Question: anyone can help me with these problems(Req1A-Req4)?...Also please write clearly and make sure every column can be seen. thank you in advance:)! PA8-2 (Algo) Interpreting

![Interpreting Disclosure of Allowance for Doubtful Accounts (LO 8-2] 27 16 2016](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e74f3bcfec6_13166e74f3b71cdd.jpg)

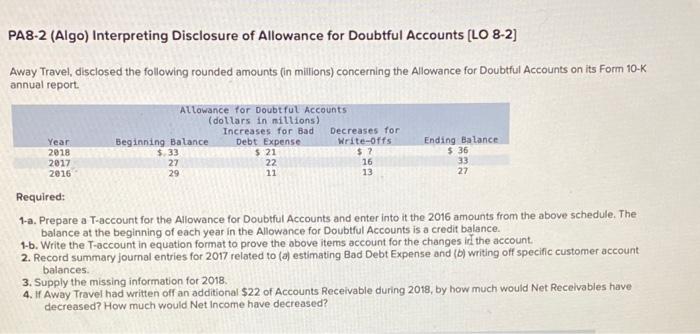

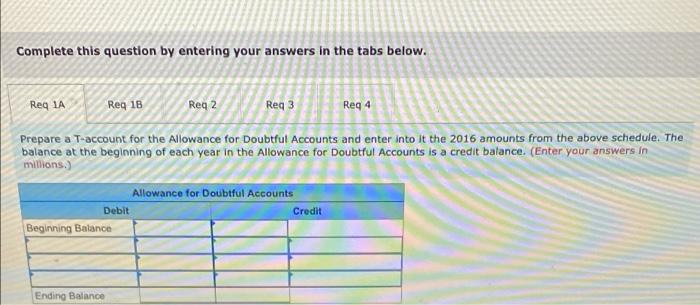

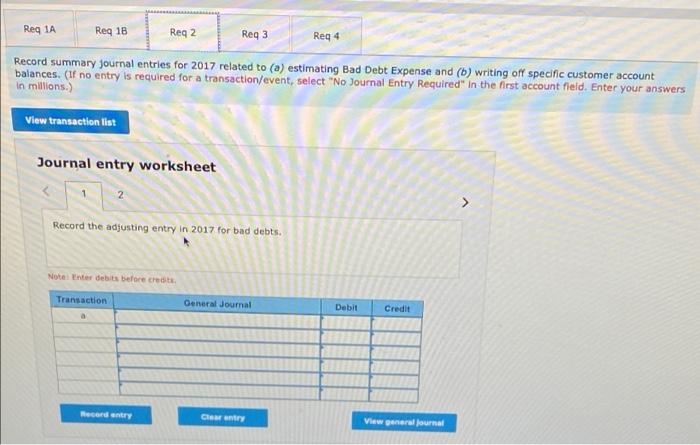

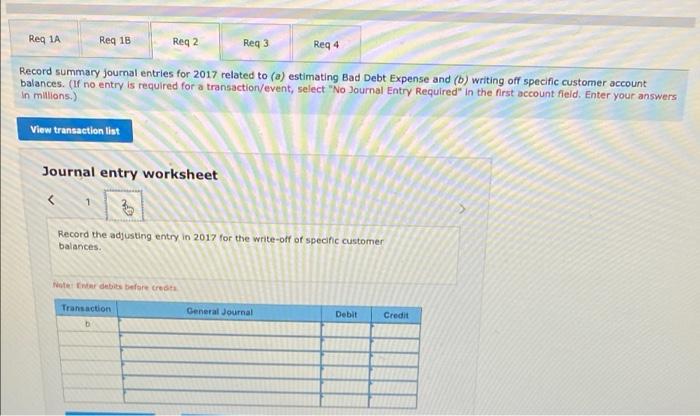

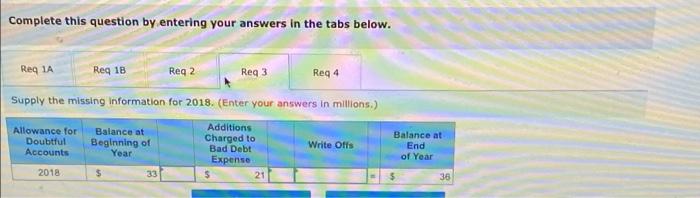

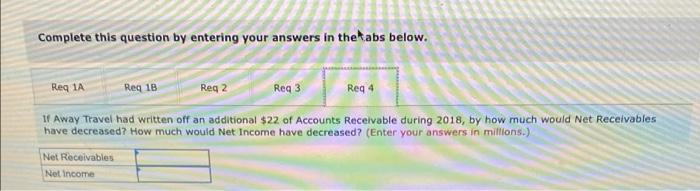

PA8-2 (Algo) Interpreting Disclosure of Allowance for Doubtful Accounts (LO 8-2] 27 16 2016 Away Travel, disclosed the following rounded amounts (in millions) concerning the Allowance for Doubtful Accounts on its Form 10-K annual report. Allowance for Doubtful Accounts (dollars in millions) Increases for Bad Decreases for Year Beginning Balance Debt Expense Write-offs Ending Balance 2018 $ 33 $ 21 $? $36 2017 22 33 29 11 13 27 Required: 1-a. Prepare a T-account for the Allowance for Doubtful Accounts and enter into it the 2016 amounts from the above schedule. The balance at the beginning of each year in the Allowance for Doubtful Accounts is a credit balance. 1-b. Write the T-account in equation format to prove the above items account for the changes id the account. 2. Record summary journal entries for 2017 related to (a) estimating Bad Debt Expense and (b) writing off specific customer account balances 3. Supply the missing information for 2018 4. If Away Travel had written off an additional $22 of Accounts Receivable during 2018, by how much would Net Receivables have decreased? How much would Net Income have decreased? Complete this question by entering your answers in the tabs below. Reg 1A Reg 16 Req 2 Req3 Reg 4 Prepare a T-account for the Allowance for Doubtful Accounts and enter into it the 2016 amounts from the above schedule. The balance at the beginning of each year in the Allowance for Doubtful Accounts is a credit balance. (Enter your answers in millions.) Allowance for Doubtful Accounts Debit Beginning Balance Credit Ending Balance Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 Reg 2 Req3 Reg 4 Write the T-account in equation format to prove the above items account for the changes in the account. (Enter your answers in miliona.) Beginning Balance Ending Balance Reg 1A Reg 1B Reg 2 Reg 3 Reg 4 Record summary journal entries for 2017 related to (a) estimating Bad Debt Expense and (b) writing off specific customer account balances. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers In millions.) View transaction list Journal entry worksheet > Record the adjusting entry in 2017 for bad debts. Note Enter debits before create Transaction General Journal Debit Credit Mecordantry Com View general Journal Reg 1A Req 18 Reg 2 Req3 Reg 4 Record summary journal entries for 2017 related to (a) estimating Bad Debt Expense and (b) writing off specific customer account balances. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field. Enter your answers In millions.) View transaction list Journal entry worksheet Record the adjusting entry in 2017 for the write-off of specific customer balances Notrebbero Transaction General Journal Debit Credit Complete this question by entering your answers in the tabs below. Req1A Req 18 Reg 2 Reg 3 Reg 4 Supply the missing Information for 2018. (Enter your answers in millions.) Allowance for Balance at Additions Doubtful Beginning of Charged to Write Offs Accounts Year Bad Debt Expense 2018 $ 33 21 Balance at End of Year 36 Complete this question by entering your answers in the abs below. Req 1A Req 18 Reg 2 Reg 3 Req4 If Away Travel had written off an additional $22 of Accounts Receivable during 2018, by how much would Net Receivables have decreased? How much would Net Income have decreased? (Enter your answers in millions.) Net Receivables Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts