Question: Anyone can help me with the solution ? On January 1, 2021, Star Company, following IFRS, sold 5 year bonds. The bonds were dated January

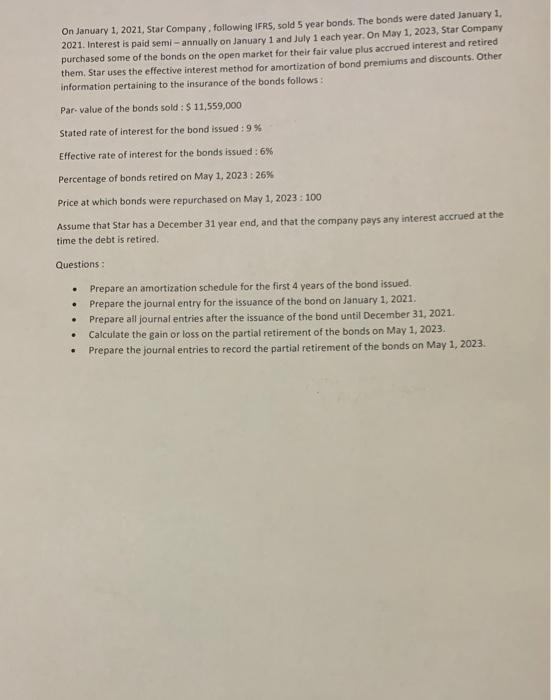

On January 1, 2021, Star Company, following IFRS, sold 5 year bonds. The bonds were dated January 1. 2021. Interest is paid semi-annually on January 1 and July 1 each year. On May 1, 2023, Star Company purchased some of the bonds on the open market for their fair value plus accrued interest and retired them, Star uses the effective interest method for amortization of bond premiums and discounts. Other information pertaining to the insurance of the bonds follows: Par value of the bonds sold: $ 11,559,000 Stated rate of interest for the bond issued : 9 % Effective rate of interest for the bonds issued : 6% Percentage of bonds retired on May 1, 2023:26% Price at which bonds were repurchased on May 1, 2023: 100 Assume that Star has a December 31 year end, and that the company pays any interest accrued at the time the debt is retired. Questions: . . . Prepare an amortization schedule for the first 4 years of the bond issued. Prepare the journal entry for the issuance of the bond on January 1, 2021. Prepare all journal entries after the issuance of the bond until December 31, 2021. Calculate the gain or loss on the partial retirement of the bonds on May 1, 2023. Prepare the journal entries to record the partial retirement of the bonds on May 1, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts