Question: Anthony Walker Company sells 8% bonds having a maturity value of $1,420,000 for $1,312,340.00. The bonds are dated January 1 , 2025 , and mature

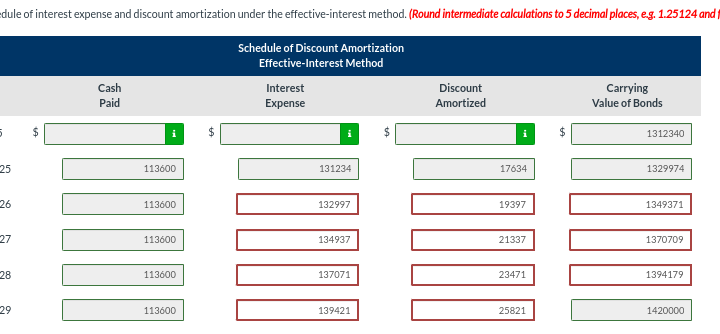

Anthony Walker Company sells 8% bonds having a maturity value of $1,420,000 for $1,312,340.00. The bonds are dated January 1 , 2025 , and mature January 1, 2030. Interest is payable annually on January 1. Click here to view factor tables. (a) Determine the effective-interest rate. (Round present value factor to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 18\%) The effective-interest rate % dule of interest expense and discount amortization under the effective-interest method. (Round intermediate calculations to 5 decimal places, e.g. 1.25124 and )

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock