Question: any answers will be rated immediately :) Q4.1 Question 4.1 4 Points Your investment portfolio consists of $10,000 worth of MLM Ltd's shares which has

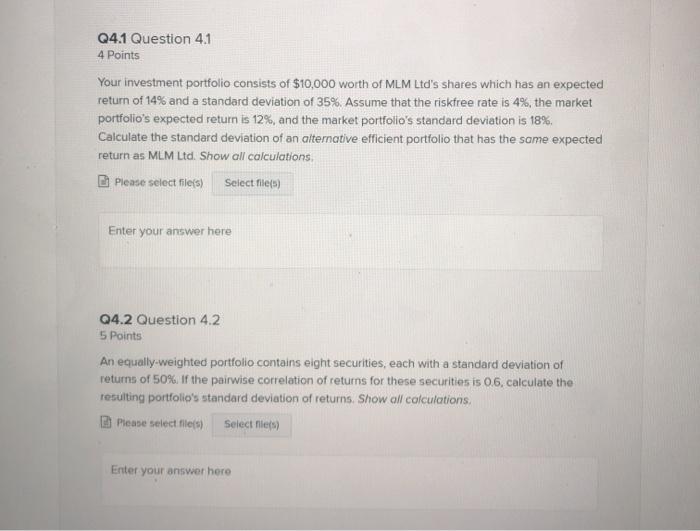

Q4.1 Question 4.1 4 Points Your investment portfolio consists of $10,000 worth of MLM Ltd's shares which has an expected return of 14% and a standard deviation of 35%. Assume that the riskfree rate is 4%, the market portfolio's expected return is 12%, and the market portfolio's standard deviation is 18% Calculate the standard deviation of an alternative efficient portfolio that has the same expected return as MLM Ltd. Show all calculations, Please select files) Select files) Enter your answer here Q4.2 Question 4.2 5 Points An equally-weighted portfolio contains eight securities, each with a standard deviation of returns of 50%. If the pairwise correlation of returns for these securities is 0.6, calculate the resulting portfolio's standard deviation of returns. Show all calculations Please select file Selectie Enter your answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts