Question: answers are from a tutors solution & are incorrect. Kold Services Corporation estimates that its 2019 taxable income will be $500,000. Thus, it is subject

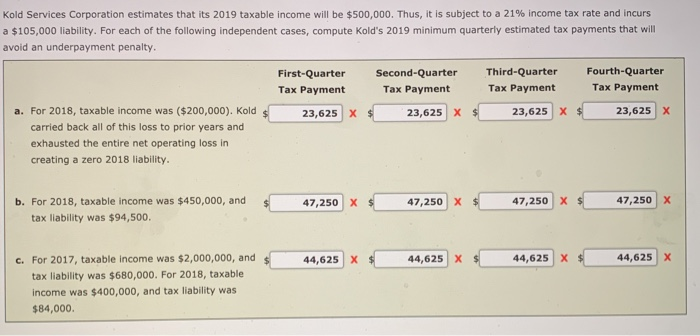

Kold Services Corporation estimates that its 2019 taxable income will be $500,000. Thus, it is subject to a 21% income tax rate and incurs a $105,000 liability. For each of the following independent cases, compute Kold's 2019 minimum quarterly estimated tax payments that will avoid an underpayment penalty. First-Quarter Second-Quarter Third-Quarter Fourth-Quarter Tax Payment Tax Payment Tax Payment Tax Payment 23,023)x 23023)x 23623)x23,623x a. For 2018, taxable income was ($200,000). Kold 23,625 X 23,6251 x carried back all of this loss to prior years and exhausted the entire net operating loss in creating a zero 2018 liability. 47,250 X b. For 2018, taxable income was $450,000, and 47,250 X 47,250| x 47,250 X tax liability was $94,500. 44,625 X 44,625 X 44,625X c. For 2017, taxable income was $2,000,000, and 44,625 X tax liability was $680,000. For 2018, taxable income was $400,000, and tax liability was $84,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts