Question: Answers needed for each part with step by step solution thanks :) The finance director of a limited company is considering a number of investment

Answers needed for each part with step by step solution thanks :)

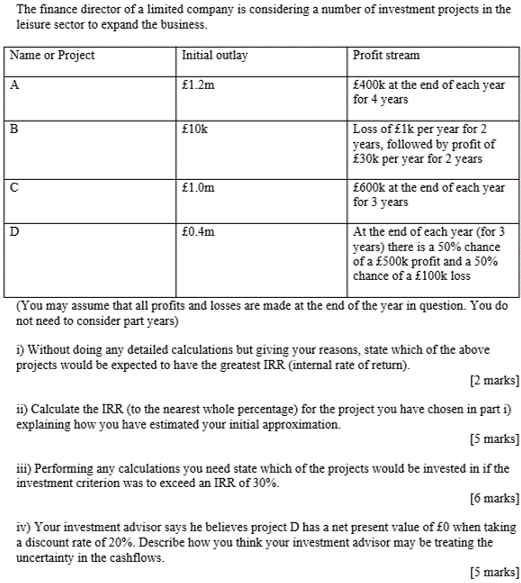

The finance director of a limited company is considering a number of investment projects in the leisure sector to expand the business. Name or Project Initial outlay Profit stream 1.2m 400k at the end of each year for 4 years 10k Loss of 1k per year for 2 years, followed by profit of 30k per year for 2 years 1.0m 600k at the end of each year for 3 years 0.4m At the end of each year (for 3 years) there is a 50% chance of a 500k profit and a 50% chance of a 100k loss (You may assume that all profits and losses are made at the end of the year in question. You do not need to consider part years) 1) Without doing any detailed calculations but giving your reasons, state which of the above projects would be expected to have the greatest IRR (internal rate of return). [2 marks ii) Calculate the IRR (to the nearest whole percentage) for the project you have chosen in parti) explaining how you have estimated your initial approximation. [5 marks] 111) Performing any calculations you need state which of the projects would be invested in if the investment criterion was to exceed an IRR of 30%. [6 marks] iv) Your investment advisor says he believes project D has a net present value of 0 when taking a discount rate of 20%. Describe how you think your investment advisor may be treating the uncertainty in the cashflows. (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts