Question: Anwser all multiple choice Multiple Choice (3 points each) 0 costs include all of the following event A wages of production workers B. depreciation on

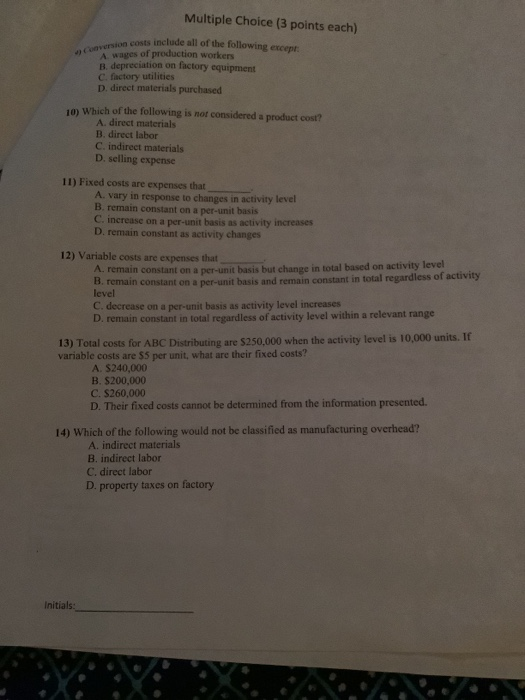

Multiple Choice (3 points each) 0 costs include all of the following event A wages of production workers B. depreciation on factory equipment C. factory utilities D. direct materials purchased 10) Which of the following is not considered a product cost? A direct materials B. direct labor C. indirect materials D. selling expense 11) Fixed costs are expenses that A. vary in response to changes in activity level B. remain constant on a per-unit basis C. increase on a per-unit basis as activity increases D. remain constant as activity changes 12) Variable costs are expenses that A remain constant on a per-unit basis but change in total based on activity level B. remain constant on a per-unit basis and remain constant in total regardless of activity level C. decrease on a per-unit basis as activity level increases D. remain constant in total regardless of activity level within a relevant range 13) Total costs for ABC Distributing are $250,000 when the activity level is 10,000 units. If variable costs are $5 per unit, what are their fixed costs? A S240,000 B. $200,000 C. S260,000 D. Their fixed costs cannot be determined from the information presented. 14) Which of the following would not be classified as manufacturing overhead? A. indirect materials B. indirect labor C. direct labor D. property taxes on factory Initials

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts