Question: any answers will be rated immediately :) Aa Copy Format Painter Times New Rome 12 - A A A A E 1 1 BTU XX

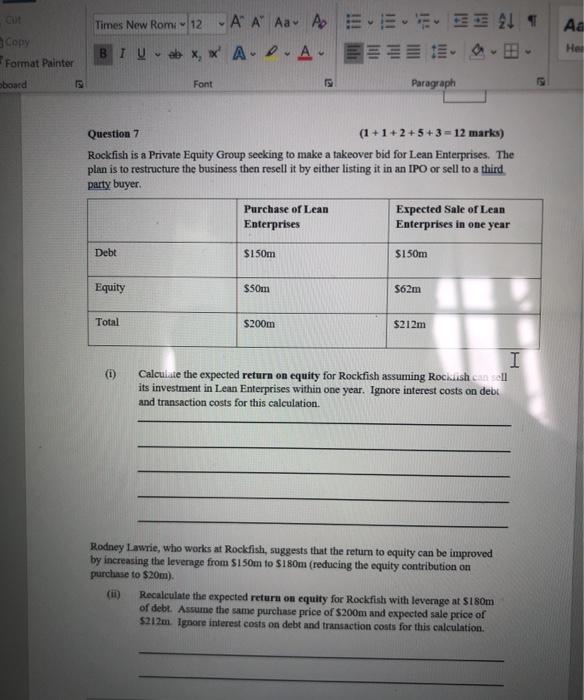

Aa Copy Format Painter Times New Rome 12 - A A A A E 1 1 BTU XX A.P.A. E12 - Hel oboard Font Paragraph Question 7 (1 +1 +2 +5+3 - 12 marks) Rockfish is a Private Equity Group seeking to make a takeover bid for Lean Enterprises. The plan is to restructure the business then resell it by either listing it in an IPO or sell to a third party buyer Purchase of Lean Enterprises Expected sale of Lean Enterprises in one year Debt $150m $150m Equity S50m $62m Total S200m $212m (1) I Calculate the expected return on equity for Rockfish assuming Rocklish can all its investment in Lean Enterprises within one year. Ignore interest costs on debi and transaction costs for this calculation Rodney Lawrie, who works at Rockfish, suggests that the return to equity can be improved by increasing the leverage from S1 50m to 5180m (reducing the equity contribution on purchase to $20m). Recalculate the expected return on equity for Rockfish with leverage at $180m of debt. Assume the same purchase price of $200m and expected sale price of $212m. Ignore interest costs on debt and transaction costs for this calculation. Question 7 (cont.) (iii) Calculate the expected return on equity if the expected sale price of Lean Enterprises is $185m? Consider both leverage scenarios of S150m and $180m. Ignore interest costs on debt and transaction costs for this calculation. (iv) Rodney's boss at Rockfish, Smith Kline, calls Rodney into a Zoom meeting to discuss why Rodney's proposal has been rejected. Smith Kline starts the meeting by saying: "It's not the risk angle of the leverage that we're worried about, but tex.... What reason does Smith Kline give Rodney? Briefly discuss. Corporate Vinocul Decision Makin, Final Examination Aa Copy Format Painter Times New Rome 12 - A A A A E 1 1 BTU XX A.P.A. E12 - Hel oboard Font Paragraph Question 7 (1 +1 +2 +5+3 - 12 marks) Rockfish is a Private Equity Group seeking to make a takeover bid for Lean Enterprises. The plan is to restructure the business then resell it by either listing it in an IPO or sell to a third party buyer Purchase of Lean Enterprises Expected sale of Lean Enterprises in one year Debt $150m $150m Equity S50m $62m Total S200m $212m (1) I Calculate the expected return on equity for Rockfish assuming Rocklish can all its investment in Lean Enterprises within one year. Ignore interest costs on debi and transaction costs for this calculation Rodney Lawrie, who works at Rockfish, suggests that the return to equity can be improved by increasing the leverage from S1 50m to 5180m (reducing the equity contribution on purchase to $20m). Recalculate the expected return on equity for Rockfish with leverage at $180m of debt. Assume the same purchase price of $200m and expected sale price of $212m. Ignore interest costs on debt and transaction costs for this calculation. Question 7 (cont.) (iii) Calculate the expected return on equity if the expected sale price of Lean Enterprises is $185m? Consider both leverage scenarios of S150m and $180m. Ignore interest costs on debt and transaction costs for this calculation. (iv) Rodney's boss at Rockfish, Smith Kline, calls Rodney into a Zoom meeting to discuss why Rodney's proposal has been rejected. Smith Kline starts the meeting by saying: "It's not the risk angle of the leverage that we're worried about, but tex.... What reason does Smith Kline give Rodney? Briefly discuss. Corporate Vinocul Decision Makin, Final Examination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts