Question: any help would be very appreciated! Problem 4-1A (Static) Comparing plantwide rate method and activity-based costing LO P1, P3 Craftmore Machining reports the following budgeted

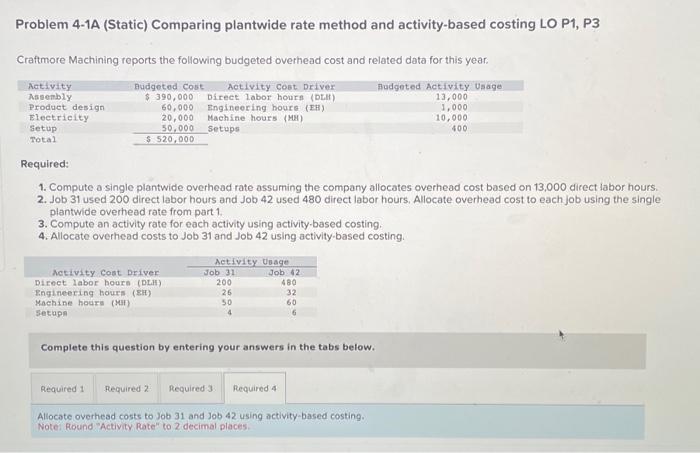

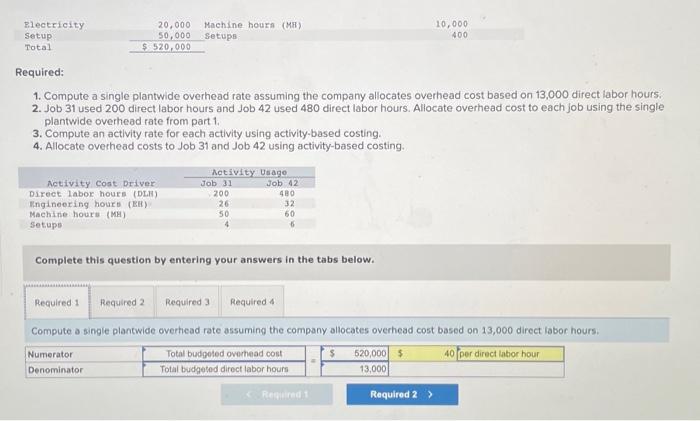

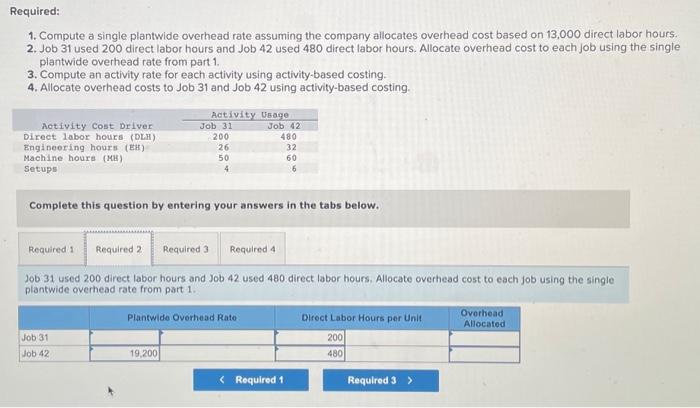

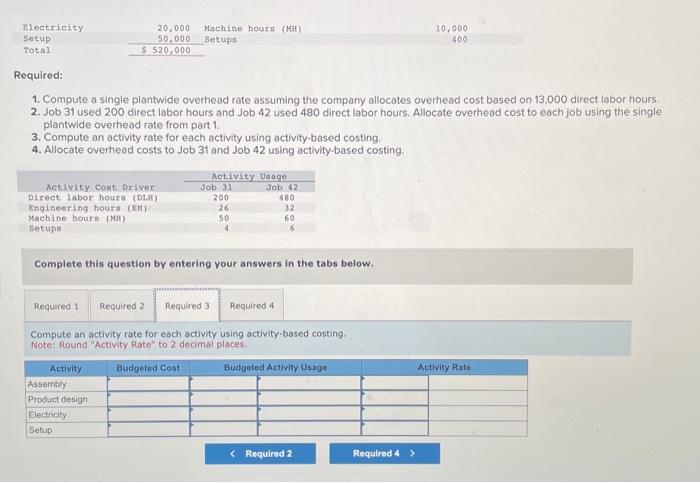

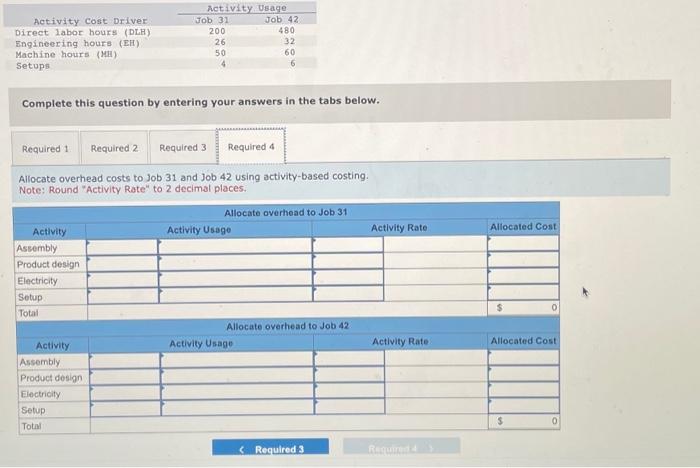

Problem 4-1A (Static) Comparing plantwide rate method and activity-based costing LO P1, P3 Craftmore Machining reports the following budgeted overhead cost and related data for this year. Required: 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 13,000 direct labor hours. 2. Job 31 used 200 direct labor hours and Job 42 used 480 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1. 3. Compute an activity rate for each activity using activity-based costing. 4. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Complete this question by entering your answers in the tabs below. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Notes Round "Activity Rate" to 2 decimal places. Complete this question by entering your answers in the tabs below. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Note: Round "Activity Rate" to 2 decimal places. 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 13,000 direct labor hours. 2. Job 31 used 200 direct labor hours and Job 42 used 480 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1. 3. Compute an activity rate for each activity using activity-based costing. 4. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Complete this question by entering your answers in the tabs below. Job 31 used 200 direct labor hours and Job 42 used 480 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1. 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 13,000 direct labor hours. 2. Job 31 used 200 direct labor hours and Job 42 used 480 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1. 3. Compute an activity rate for each activity using activity-based costing. 4. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Complete this question by entering your answers in the tabs below. 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 13,000 direct labor hours 2. Job 31 used 200 direct labor hours and Job 42 used 480 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1. 3. Compute an activity rate for each activity using activity-based costing. 4. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Complete this question by entering your answers in the tabs below. Compute an activity rate for each activity using activity-based costing. Note: Round "Activity Rate" to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts