Question: Any help on tgese questions would be appreciated Homework 2 Due: 11:59PM Sep 19th 2021 1. Based on the provided pension account in the table

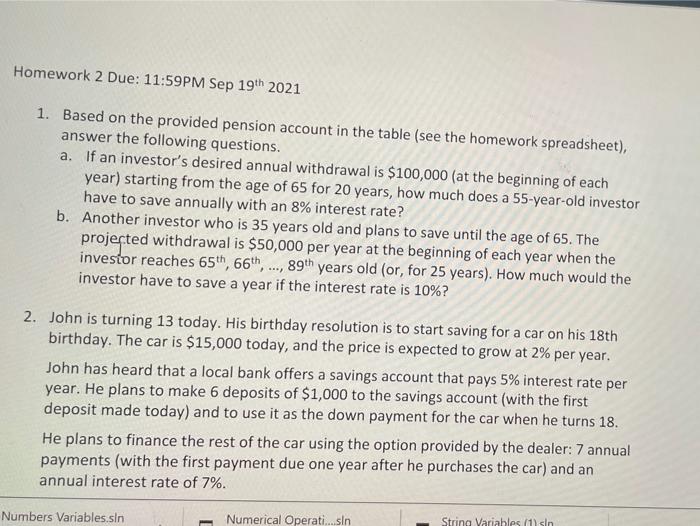

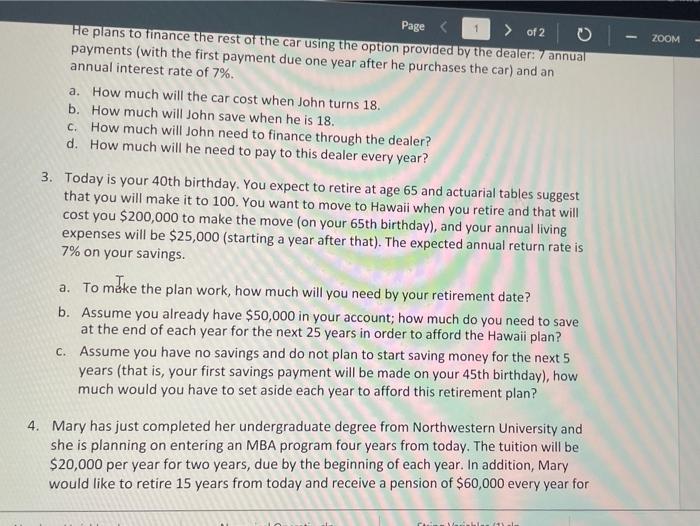

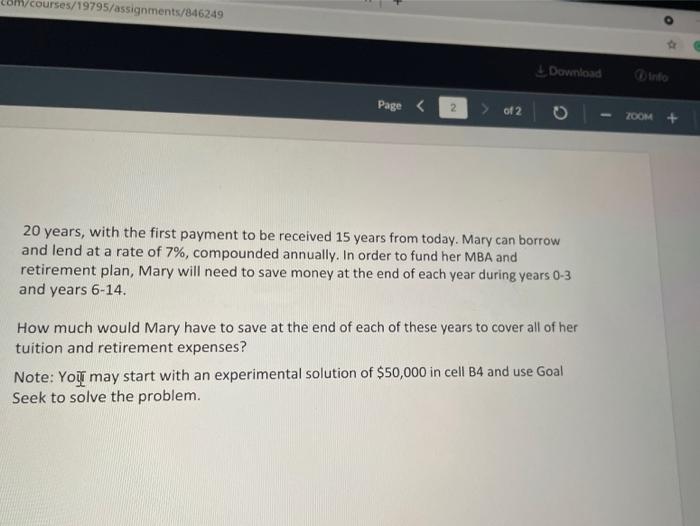

Homework 2 Due: 11:59PM Sep 19th 2021 1. Based on the provided pension account in the table (see the homework spreadsheet), answer the following questions. a. If an investor's desired annual withdrawal is $100,000 (at the beginning of each year) starting from the age of 65 for 20 years, how much does a 55-year-old investor have to save annually with an 8% interest rate? b. Another investor who is 35 years old and plans to save until the age of 65. The projected withdrawal is $50,000 per year at the beginning of each year when the investor reaches 65th, 66th, ..., 89th years old (or, for 25 years). How much would the investor have to save a year if the interest rate is 10%? 2. John is turning 13 today. His birthday resolution is to start saving for a car on his 18th birthday. The car is $15,000 today, and the price is expected to grow at 2% per year. John has heard that a local bank offers a savings account that pays 5% interest rate per year. He plans to make 6 deposits of $1,000 to the savings account (with the first deposit made today) and to use it as the down payment for the car when he turns 18. He plans to finance the rest of the car using the option provided by the dealer: 7 annual payments (with the first payment due one year after he purchases the car) and an annual interest rate of 7%. Numbers Variables.sin Numerical Operati....sin String Variables (1) sin Page ZOOM > of 2 He plans to finance the rest of the car using the option provided by the dealer: 7 annual payments (with the first payment due one year after he purchases the car) and an annual interest rate of 7%. a. How much will the car cost when John turns 18. b. How much will John save when he is 18. C. How much will John need to finance through the dealer? d. How much will he need to pay to this dealer every year? 3. Today is your 40th birthday. You expect to retire at age 65 and actuarial tables suggest that you will make it to 100. You want to move to Hawaii when you retire and that will cost you $200,000 to make the move on your 65th birthday), and your annual living expenses will be $25,000 (starting a year after that). The expected annual return rate is 7% on your savings. a. To moke the plan work, how much will you need by your retirement date? b. Assume you already have $50,000 in your account; how much do you need to save at the end of each year for the next 25 years in order to afford the Hawaii plan? C. Assume you have no savings and do not plan to start saving money for the next 5 years (that is, your first savings payment will be made on your 45th birthday), how much would you have to set aside each year to afford this retirement plan? 4. Mary has just completed her undergraduate degree from Northwestern University and she is planning on entering an MBA program four years from today. The tuition will be $20,000 per year for two years, due by the beginning of each year. In addition, Mary would like to retire 15 years from today and receive a pension of $60,000 every year for Hilal courses/19795/assignments/846249 Download Info Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts