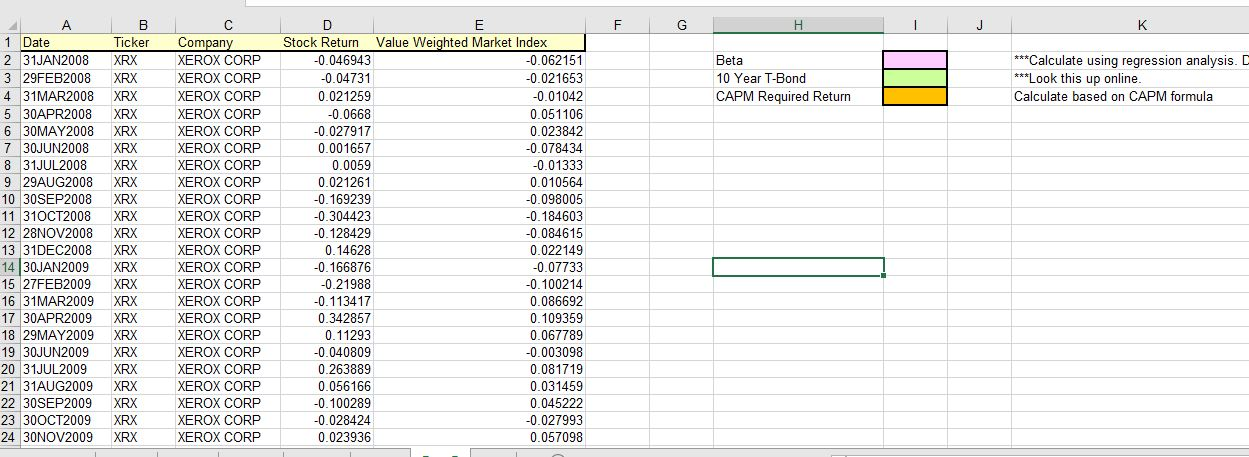

Question: Any tips on how I would start on this spreadsheet. How do I find the 10 year T-Bond? F G J K Beta 10 Year

Any tips on how I would start on this spreadsheet. How do I find the 10 year T-Bond?

F G J K Beta 10 Year T-Bond CAPM Required Return ***Calculate using regression analysis. C ***Look this up online. Calculate based on CAPM formula A 1 Date 2 31JAN2008 3 29FEB2008 4 31MAR 2008 5 30APR2008 6 30MAY 2008 7 30JUN 2008 8 31JUL2008 9 29AUG2008 10 30SEP 2008 11 310CT2008 12 28NOV2008 13 31DEC2008 1430JAN2009 15 27FEB2009 16 31MAR 2009 17 30APR2009 18 29MAY 2009 19 30JUN2009 20 31JUL2009 21 31AUG2009 22 30SEP 2009 23 300CT2009 24 30NOV2009 B Ticker XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX XRX Company XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP XEROX CORP D E Stock Return value Weighted Market Index -0.046943 -0.062151 -0.04731 -0.021653 0.021259 -0.01042 -0.0668 0.051106 -0.027917 0.023842 0.001657 -0.078434 0.0059 -0.01333 0.021261 0.010564 -0.169239 -0.098005 -0.304423 -0.184603 -0.128429 -0.084615 0.14628 0.022149 -0.166876 -0.07733 -0.21988 -0.100214 -0.113417 0.086692 0.342857 0.109359 0.11293 0.067789 -0.040809 -0.003098 0.263889 0.081719 0.056166 0.031459 -0.100289 0.045222 -0.028424 -0.027993 0.023936 0.057098 XRX XRX XRX XRX XRX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts