Question: Any tutor to help? Question 1 Prepare General Journal entries to record the following periodic system merchandising transactions for Safety Merchandising. Use a separate account

Any tutor to help?

Question 1

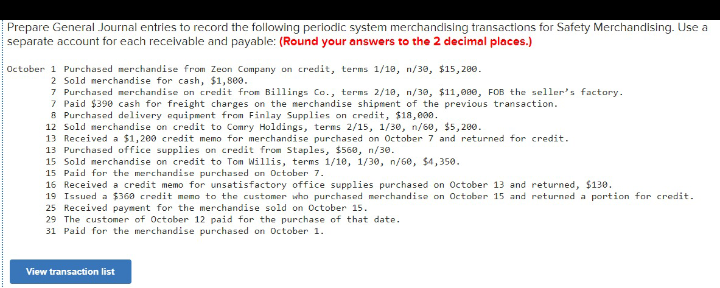

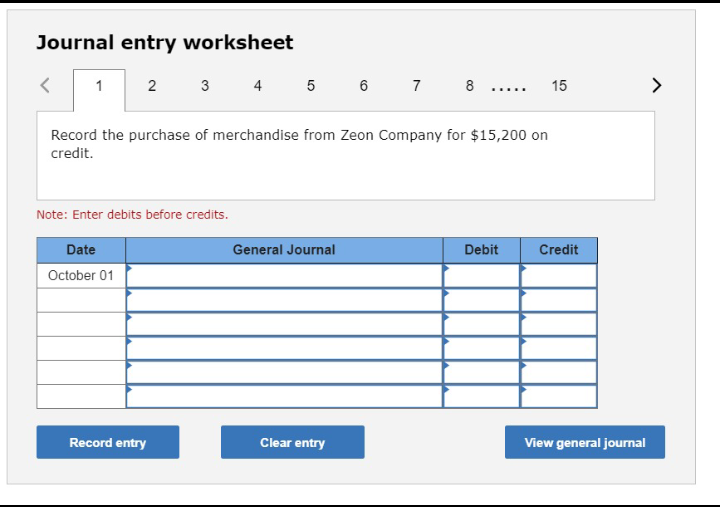

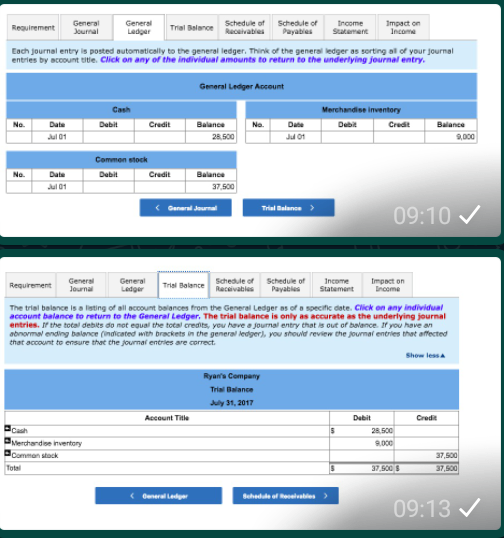

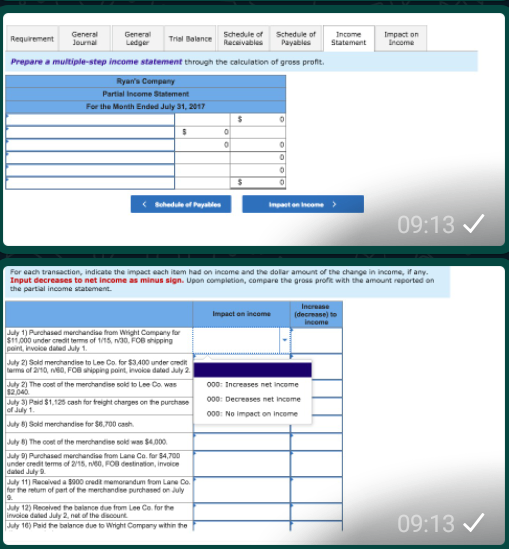

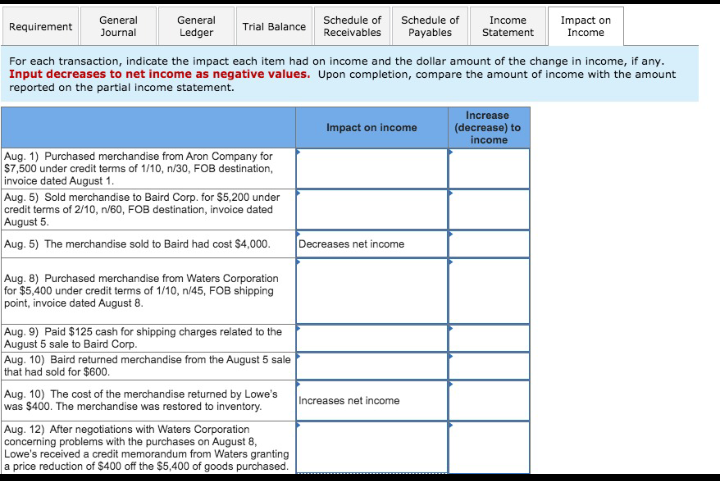

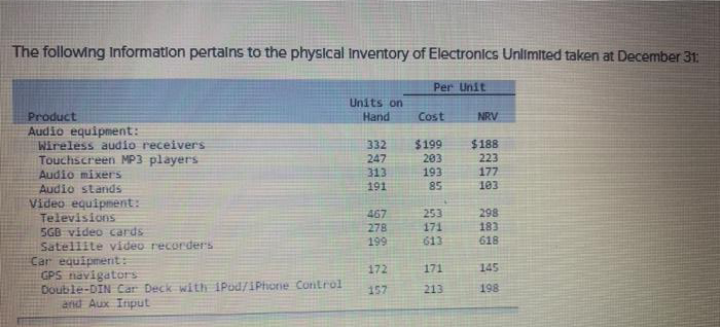

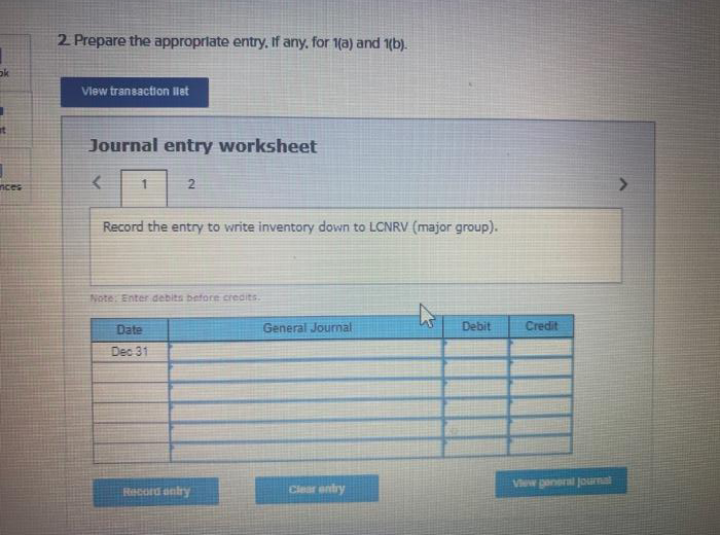

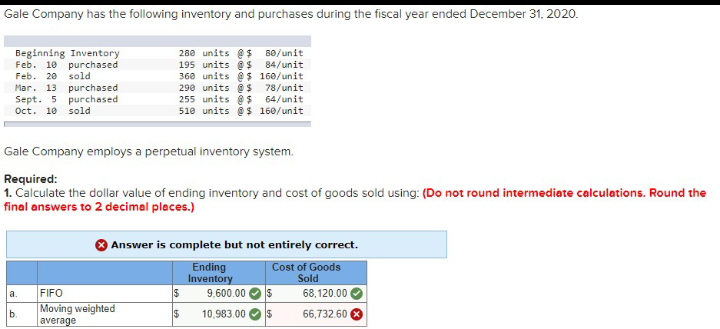

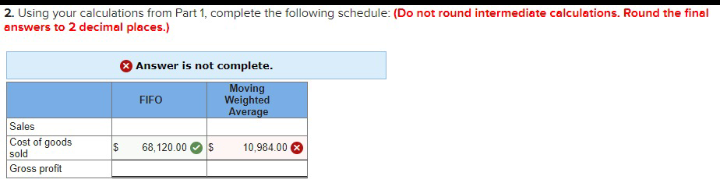

Prepare General Journal entries to record the following periodic system merchandising transactions for Safety Merchandising. Use a separate account for each receivable and payable: (Round your answers to the 2 decimal places.) October 1 Purchased merchandise from Zeon Company on credit, terms 1/10, n/30, $15,206. 2 Sold merchandise for cash, $1, 809. 7 Purchased merchandise on credit from Billings Co., terms 2/10, n/30, $11,080, FOB the seller's factory. 7 Paid $390 cash for freight charges on the merchandise shipment of the previous transaction. 8 Purchased delivery equipment from Finlay Supplies on credit, $18,609. 12 Sold merchandise on credit to Comry Holdings, terms 2/15, 1/30, n/60, $5,290. 13 Received a $1, 260 credit memo for merchandise purchased on October 7 and returned for credit. 13 Purchased office supplies on credit from Staples, $560, n/30. 15 Sold merchandise on credit to Tom Willis, terms 1/10, 1/30, n/60, $4,350. 15 Paid for the merchandise purchased on October 7. 16 Received a credit memo for unsatisfactory office supplies purchased on October 13 and returned, $130. 19 Issued a $360 credit memo to the customer who purchased merchandise on October 15 and returned a portion for credit. 25 Received payment for the merchandise sold on October 15. 29 The customer of October 12 paid for the purchase of that date. 31 Paid for the merchandise purchased on October 1. View transaction listJournal entry worksheet 2 3 4 5 6 7 8 15 Record the purchase of merchandise from Zeon Company for $15,200 on credit. Note: Enter debits before credits. Date General Journal Debit Credit October 01 Record entry Clear entry View general journalGeneral General Schedule of Schedule of Income Impact on Requirement Journal Trial Balance In cord Each journal entry is posted automatically to the general ledger, Think of the general ledger as sorting all of your journal entries by account tide. Click on any of the individual amounts to return to the underlying journal entry. General Ledger Account Cash Merchandise Inventory Credit Balance Na. Crude Balance Jul Of 281500 Jul Of 9,000 Common mock Credit Balance Jul Of 37 500 Trial Balance 09:10 V General Schedule of Income Impact on Requirement General Schedule of Journal Lidger Trial Balance Income The trial balance is a listing of all account balances from the General Ledger as of a specific date. Click on any individual account balance to return to the General Ledger, The trial balance is only as accurate as the underlying journal entries. If the total debits do not equal the total credits, you have a journal entry that is out of balance. If' you have an abroomw ending balance (Indicated with brackets in the general ledger). you should review the journal entries that affected that account to ensure that the journal entries are correct. Show lesia Ryan's Company Trial Balance July 31, 2017 Account Tilla Dabit Crude 5 281500 Merchandise Inventory Common Stock 37,500 37530 8 37,500 09:13 VGeneral Impact on Requirement General Schedule of Income Journal Lidgir Trial Balance Schedule of Statement Prepare a multiple-step income statement through the calculation of gross profit. Ryan's Company Partial Income Statement For the Month Ended July 31, 2017 Schedule ad Payables inpart on home > 09:13 V For gach transaction, indicate the impact each imam had on income and that dollar amount of the change in income, if ary. Input decreases to net Income as minus sign. Upon completion, compare the gross profit with the amount reported on the partial income statement Incruise Impact on income July 1] Purchased marchandian from Wright Company lar $11,000 under credit terms of 1/18, no0. FOB shipping point, boston defend July 1. July 21 Sold merchandise to Lee Co for $3400 under credit Carma of a710, mild, Fou chipping point, Involes dated July 2. July 21 The coot of the merchandise sold to Lee Co. was 000: Increases net Income July 3) Paid $ 1 123 cash for freight charges on the purchase 909: Decreases net Income of July 1. 900 No Impact on Income July 1) Sold merchandise for $6.700 cash. July () The ogot of the merchandise sold was $4003. July D) Purchased marchandian from Lana Co. far 34,700 under creation of 7/18, n40, FOU cortinaion, imacs July 11] Received a $400 credit mamorandom from Lane De. for the chum of part of the merchandise purchased on duty IFa balance due from Les Co. for te not of the diff July 10) Paid the balance due to Wright Company within the 09:13 VGeneral General Schedule of Schedule of Income Impact on Requirement Journal Ledger Trial Balance Receivables Payables Statement Income For each transaction, indicate the impact each item had on income and the dollar amount of the change in income, if any. Input decreases to net income as negative values. Upon completion, compare the amount of income with the amount reported on the partial income statement. Increase Impact on income (decrease) to income Aug. 1) Purchased merchandise from Aron Company for $7,500 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1. Aug. 5) Sold merchandise to Baird Corp. for $5,200 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5. Aug. 5) The merchandise sold to Baird had cost $4,000. Decreases net income Aug. 8) Purchased merchandise from Waters Corporation for $5,400 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8. Aug. 9) Paid $125 cash for shipping charges related to the August 5 sale to Baird Corp. Aug. 10) Baird returned merchandise from the August 5 sale that had sold for $600. Aug. 10) The cost of the merchandise returned by Lowe's was $400. The merchandise was restored to inventory. Increases net income Aug. 12) After negotiations with Waters Corporation concerning problems with the purchases on August 8, Lowe's received a credit memorandum from Waters granting a price reduction of $400 off the $5,400 of goods purchased.The following Information pertains to the physical Inventory of Electronics Unlimited taken at December 31: Per Unit Units on Product Hand Cost NRV Audio equipment: Wireless audio receivers 332 $199 $ 188 Touchscreen MP3 players 247 203 223 Audio mixers 313 193 177 Audio stands 191 85 103 Video equipment: Televisions 467 253 298 5GB video cards 278 171 183 Satellite video recorders 199 613 618 Car equipment: GPS navigators 172 171 145 Double-DIN Car Deck with 1Pod/ iPhone Control 157 213 198 and Aux Input2. Prepare the appropriate entry. If any. for 1(a) and 1(b). View transaction list Journal entry worksheet 2 Record the entry to write inventory down to LCNRV (major group). Note. Enter debits before credits. Date General Journal Debit Credit Dec 31 Clear entry Vher paneral journal Record onlyGale Company has the following inventory and purchases during the fiscal year ended December 31, 2020. Beginning Inventory 280 units 80/unit Feb. 10 purchased 195 units 84/unit Feb. 20 sold 360 units 160/unit Mar. 13 purchased 290 units 78/unit Sept. 5 purchased 255 units 64/unit Oct. 10 sold 510 units @$ 160/unit Gale Company employs a perpetual inventory system. Required: 1. Calculate the dollar value of ending inventory and cost of goods sold using: (Do not round intermediate calculations. Round the final answers to 2 decimal places.) * Answer is complete but not entirely correct. Ending Cost of Goods Inventory Sold al FIFO 9.600.00 $ 68, 120.00 b Moving weighted 10.983.00 $ 66,732.60 average2. Using your calculations from Part 1, complete the following schedule: (Do not round intermediate calculations. Round the final answers to 2 decimal places.) * Answer is not complete. Moving FIFO Weighted Average Sales Cost of goods S 68, 120.00 S sold 10,984.00 x Gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts