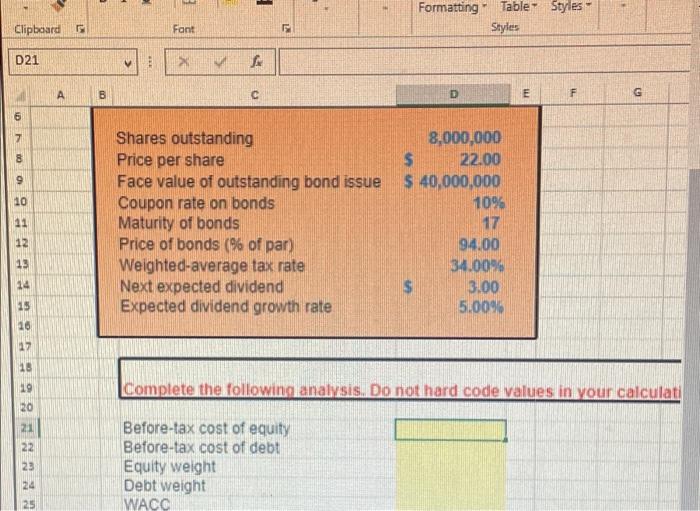

Question: answers must be as a FORMULA!! E - Formatting Table Styles Styles Clipboard Fant F D21 > P B c D E F G 6

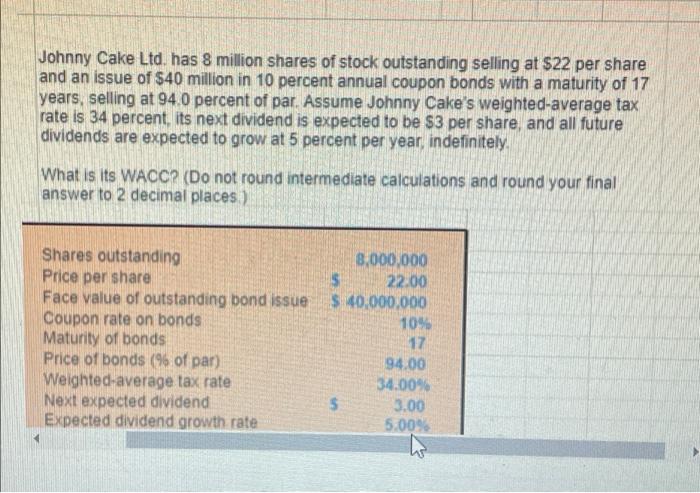

E - Formatting Table Styles Styles Clipboard Fant F D21 > P B c D E F G 6 7 8 9 10 11 Shares outstanding Price per share Face value of outstanding bond issue Coupon rate on bonds Maturity of bonds Price of bonds (% of par) Weighted-average tax rate Next expected dividend Expected dividend growth rate 8,000,000 $ 22.00 $ 40,000,000 10% 17 94.00 34.00% 3.00 5.00% 12 13 14 19 16 17 18 19 Complete the following analysis. Do not hard code values in your calculati 20 21 22 23 Before-tax cost of equity Before-tax cost of debt Equity weight Debt weight WACC 24 Johnny Cake Ltd. has 8 million shares of stock outstanding selling at $22 per share and an issue of $40 million in 10 percent annual coupon bonds with a maturity of 17 years, selling at 940 percent of par. Assume Johnny Cake's weighted average tax rate is 34 percent, its next dividend is expected to be $3 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely What is its WACC? (Do not round intermediate calculations and round your final answer to 2 decimal places) Shares outstanding Price per share Face value of outstanding bond issue Coupon rate on bonds Maturity of bonds Price of bonds (9 of par) Weighted-average tax rate Next expected dividend Expected dividend growth rate 8.000.000 $ 22:00 $40,000,000 10% 17 94.00 34.00% $ 3.00 5.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts