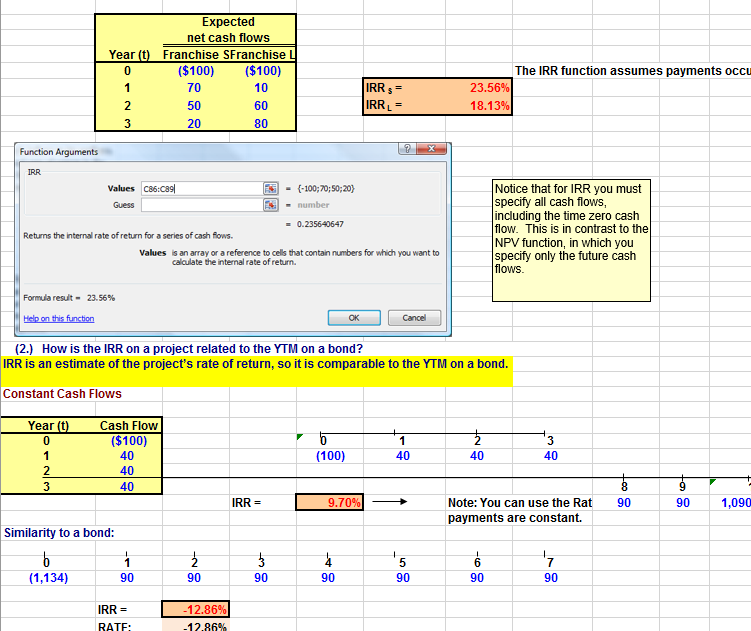

Question: Any help you could provide will be much appreciated! Expected net cash flows Year (t) Franchise SFranchise ($100) ($100) The IRR function assumes payments occu

Any help you could provide will be much appreciated!

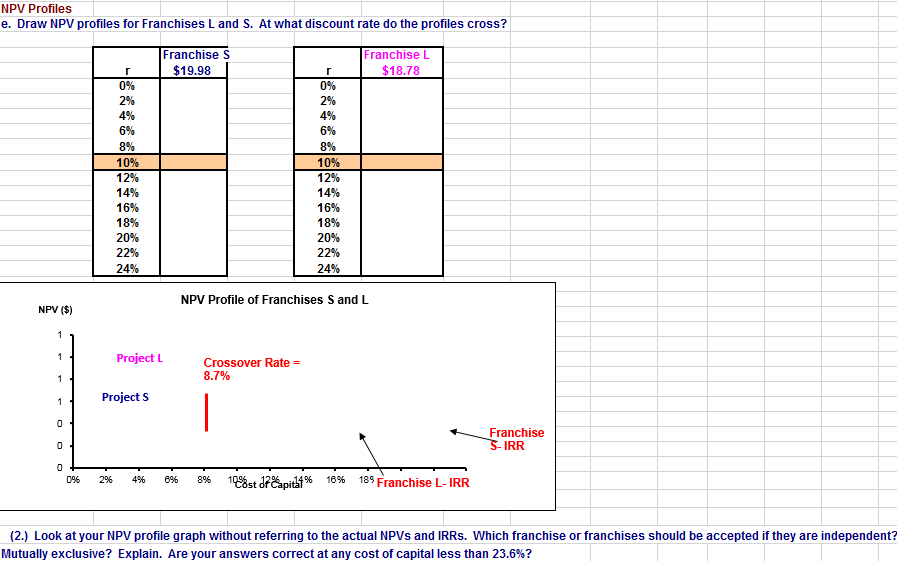

Expected net cash flows Year (t) Franchise SFranchise ($100) ($100) The IRR function assumes payments occu 70 50 20 10 60 80 IRRs IRR L = 23.56% 18.13% Function Arguments Values C86:C89 -100;70:50;20) -number Notice that for IRR you must specify all cash flows, including the time zero cash flow. This is in contrast to the NPV function, in which you specify only the future cash flows 0.235640647 Returns the internal rate ofreturn for a series of cash lows Values is an array or a reference to cells that contain numbers for which you want to calculate the internal rate of return Formula result- 23.56% (2.) How is the IRR on a project related to the YTM on a bond? IRR is an estimate of the project's rate of return, so it is comparable to the YTM on a bond. Constant Cash Flows Year (t ($100) 40 40 40 (100) 40 40 40 IRR = 9.7 % Note: You can use the Rat payments are constant. 90 90 1,090 Similarity to a bond: 5 90 (1,134) 90 90 90 90 90 90 IRR 12.86% Expected net cash flows Year (t) Franchise SFranchise ($100) ($100) The IRR function assumes payments occu 70 50 20 10 60 80 IRRs IRR L = 23.56% 18.13% Function Arguments Values C86:C89 -100;70:50;20) -number Notice that for IRR you must specify all cash flows, including the time zero cash flow. This is in contrast to the NPV function, in which you specify only the future cash flows 0.235640647 Returns the internal rate ofreturn for a series of cash lows Values is an array or a reference to cells that contain numbers for which you want to calculate the internal rate of return Formula result- 23.56% (2.) How is the IRR on a project related to the YTM on a bond? IRR is an estimate of the project's rate of return, so it is comparable to the YTM on a bond. Constant Cash Flows Year (t ($100) 40 40 40 (100) 40 40 40 IRR = 9.7 % Note: You can use the Rat payments are constant. 90 90 1,090 Similarity to a bond: 5 90 (1,134) 90 90 90 90 90 90 IRR 12.86%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts