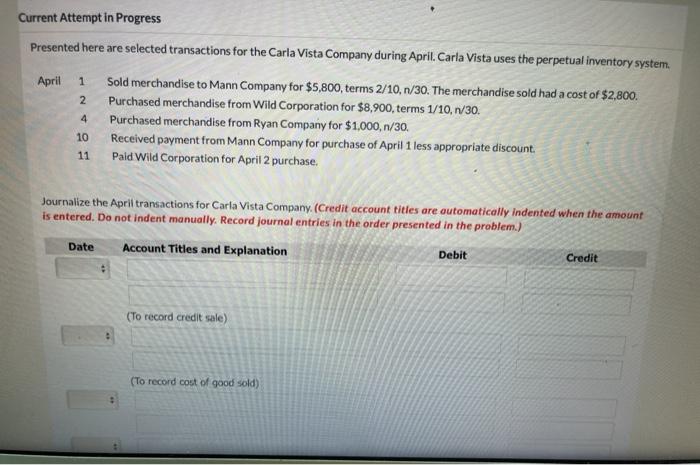

Question: any help? Current Attempt in Progress Presented here are selected transactions for the Carla Vista Company during April. Carla Vista uses the perpetual inventory system.

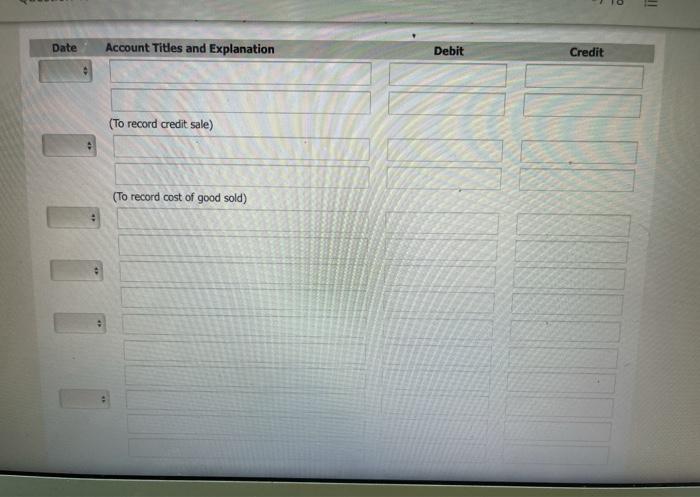

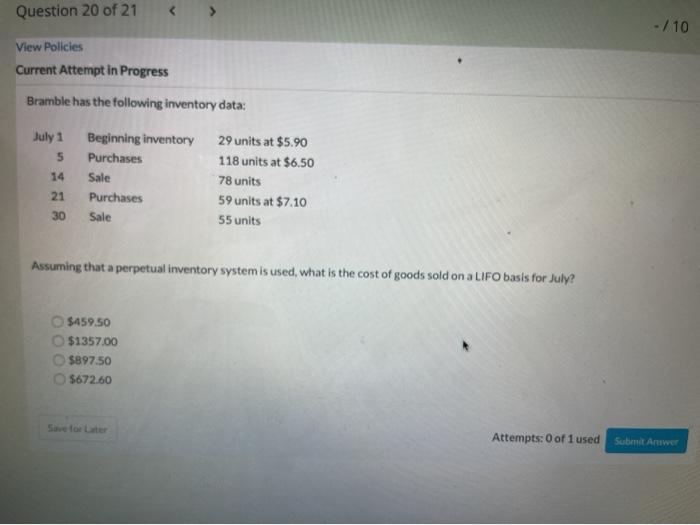

Current Attempt in Progress Presented here are selected transactions for the Carla Vista Company during April. Carla Vista uses the perpetual inventory system. April 1 2 4 10 11 Sold merchandise to Mann Company for $5,800, terms 2/10, 1/30. The merchandise sold had a cost of $2,800. Purchased merchandise from Wild Corporation for $8,900, terms 1/10, 1/30. Purchased merchandise from Ryan Company for $1.000, 1/30. Received payment from Mann Company for purchase of April 1 less appropriate discount Pald Wild Corporation for April 2 purchase. Journalize the April transactions for Carla Vista Company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Credit Debit (To record credit sale) (To record cost of good sold) = Date Account Titles and Explanation Debit Credit (To record credit sale) (To record cost of good sold) Question 20 of 21 - / 10 View Policies Current Attempt in Progress Bramble has the following inventory data: July 1 5 14 Beginning inventory Purchases Sale Purchases Sale 29 units at $5.90 118 units at $6.50 78 units 59 units at $7.10 55 units 21 30 Assuming that a perpetual inventory system is used, what is the cost of goods sold on a LIFO basis for July? $459.50 $1357.00 $897.50 $672.60 Attempts: 0 of 1 used Submit Aruwer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts