hours please

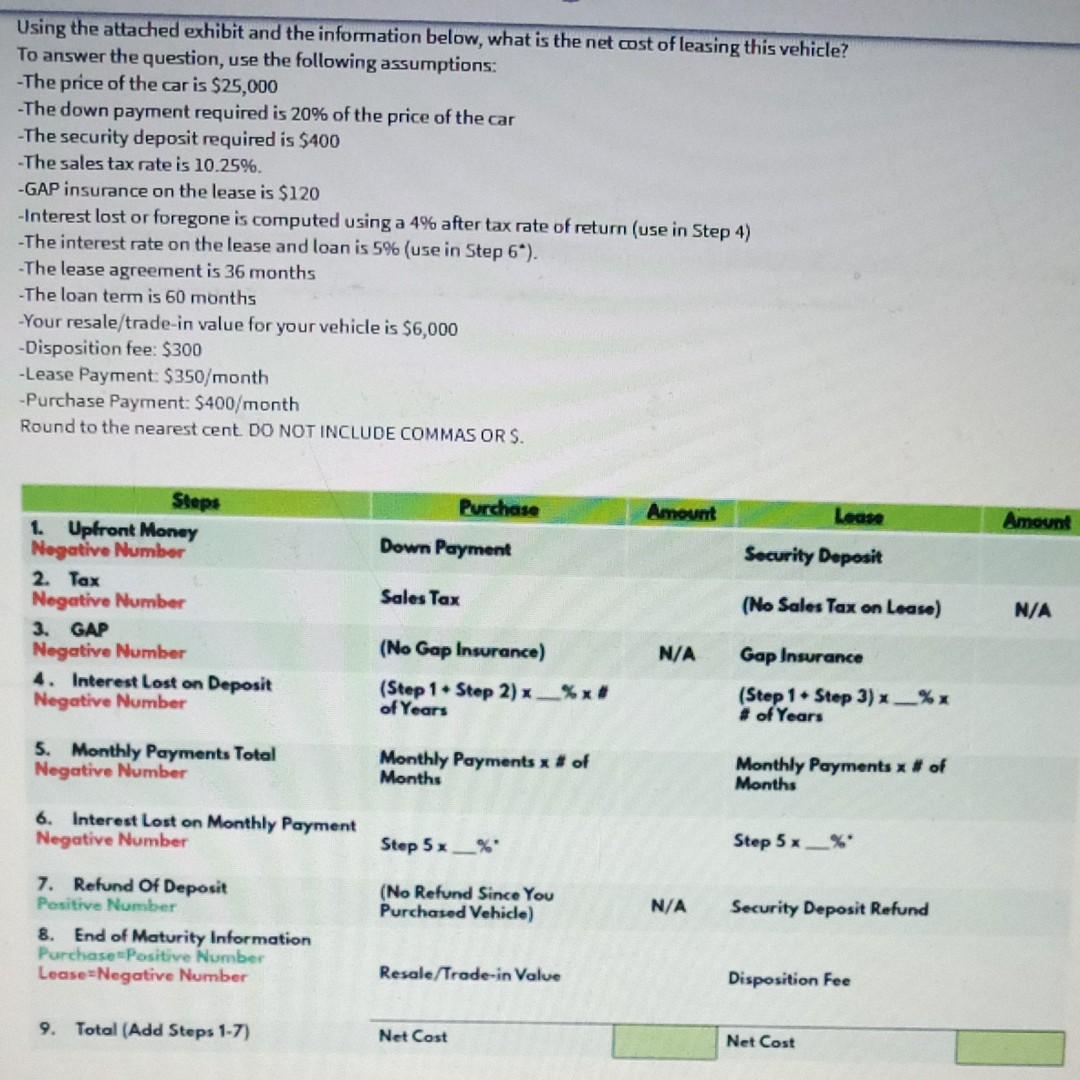

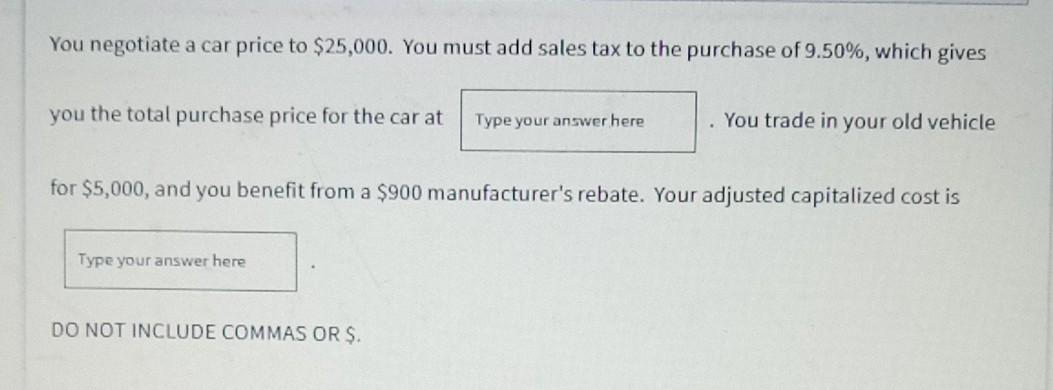

Jamil is purchasing a new truck and financing $27,000. Jamil will make 60 monthly payments of $500 each. What are the total finance costs on this loan? DO NOT INCLUDE COMMAS ORS Using the attached exhibit and the information below, what is the net cost of leasing this vehicle? To answer the question, use the following assumptions: -The price of the car is $25,000 -The down payment required is 20% of the price of the car -The security deposit required is $400 -The sales tax rate is 10.25%. -GAP insurance on the lease is $120 -Interest lost or foregone is computed using a 4% after tax rate of return (use in Step 4) -The interest rate on the lease and loan is 5% (use in Step 6'). -The lease agreement is 36 months -The loan term is 60 months -Your resale/trade-in value for your vehicle is $6,000 -Disposition fee: $300 -Lease Payment: $350/month -Purchase Payment: $400/month Round to the nearest cent DO NOT INCLUDE COMMAS ORS. Purchase Amount Lease Amount Down Payment Security Deposit Steps 1. Upfront Money Negative Number 2. Tax Negative Number 3. GAP Negative Number 4. Interest Lost on Deposit Negative Number Sales Tax (No Sales Tax on Lease) N/A N/A (No Gap Insurance) (Step 1. Step 2)x__%x. of Years Gap Insurance (Step 1. Step 3) x_%x # of Years 5. Monthly Payments Total Negative Number Monthly Payments x # of Months Monthly Payments x # of Months 6. Interest Lost on Monthly Payment Negative Number Step 5x __% Step 5x__% (No Refund Since You Purchased Vehicle) N/A Security Deposit Refund 7. Refund Of Deposit Positive Number 8. End of Maturity Information Purchase Positive Number Lease-Negative Number Resale/Trade-in Value Disposition Fee 9. Total (Add Steps 1-7) Net Cost Net Cost You negotiate a car price to $25,000. You must add sales tax to the purchase of 9.50%, which gives you the total purchase price for the car at Type your answer here . You trade in your old vehicle for $5,000, and you benefit from a $900 manufacturer's rebate. Your adjusted capitalized cost is Type your answer here DO NOT INCLUDE COMMAS OR $. Chris and Patti have a combined gross income of $90,000. Using the 28/36 ratio, how much of their gross income should be expected to go towards their mortgage? DO NOT INCLUDE COMMAS ORS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts