Question: Any help would be great! Use the Dynamic Exhibit to answer the following questions. 1. Fill in depreciation expense in year 3 under each depreciation

Any help would be great!

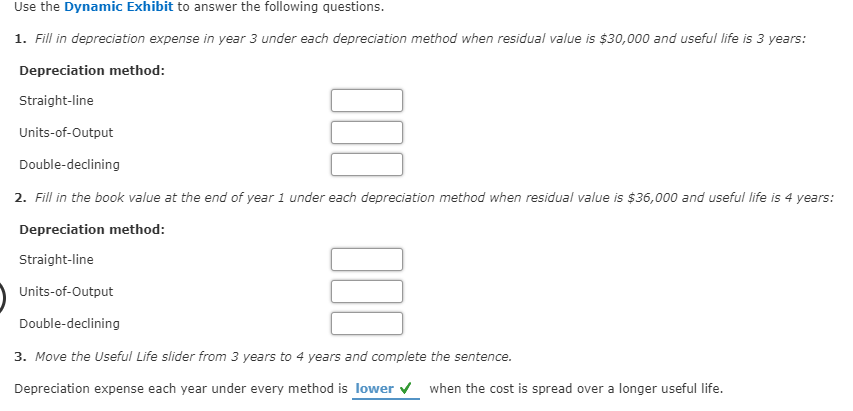

Use the Dynamic Exhibit to answer the following questions. 1. Fill in depreciation expense in year 3 under each depreciation method when residual value is $30,000 and useful life is 3 years: Depreciation method: Straight-line Units-of-Output Double-declining 2. Fill in the book value at the end of year 1 under each depreciation method when residual value is $36,000 and useful life is 4 years: Depreciation method: Straight-line Units-of-Output Double-declining 3. Move the Useful Life slider from 3 years to 4 years and complete the sentence. Depreciation expense each year under every method is lower when the cost is spread over a longer useful life. Use the Dynamic Exhibit to answer the following questions. 1. Fill in depreciation expense in year 3 under each depreciation method when residual value is $30,000 and useful life is 3 years: Depreciation method: Straight-line Units-of-Output Double-declining 2. Fill in the book value at the end of year 1 under each depreciation method when residual value is $36,000 and useful life is 4 years: Depreciation method: Straight-line Units-of-Output Double-declining 3. Move the Useful Life slider from 3 years to 4 years and complete the sentence. Depreciation expense each year under every method is lower when the cost is spread over a longer useful life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts