Question: ANSWERS MUST BE IN FORMULA PLEASE Overhead Analysis and Preparing Schedules of Cost of Goods using Excel's SUM and Basic Math Functions Stanford Enterprises has

ANSWERS MUST BE IN FORMULA PLEASE

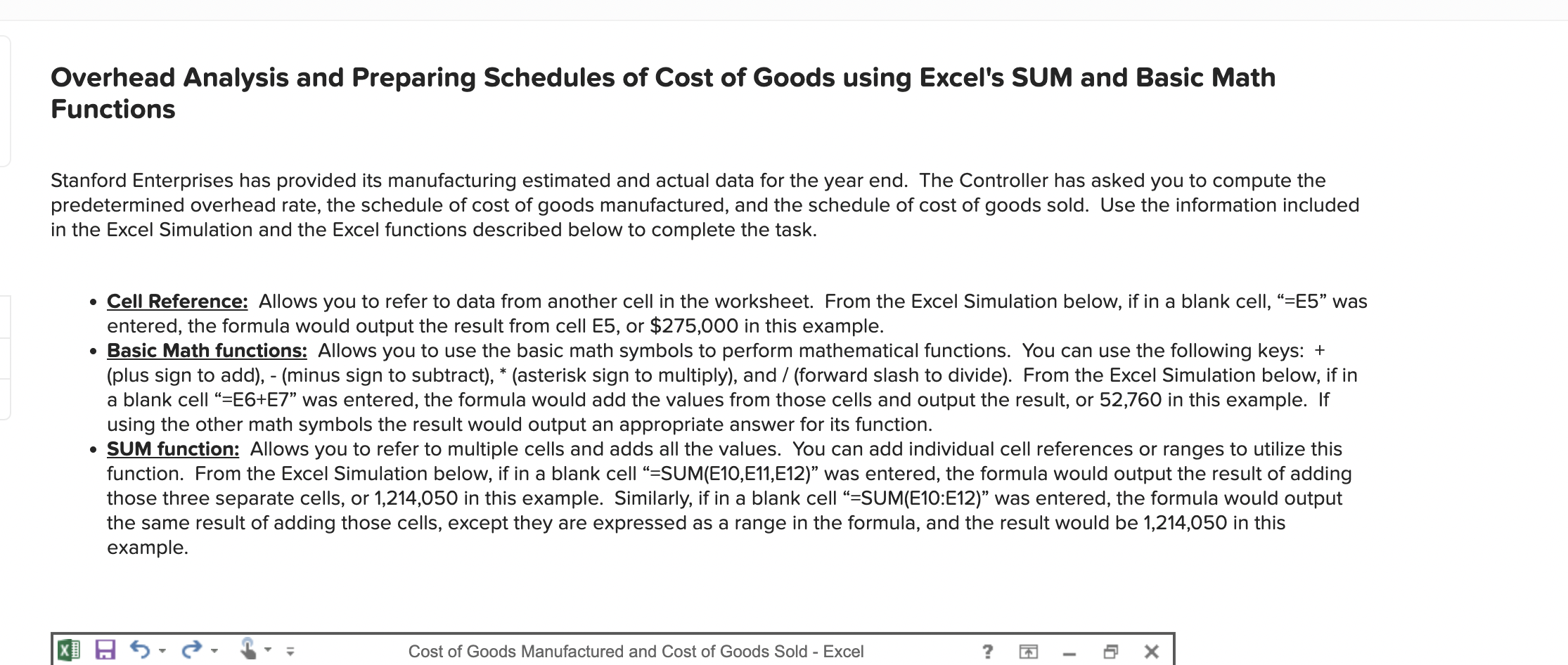

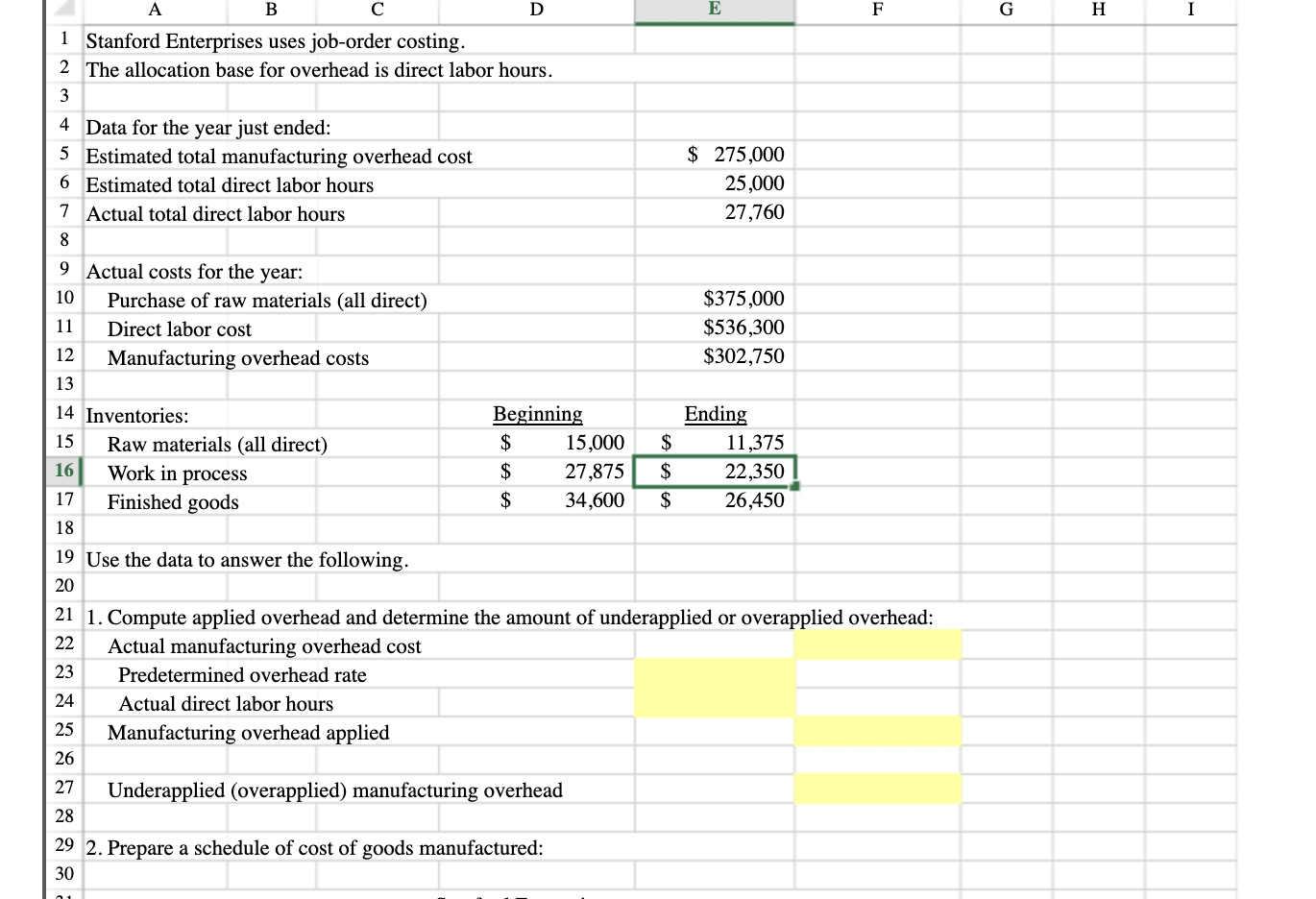

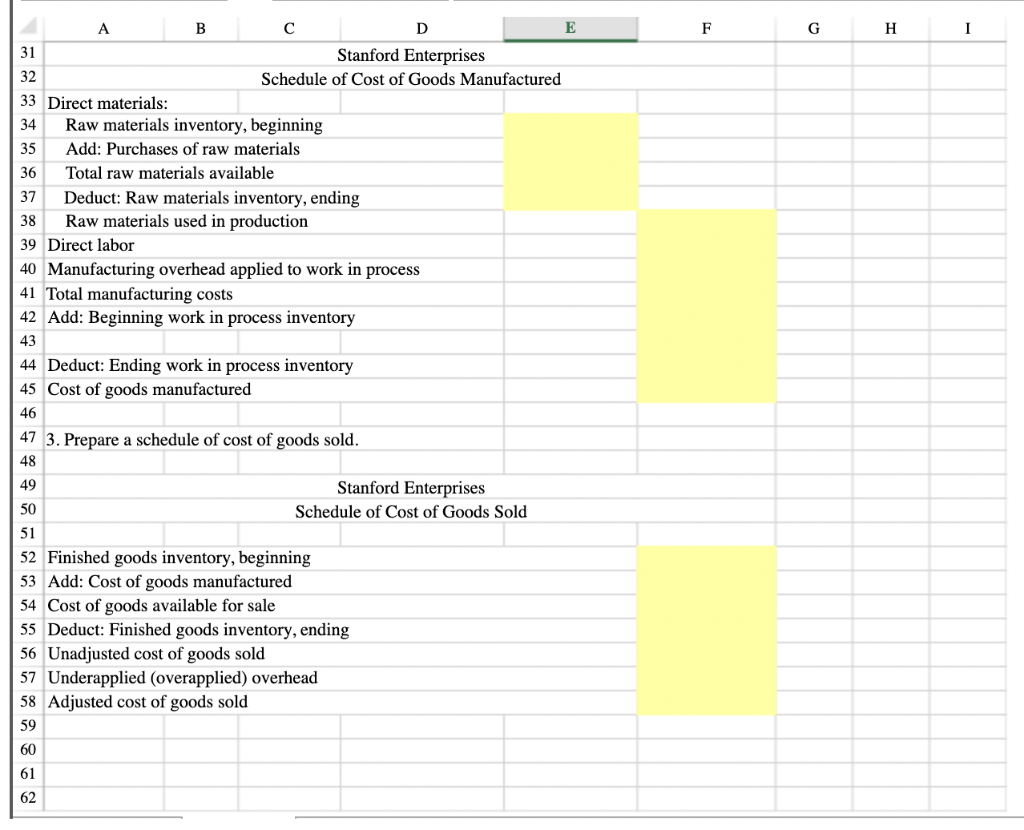

Overhead Analysis and Preparing Schedules of Cost of Goods using Excel's SUM and Basic Math Functions Stanford Enterprises has provided its manufacturing estimated and actual data for the year end. The Controller has asked you to compute the predetermined overhead rate, the schedule of cost of goods manufactured, and the schedule of cost of goods sold. Use information included in the Excel Simulation and the Excel functions described below to complete the task. - Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, "E5" was entered, the formula would output the result from cell E5, or $275,000 in this example. - Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), (asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below, if in a blank cell "=E6+E7" was entered, the formula would add the values from those cells and output the result, or 52,760 in this example. If using the other math symbols the result would output an appropriate answer for its function. - SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel Simulation below, if in a blank cell "=SUM(E10,E11,E12)" was entered, the formula would output the result of adding those three separate cells, or 1,214,050 in this example. Similarly, if in a blank cell "=SUM(E10:E12)" was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 1,214,050 in this example. \begin{tabular}{cccc} & A & B & C \\ \hline 1 & Stanford Enterprises uses job-order costing. \end{tabular} E 2 The allocation base for overhead is direct labor hours

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts