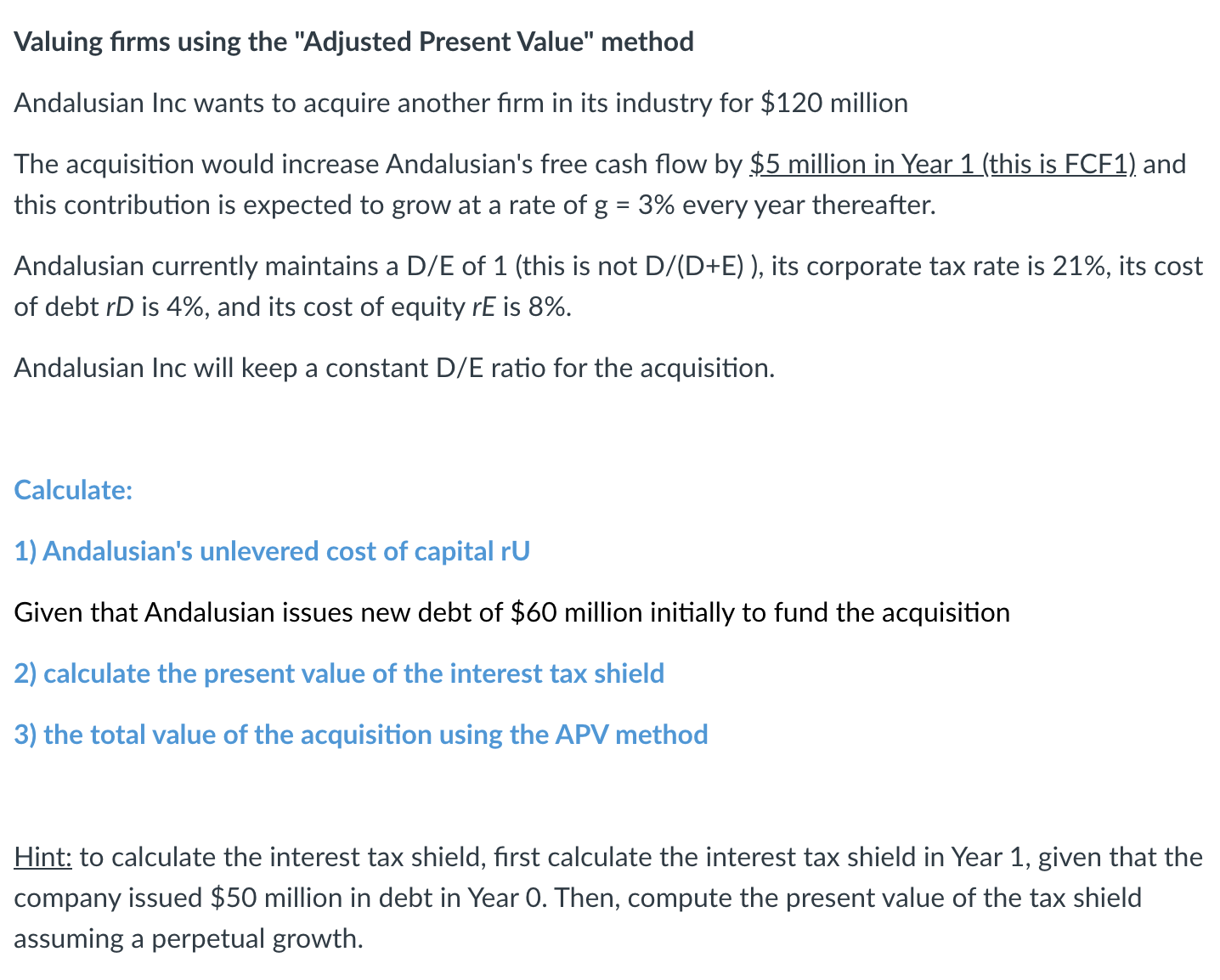

Question: Any help would be appreciated. Thank you! Valuing rms using the Adjusted Present Value method Andalusian Inc wants to acquire another rm in its industry

Any help would be appreciated. Thank you!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock