Question: Answers without A. B C option are True and False questions 1. Under US banking law, national-chartered banks must purchase FDIC insurance but state- chartered

Answers without A. B C option are True and False questions

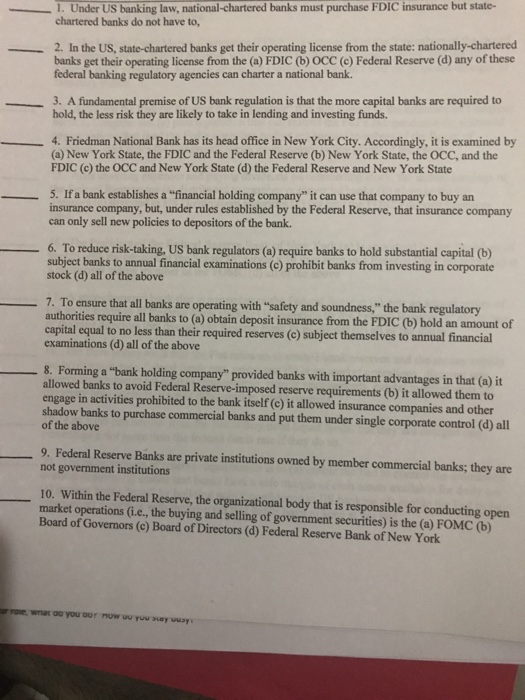

1. Under US banking law, national-chartered banks must purchase FDIC insurance but state- chartered banks do not have to, -2. In the US, state chartered banks get their operating license from the state: nationally-chartered banks get their operating license from the (a) FDIC (bOCC (c) Federal Reserve (d) any of these federal banking regulatory agencies can charter a national bank. 3. A fundamental premise of US bank regulation is that the more capital banks are required to hold, the less risk they are likely to take in lending and investing funds. -4. Friedman National Bank has its head office in New York City. Accordingly, it is examined by (a) New York State, the FDIC and the Federal Reserve (b) New York State, the OCC, and the FDIC (c) the OCC and New York State (d) the Federal Reserve and New York State -5. If a bank establishes a "financial holding company" it can use that company to buy an insurance company, but, under rules established by the Federal Reserve, that insurance company can only sell new policies to depositors of the bank. 6. To reduce risk-taking, US bank regulators (e) require banks to hold substantial capital (b) subject banks to annual financial examinations (c) prohibit banks from investing in corporate stock (d) all of the above 7. To ensure that all banks are operating with "safety and soundness," the bank regulatory authorities require all banks to (a) obtain deposit insurance from the FDIC (b) hold an amount of capital equal to no less than their required reserves (c) subject themselves to annual financial examinations (d) all of the above 8. Forming a "bank holding company" provided banks with important advantages in that (a) it allowed banks to avoid Federal Reserve-imposed reserve requirements (b) it allowed them to engage in activities prohibited to the bank itself (c) it allowed insurance companies and other shadow banks to purchase commercial banks and put them under single corporate control (d) all of the above cserve not government institutions 10. Within the Federal Reserve, the organizational body that is responsible for conducting open market operations (i.e., the buying and selling of government securities) is the (a) FOMC (b) Board of Governors (c) Board of Directors (d) Federal Reserve Bank of New York FoRE, Wiat do you oor now uu you suay uuay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts