Question: Answering the following problem utilizing Visual Data Studio. Also, C# would be the required coding language for this problem. If possible provide as many comments

Answering the following problem utilizing Visual Data Studio. Also, C# would be the required coding language for this problem. If possible provide as many comments throughout the code and post a picture of the output. I have attached both a picture of the question and a screen shot of the exact output as reference as well. Please make the output look identical to the one provided and I will rate immediately afterwards! Thank you.

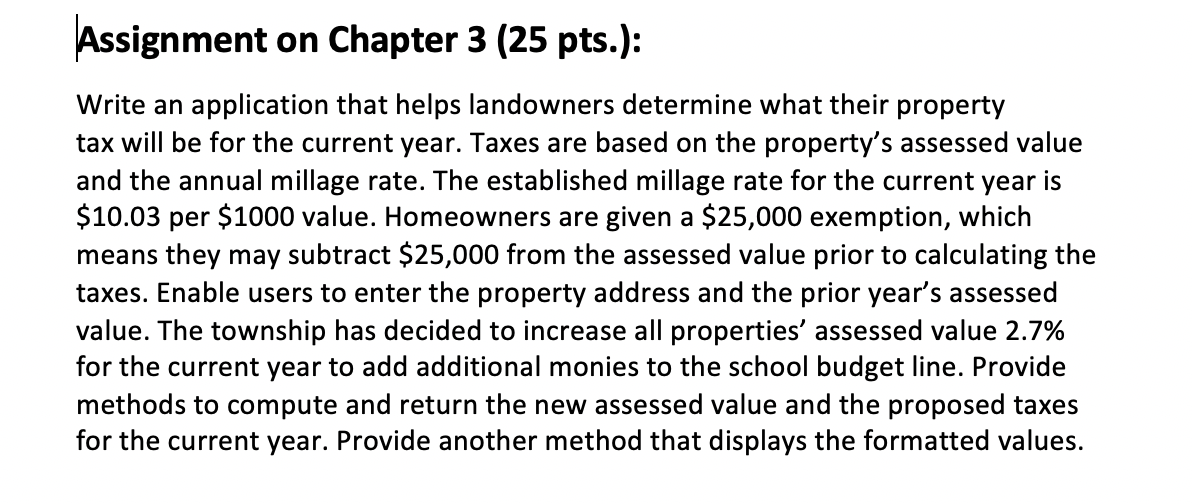

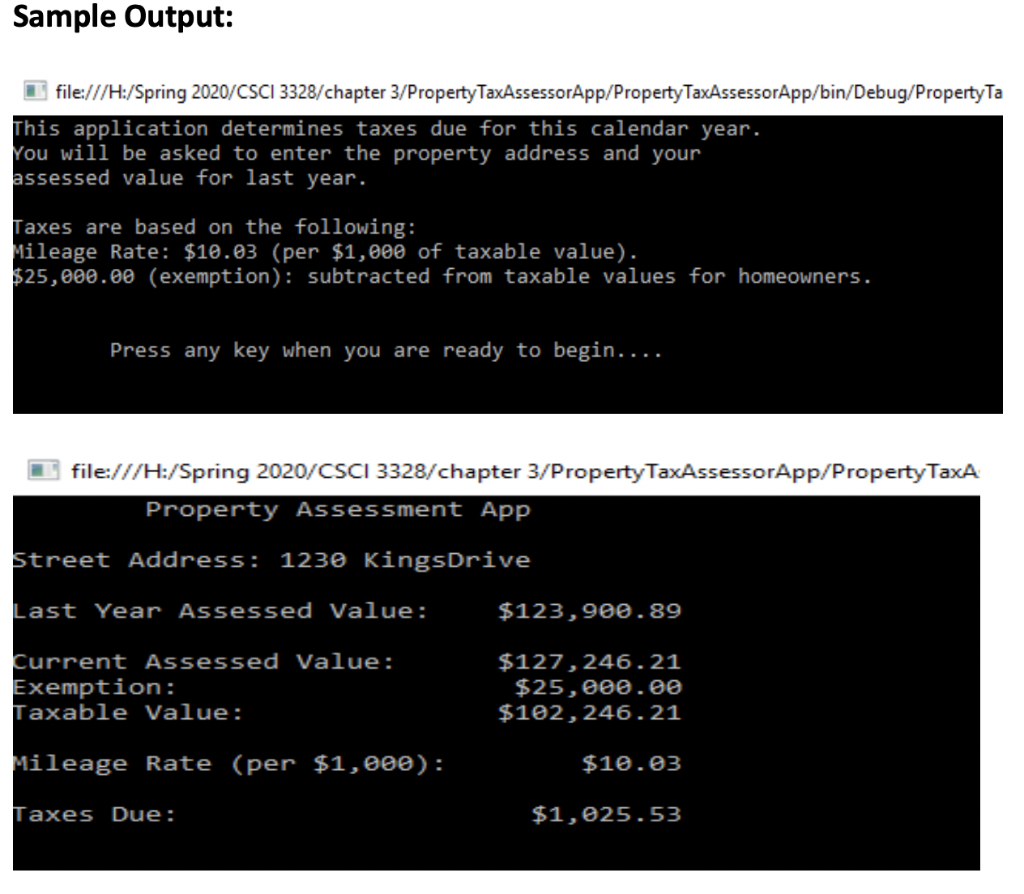

Assignment on Chapter 3 (25 pts.): Write an application that helps landowners determine what their property tax will be for the current year. Taxes are based on the property's assessed value and the annual millage rate. The established millage rate for the current year is $10.03 per $1000 value. Homeowners are given a $25,000 exemption, which means they may subtract $25,000 from the assessed value prior to calculating the taxes. Enable users to enter the property address and the prior year's assessed value. The township has decided to increase all properties' assessed value 2.7% for the current year to add additional monies to the school budget line. Provide methods to compute and return the new assessed value and the proposed taxes for the current year. Provide another method that displays the formatted values Sample Output: file:///H:/Spring 2020/CSCI 3328/chapter 3/Property TaxAssessorApp/Property TaxAssessorApp/bin/Debug/Property Ta This application determines taxes due for this calendar year. You will be asked to enter the property address and your assessed value for last year. Taxes are based on the following: Mileage Rate: $10.03 (per $1,000 of taxable value). $25,000.00 (exemption): subtracted from taxable values for homeowners. Press any key when you are ready to begin.... file:///H:/Spring 2020/CSCI 3328/chapter 3/Property TaxAssessorApp/Property Taxa Property Assessment App Street Address: 1230 KingsDrive Last Year Assessed Value: $123,900.89 Current Assessed Value: Exemption: Taxable Value: $127,246.21 $25,000.00 $102,246.21 $10.03 Mileage Rate (per $1,000): Taxes Due: $1,025.53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts