Question: any one help me with this? Individual plus group. Assignment on Chapter 12 1. Choose two stocks from two different industries (for example, you may

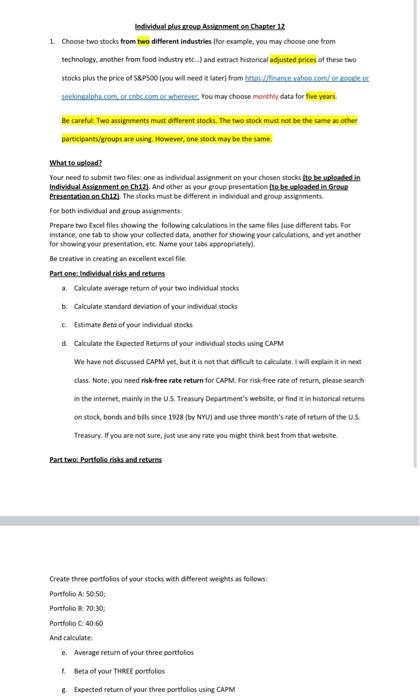

Individual plus group. Assignment on Chapter 12 1. Choose two stocks from two different industries (for example, you may choose one from technology, another from food industry etc..) and extract historical adjusted prices of these two stocks plus the price of S&P500 Iyou will need it later from http://trance yahoo.com/ember seckin alpha com or cnbc.com or whertye. You may choose monthly data for five years. Be careful. Two assignments must afferent stocks. The two stock must not be the same as other participantercups are tine. However, one stock may be the same What to upload? Your need to submit two files one as individual assignment on your chosen stocks to be loaded in Individual Assignment on Chizi. And other as your group presentation to be uploaded in Group Presentation on Chi2). The stocks must be different in individual and group assignments For both individual and group assignments Prepare two Excel files showing the following calculations in the same files (use different tabs. For instance, one tab to show your collected data, another for showing your calculations, and yet another for showing your presentation, etc. Name your tabs appropriately Be creative in creating an excellent excel file. Parton:Individuals and returns Calculate average return of your two individual stocks Calculate standard deviation of your individual stocks Estimate Beto of your individual stocks Calculate the Expected Returns of your individual stocks using CAPM We have not discussed CAPM yet, but it is not that difficult to calculate. I will explain it in next class. Note: you need risk free rate return for CAPM. For risk free rate of retum, please search in the internet, mainly in the US Treasury Department's website, or find it in historical returns on stock bonds and bils since 1928 (by NYU) and use three month's rate of return of the US Treasury. If you are not sure, just use any rate you might think best from that website Part two: Portfolio risks and returns Create three portfolios of your stocks with different weights as follows: Portfolio A: 50:50: Portfolio 8 20:30 Portfolio 40:60 And calculate e. Average return of your three portfolios Beta of your THREE portfolios & Expected return of your three portfolios using CAPM Individual plus group. Assignment on Chapter 12 1. Choose two stocks from two different industries (for example, you may choose one from technology, another from food industry etc..) and extract historical adjusted prices of these two stocks plus the price of S&P500 Iyou will need it later from http://trance yahoo.com/ember seckin alpha com or cnbc.com or whertye. You may choose monthly data for five years. Be careful. Two assignments must afferent stocks. The two stock must not be the same as other participantercups are tine. However, one stock may be the same What to upload? Your need to submit two files one as individual assignment on your chosen stocks to be loaded in Individual Assignment on Chizi. And other as your group presentation to be uploaded in Group Presentation on Chi2). The stocks must be different in individual and group assignments For both individual and group assignments Prepare two Excel files showing the following calculations in the same files (use different tabs. For instance, one tab to show your collected data, another for showing your calculations, and yet another for showing your presentation, etc. Name your tabs appropriately Be creative in creating an excellent excel file. Parton:Individuals and returns Calculate average return of your two individual stocks Calculate standard deviation of your individual stocks Estimate Beto of your individual stocks Calculate the Expected Returns of your individual stocks using CAPM We have not discussed CAPM yet, but it is not that difficult to calculate. I will explain it in next class. Note: you need risk free rate return for CAPM. For risk free rate of retum, please search in the internet, mainly in the US Treasury Department's website, or find it in historical returns on stock bonds and bils since 1928 (by NYU) and use three month's rate of return of the US Treasury. If you are not sure, just use any rate you might think best from that website Part two: Portfolio risks and returns Create three portfolios of your stocks with different weights as follows: Portfolio A: 50:50: Portfolio 8 20:30 Portfolio 40:60 And calculate e. Average return of your three portfolios Beta of your THREE portfolios & Expected return of your three portfolios using CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts