Question: Anton purchases a building on May 4, 2002, at a cost of $380,000. The land is properly allocated $20,000 of the cost. Anton sells the

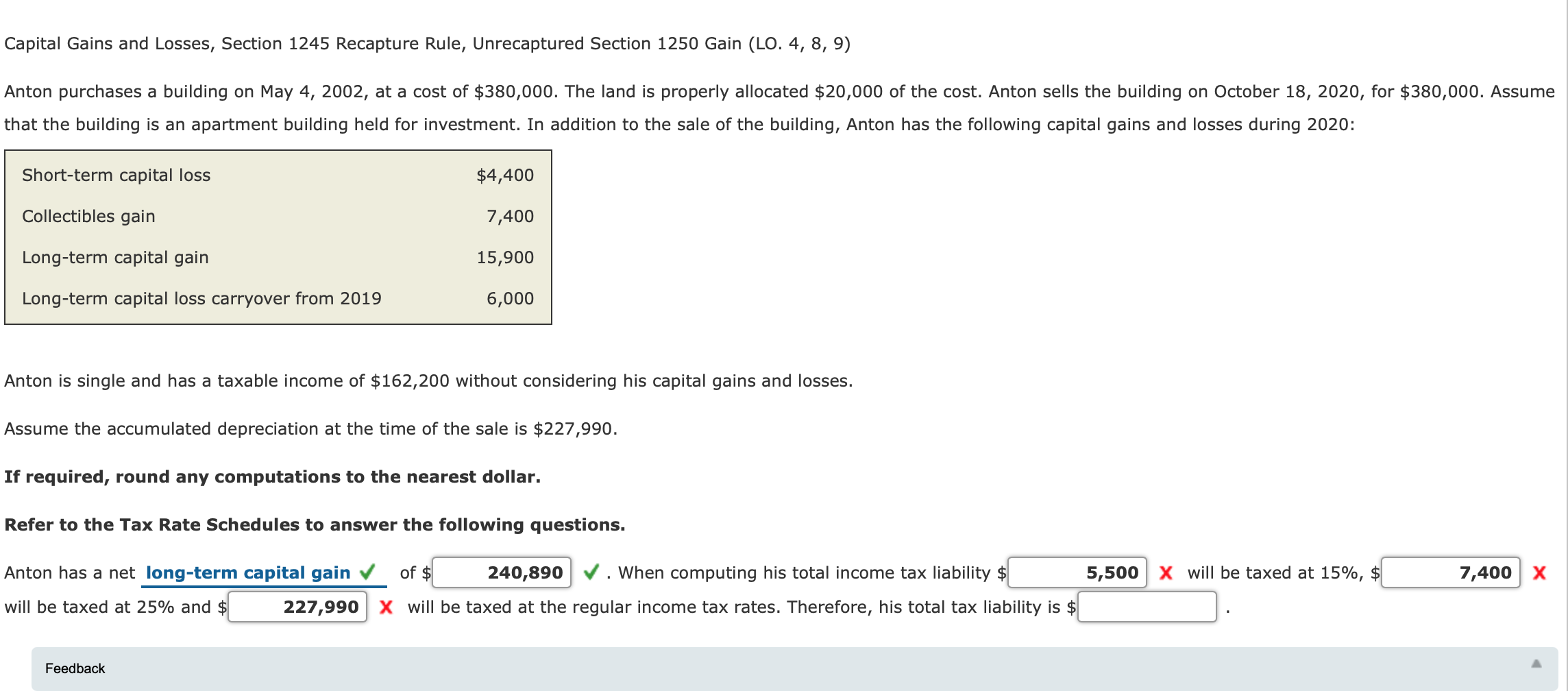

Anton purchases a building on May 4, 2002, at a cost of $380,000. The land is properly allocated $20,000 of the cost. Anton sells the building on October 18, 2020, for $380,000. Assume that the building is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2020:

Capital Gains and Losses, Section 1245 Recapture Rule, Unrecaptured Section 1250 Gain (LO. 4, 8, 9) Anton purchases a building on May 4, 2002, at a cost of $380,000. The land is properly allocated $20,000 of the cost. Anton sells the building on October 18, 2020, for $380,000. Assume that the building is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2020: Short-term capital loss $4,400 Collectibles gain 7,400 Long-term capital gain 15,900 Long-term capital loss carryover from 2019 6,000 Anton is single and has a taxable income of $162,200 without considering his capital gains and losses. Assume the accumulated depreciation at the time of the sale is $227,990. If required, round any computations to the nearest dollar. Refer to the Tax Rate Schedules to answer the following questions. 5,500 X will be taxed at 15%, 7,400 x Anton has a net long-term capital gain of $ 240,890. When computing his total income tax liability $ will be taxed at 25% and $ 227,990 X will be taxed at the regular income tax rates. Therefore, his total tax liability is $ Feedback Capital Gains and Losses, Section 1245 Recapture Rule, Unrecaptured Section 1250 Gain (LO. 4, 8, 9) Anton purchases a building on May 4, 2002, at a cost of $380,000. The land is properly allocated $20,000 of the cost. Anton sells the building on October 18, 2020, for $380,000. Assume that the building is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2020: Short-term capital loss $4,400 Collectibles gain 7,400 Long-term capital gain 15,900 Long-term capital loss carryover from 2019 6,000 Anton is single and has a taxable income of $162,200 without considering his capital gains and losses. Assume the accumulated depreciation at the time of the sale is $227,990. If required, round any computations to the nearest dollar. Refer to the Tax Rate Schedules to answer the following questions. 5,500 X will be taxed at 15%, 7,400 x Anton has a net long-term capital gain of $ 240,890. When computing his total income tax liability $ will be taxed at 25% and $ 227,990 X will be taxed at the regular income tax rates. Therefore, his total tax liability is $ Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts