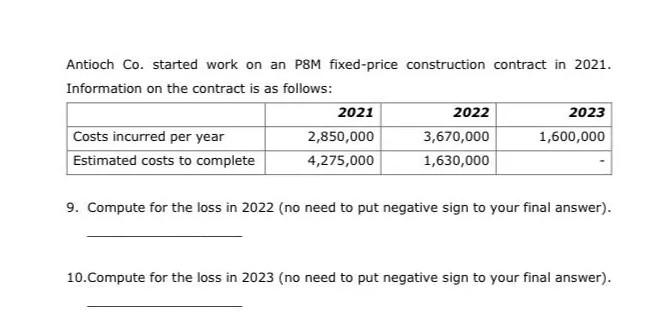

Question: Antioch Co. started work on an P8M fixed-price construction contract in 2021. Information on the contract is as follows: 2021 2022 2023 Costs incurred per

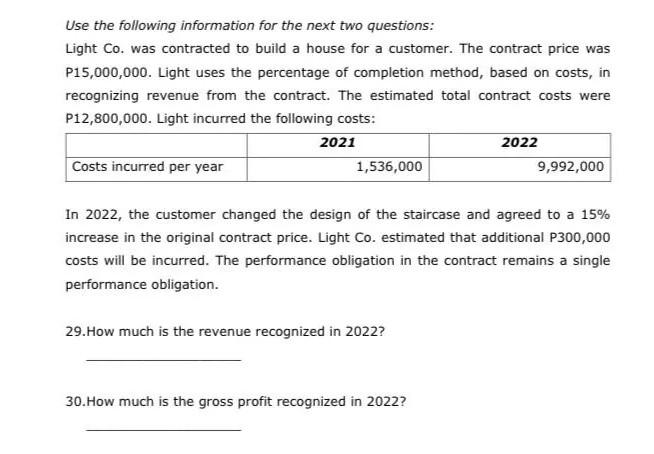

Antioch Co. started work on an P8M fixed-price construction contract in 2021. Information on the contract is as follows: 2021 2022 2023 Costs incurred per year 2,850,000 3,670,000 1,600,000 Estimated costs to complete 4,275,000 1,630,000 9. Compute for the loss in 2022 (no need to put negative sign to your final answer). 10. Compute for the loss in 2023 (no need to put negative sign to your final answer). Use the following information for the next two questions: Light Co. was contracted to build a house for a customer. The contract price was P15,000,000. Light uses the percentage of completion method, based on costs, in recognizing revenue from the contract. The estimated total contract costs were P12,800,000. Light incurred the following costs: 2021 2022 Costs incurred per year 1,536,000 9,992,000 In 2022, the customer changed the design of the staircase and agreed to a 15% increase in the original contract price. Light Co. estimated that additional P300,000 costs will be incurred. The performance obligation in the contract remains a single performance obligation. 29. How much is the revenue recognized in 2022? 30. How much is the gross profit recognized in 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts