Question: any help please Chapter 6 Orientation Video Savi 1 costs of goods sold are removed from Inventory and reported as an expense called Cost of

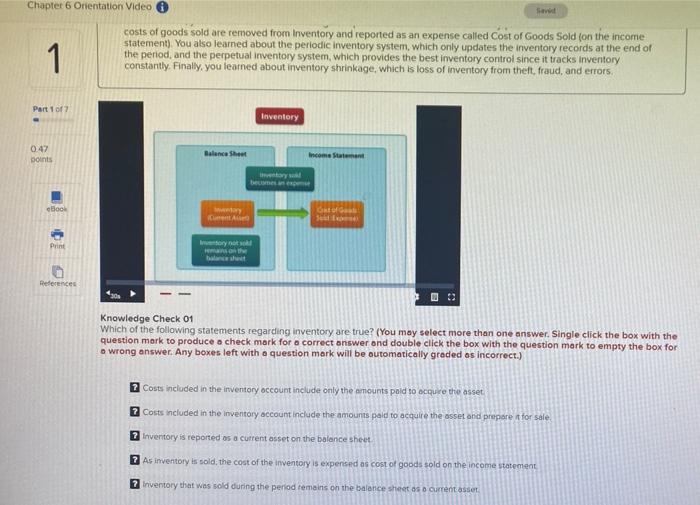

Chapter 6 Orientation Video Savi 1 costs of goods sold are removed from Inventory and reported as an expense called Cost of Goods Sold (on the income statement). You also learned about the periodic inventory system, which only updates the inventory records at the end of the period, and the perpetual inventory system, which provides the best inventory control since it tracks inventory constantly. Finally, you learned about inventory shrinkage, which is loss of inventory from theft, fraud, and errors. Part 1 of 7 Inventory 0.47 points Balance Sheet Income Same w Bool Print ry month References Knowledge Check 01 Which of the following statements regarding inventory are true? (You may select more than one answer. Single click the box with the question mark to produce o check mark for a correct answer and double click the box with the question mark to empty the box for wrong answer. Any boxes left with a question mark will be automatically graded os incorrect.) 2 Costs included in the inventory occount include only the amounts paid to acqure the asset 2 Costs included in the inventory account include the amounts paid to acquire the asset and prepare for sale 2 Inventory is reported as a current asset on the balance sheet 2 As inventory is sold, the cost of the inventory is expensed as cost of goods sold on the income statement 2 Inventory that was sold during the period remains on the balance sheet as a current asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts