Question: Answers the following three problems in separate sheets. Also, show your worker or risk not receiving credit. A company that does not pay dividend is

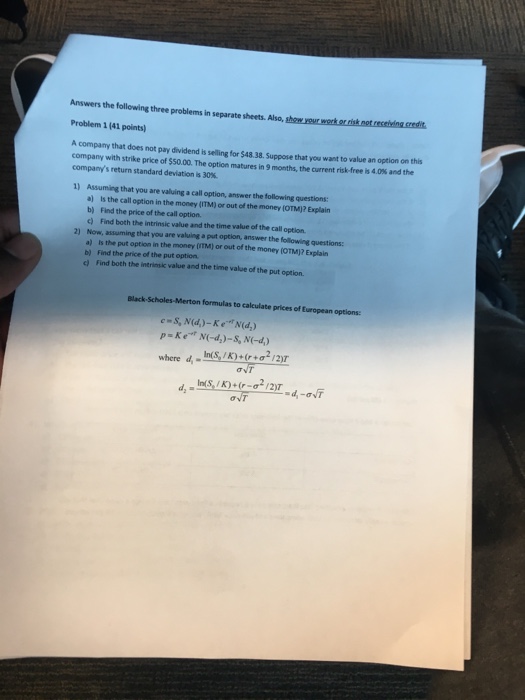

Answers the following three problems in separate sheets. Also, show your worker or risk not receiving credit. A company that does not pay dividend is selling for $48.38. Suppose that you want to value an option on this company with strike price of $50.00. The option matures in 9 months, the current risk-free is 4.0% and the company's return standard deviation is 30%. Assuming that you are valuing a call option, answer the following questions: a) Is the call option in the money (ITM) or out of the money (OTM)?Explain b) Find the price of the call option. c) Find both the intrinsic value and the time value of the call option. Now, assuming that you are valuing a put option, answer the following questions: a) Is the put option in the money (ITM) or out of the money (OTM)? Explain b) Find the price of the put option. c) Find both the intrinsic value and the time value of the put option. Black-Scholes-Merton formulas to calculate prices of options: c = S_a N (d_1) - K e^N (d_2) p = K e^N (- d_2) - S_ N (- d_1) where d_1 = In (S_0/K) + (r + sigma^2/2)T/sigma Squareroot T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts