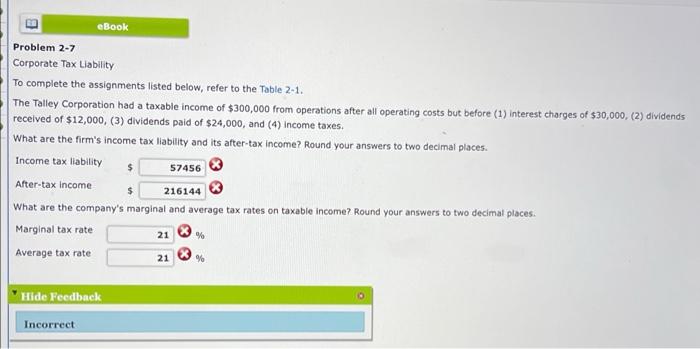

Question: answersd incorrectly, please round and ill leave a like! Problem 2-7 Corporate Tax Liability To complete the assignments listed below, refer to the Table 21.

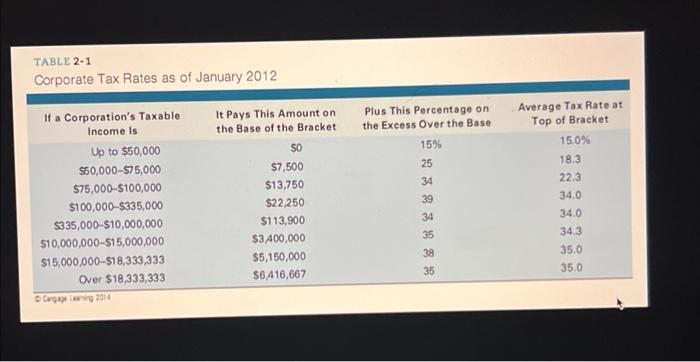

Problem 2-7 Corporate Tax Liability To complete the assignments listed below, refer to the Table 21. The Talley Corporation had a taxable income of $300,000 from operations after all operating costs but before (1) interest charges of $30,000, (2) dividends recelved of $12,000,(3) dividends paid of $24,000, and (4) income taxes. What are the firm's income tax llability and its after-tax income? Round your answers to two decimal places. Income tax liability After-tax income What are the company's marginal and average tax rates on taxable income? Round your answers to two decimal places. Marginal tax rate Average tax rate TABLE 2-1 Anuenuwa Tav Datae de nf. Ianiuary 2012

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts