Question: Any expert can help me solve this ques (for all 8 column Project ABC7 costs RM15,000. Its expected cash flows would be RM4,500 per year

Any expert can help me solve this ques (for all 8 column

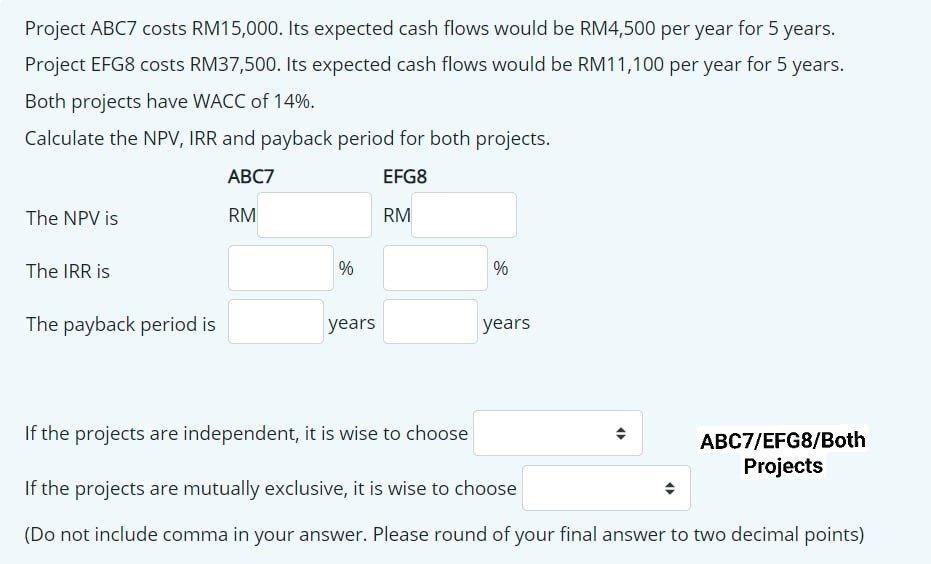

Project ABC7 costs RM15,000. Its expected cash flows would be RM4,500 per year for 5 years. Project EFG8 costs RM37,500. Its expected cash flows would be RM11,100 per year for 5 years. Both projects have WACC of 14%. Calculate the NPV, IRR and payback period for both projects. ABC7 EFG8 The NPV is RM RM The IRR is % % The payback period is years years If the projects are independent, it is wise to choose ABC7/EFG8/Both Projects If the projects are mutually exclusive, it is wise to choose (Do not include comma in your answer. Please round of your final answer to two decimal points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts