Question: answers to both options would be appreciated Case study 1: Impact of writeoff/writedown on economics Applying the economic analysis model of ATCF to evaluate the

answers to both options would be appreciated

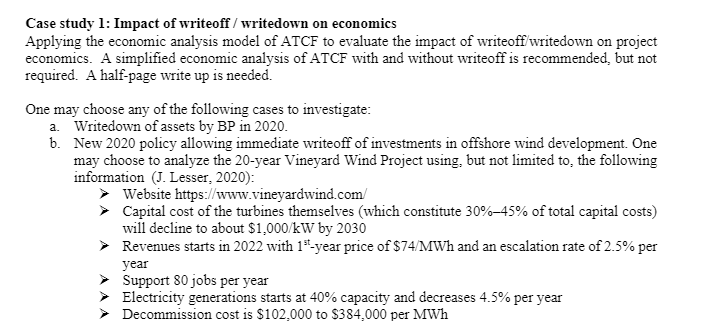

Case study 1: Impact of writeoff/writedown on economics Applying the economic analysis model of ATCF to evaluate the impact of writeoff/writedown on project economics. A simplified economic analysis of ATCF with and without writeoff is recommended, but not required. A half-page write up is needed. One may choose any of the following cases to investigate: a. Writedown of assets by BP in 2020. b. New 2020 policy allowing immediate writeoff of investments in offshore wind development. One may choose to analyze the 20-year Vineyard Wind Project using, but not limited to, the following information (J. Lesser, 2020) Website https://www.vineyardwind.com/ Capital cost of the turbines themselves (which constitute 30%-45% of total capital costs) will decline to about $1.000/kW by 2030 Revenues starts in 2022 with 1st-year price of $74/MWh and an escalation rate of 2.5% per year Support 80 jobs per year Electricity generations starts at 40% capacity and decreases 4.5% per year Decommission cost is $102,000 to $384.000 per MWh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts