Question: Answering any or all would be a huge help. Please show work 2. Your company issues 2,500 bonds each with a face value (par value)

Answering any or all would be a huge help. Please show work

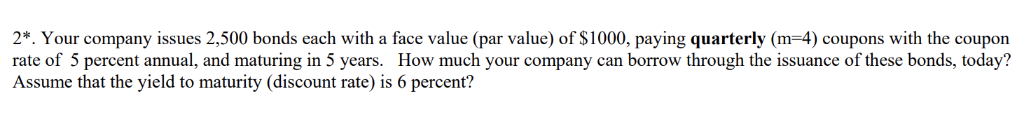

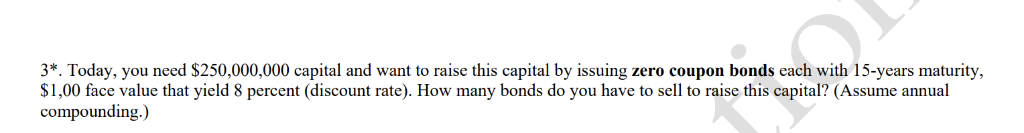

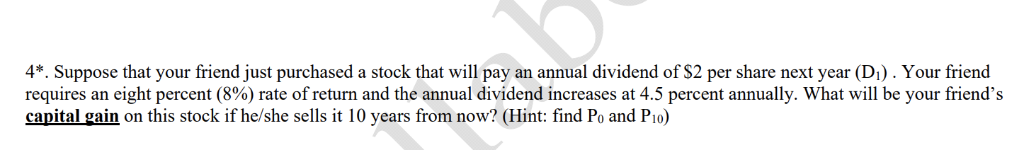

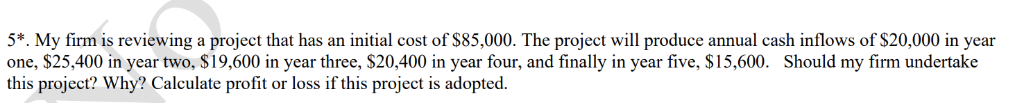

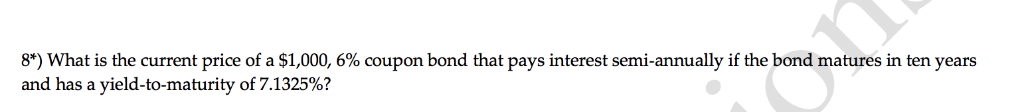

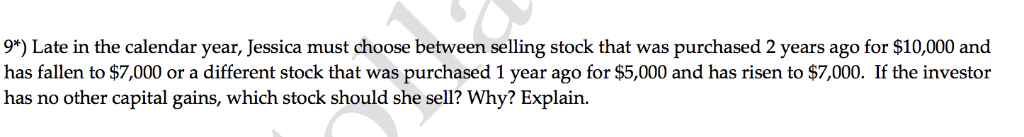

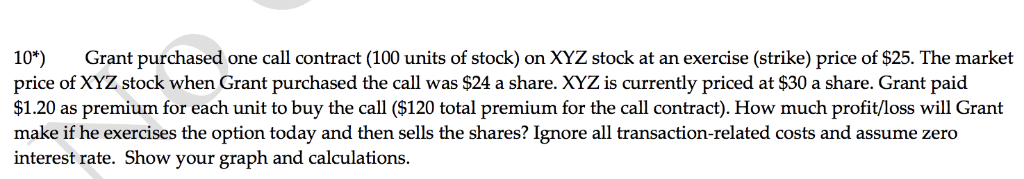

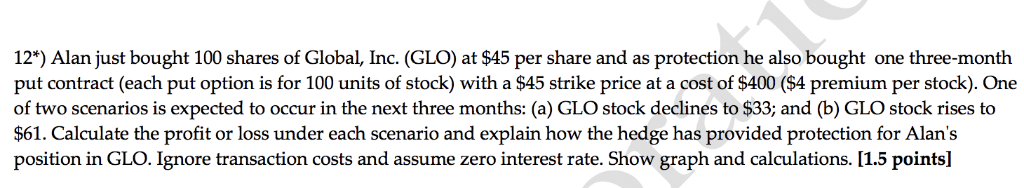

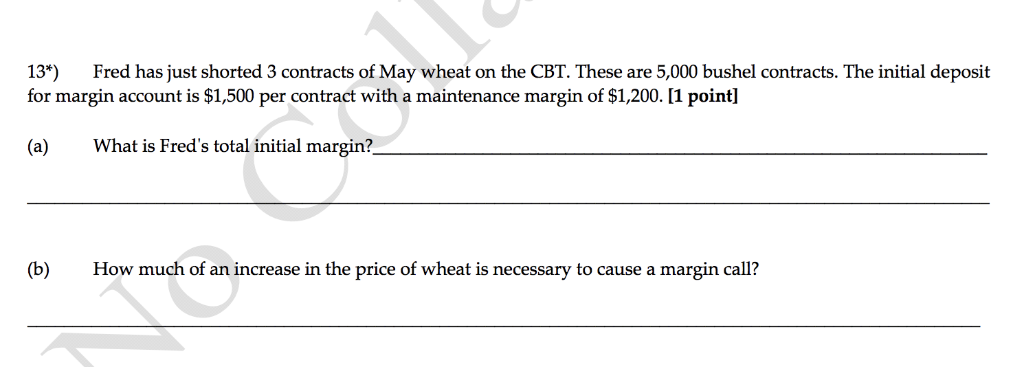

2. Your company issues 2,500 bonds each with a face value (par value) of S1000, paying quarterly (m-4) coupons with the coupon rate of 5 percent annual, and maturing in 5 years. How much your company can borrow through the issuance of these bonds, today? Assume that the yield to maturity (discount rate) is 6 percent? 3*. Today, you need $250,000,000 capital and want to raise this capital by issuing zero coupon bonds each with 15-years maturity, $1,00 face value that yield 8 percent (discount rate). How many bonds do you have to sell to raise this capital? (Assume annual compounding.) 4*. Suppose that your friend just purchased a stock that will pay an annual dividend of S2 per share next year (D).Your friend requires an eight percent (8%) rate of return and the annual dividend increases at 4.5 percent annually. What will be your friends capital gain on this stock if he/she sells it 10 years from now? (Hint: find Po and Pio) 5*. My firm is reviewing a project that has an initial cost of $85,000. The project will produce annual cash inflows of $20,000 in year one, $25,400 in year two, $19,600 in year three, $20,400 in year four, and finally in year five, $15,600. Should my firm undertake this project? Why? Calculate profit or loss if this project is adopted. What is the current price of a $1,000, 6% coupon bond that pays interest semi-annually if the bond matures in ten years and has a yield-to-maturity of 7.1325%? 9*) Late in the calendar year, Jessica must choose between selling stock that was purchased 2 years ago for $10,000 and has fallen to $7,000 or a different stock that was purchased 1 year ago for $5,000 and has risen to $7,000. If the investor has no other capital gains, which stock should she sell? Why? Explain. 10") Grant purchased one call contract (100 units of stock) on XYZ stock at an exercise (strike) price of $25. The market price of XYZ stock when Grant purchased the call was $24 a share. XYZ is currently priced at $30 a share. Grant paid $1.20 as premium for each unit to buy the call ($120 total premium for the call contract). How much profit/loss will Grant make if he exercises the option today and then sells the shares? Ignore all transaction-related costs and assume zero interest rate. Show your graph and calculations. 12*) Alan just bought 100 shares of Global, Inc. (GLO) at $45 per share and as protection he also bought one three-month put contract (each put option is for 100 units of stock) with a $45 strike price at a cost of $400 ($4 premium per stock). One of two scenarios is expected to occur in the next three months: (a) GLO stock declines to $33; and (b) GLO stock rises to $61. Calculate the profit or loss under each scenario and explain how the hedge has provided protection for Alan's position in GLO. Ignore transaction costs and assume zero interest rate. Show graph and calculations. [1.5 points] 13") Fred has just shorted 3 contracts of May wheat on the CBT. These are 5,000 bushel contracts. The initial deposit for margin account is $1,500 per contract with a maintenance margin of $1,200. [1 point] What is Fred's total initial margin? (a) (b) How much of an increase in the price of wheat is necessary to cause a margin call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts