Question: answers please QUESTION 1 a. Philip Itd is considering a project costing N80,000. The project is expected to generate annual cash benefits of NS0,000 per

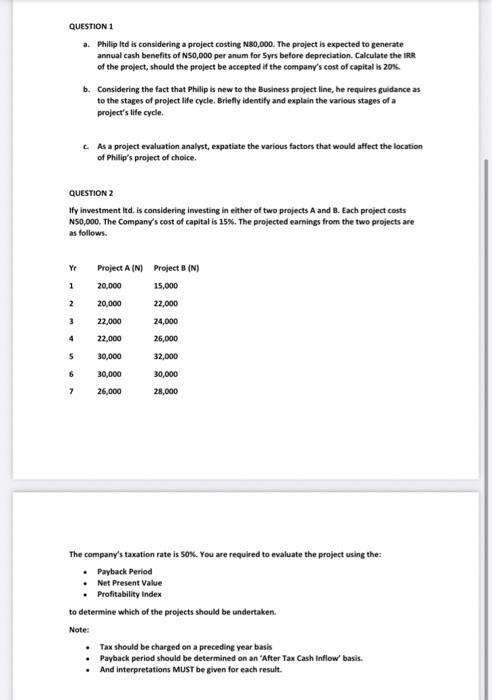

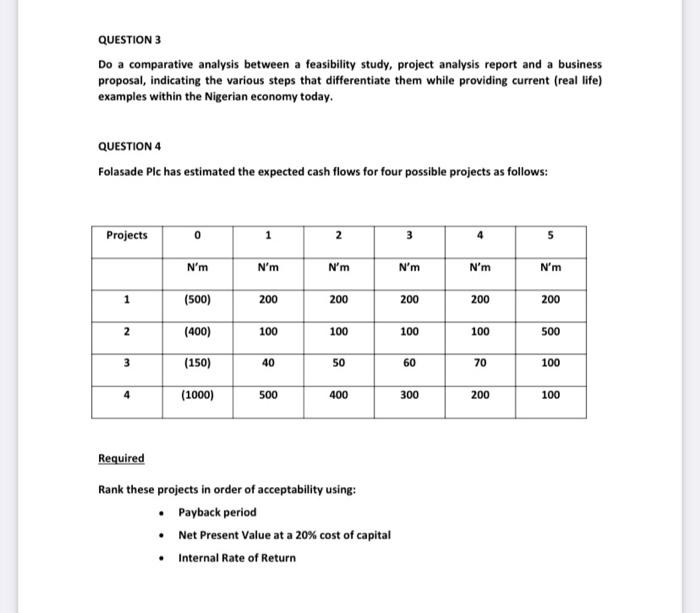

QUESTION 1 a. Philip Itd is considering a project costing N80,000. The project is expected to generate annual cash benefits of NS0,000 per anum for 5 yrs before depreciation. Calculate the ing of the project, should the project be accepted if the company's cost of capital is 20K. b. Considering the fact that Philip is new to the Business project line, he requires guidance as to the stages of project life cycle. Briefly identify and explain the various stages of a project's life cycle. c. As a project evaluation analyst, expatiate the various factors that would affect the location of Philiip's project of choice. QUESTION 2 Ify investment itd. is considering investing in either of two projects A and B. Each project costs N50,000. The Company's cost of capital is 15%. The projected earnings from the two projects are as follows. The company's taxation rate is 50k. You are required to evaluate the project using the : - Payback Period - Net Present Value - Profitability Index to determine which of the projects should be undertaken. Note: - Tax should be charged on a preceding year basis - Payback period should be determined on an 'After Tax Cash Inflow' basis. - And interpretations Must be given for each result. QUESTION 3 Do a comparative analysis between a feasibility study, project analysis report and a business proposal, indicating the various steps that differentiate them while providing current (real life) examples within the Nigerian economy today. QUESTION 4 Folasade Pic has estimated the expected cash flows for four possible projects as follows: Required Rank these projects in order of acceptability using: - Payback period - Net Present Value at a 20\% cost of capital - Internal Rate of Return QUESTION 1 a. Philip Itd is considering a project costing N80,000. The project is expected to generate annual cash benefits of NS0,000 per anum for 5 yrs before depreciation. Calculate the ing of the project, should the project be accepted if the company's cost of capital is 20K. b. Considering the fact that Philip is new to the Business project line, he requires guidance as to the stages of project life cycle. Briefly identify and explain the various stages of a project's life cycle. c. As a project evaluation analyst, expatiate the various factors that would affect the location of Philiip's project of choice. QUESTION 2 Ify investment itd. is considering investing in either of two projects A and B. Each project costs N50,000. The Company's cost of capital is 15%. The projected earnings from the two projects are as follows. The company's taxation rate is 50k. You are required to evaluate the project using the : - Payback Period - Net Present Value - Profitability Index to determine which of the projects should be undertaken. Note: - Tax should be charged on a preceding year basis - Payback period should be determined on an 'After Tax Cash Inflow' basis. - And interpretations Must be given for each result. QUESTION 3 Do a comparative analysis between a feasibility study, project analysis report and a business proposal, indicating the various steps that differentiate them while providing current (real life) examples within the Nigerian economy today. QUESTION 4 Folasade Pic has estimated the expected cash flows for four possible projects as follows: Required Rank these projects in order of acceptability using: - Payback period - Net Present Value at a 20\% cost of capital - Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts