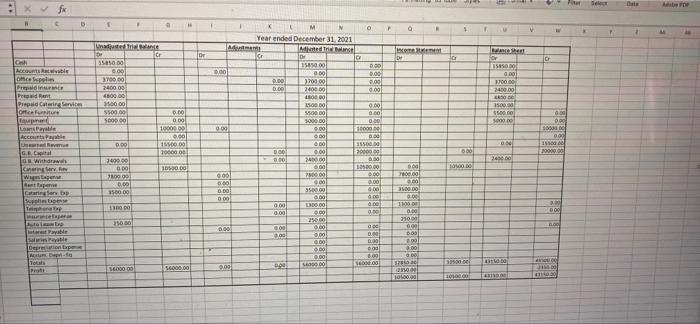

Question: anyone can help pls x fx C R D Ca Accounts Receivable Office Supplies Prepaid Insurance Prepaid Rent Prepaid Catering Services Office Furniture Rasponent Loans

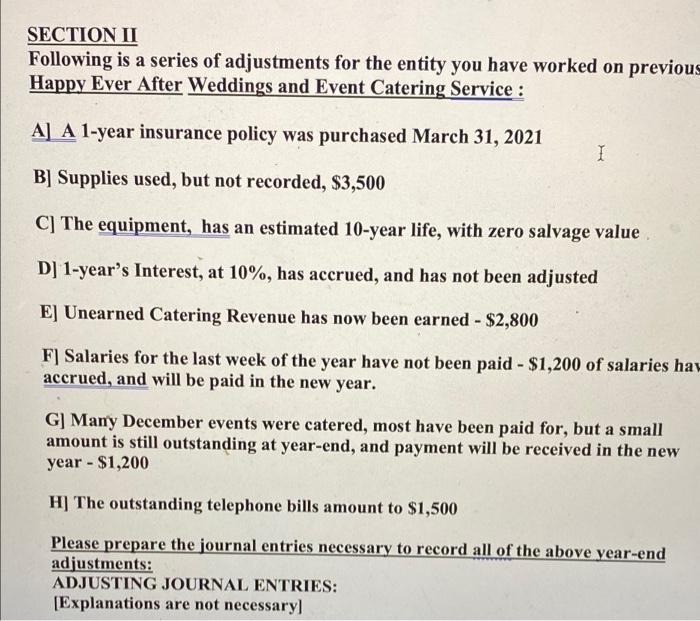

x fx C R D Ca Accounts Receivable Office Supplies Prepaid Insurance Prepaid Rent Prepaid Catering Services Office Furniture Rasponent Loans Payable Accounts Payable Uneared Revere GB Capital 20 Worden GB Withdrawa Canering Serv Wag Expense Rent Expense Cataring Serv Exp Supplies Expense Telphoxp Marance Exper Auto La Exp Interest Payable Salaries Payable Depreciation Expense Acum Dept-g Totals Prot My Unadjusted Trial Balance Dr cr 35850.00 0.00 $700.00 2400 00 480000 100 1500.00 $500.00 5000.00 0.00 3400.00 6.00 Poo bone 6.00 150000 130000 250.00 . 16000 00 G M. 0.00 0.00 10000 00 0.00 15500.00 30000.00 10500.00 56000.00 Dr 1 8.00 1000 Adortments 0.00 0.00 0.00 0.00 0.00 I 0.00 Year ended December 31, 2021 Adoted Trial Balance Dr Cr 0.00 0.00 0.00 0.00 0.00 0.00 8.00 3.00 ada 15850.00 0.00 1700 00 240000 4800 00 150000 5500 00 5000.00 0:00 0.00 6.00 16:00 0.00 2400.00 6.00 7500.00 4.00 3500.00 0.00 1.300.00 6.00 25000 0.00 0,00 00 0.00 0.00 54000 00 la 0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10000 0.00 15500.00 20000.00 0.00 10600.00 0.00 0.00 0:00 000 4.00 0.00 300 0.00 0.00 Dad 6.00 $6000.00 P cometement D 0.00 7000.00 0.00 3500.00 4:00 1300 0.00 210.00 0.00 0.00 8.00 0.00 000 $2850 ac R 35000 10500.00 a 1 6.00 1050000 10100.00 F M Balance Sheet for 15850.00 0.00 3700.00 2400.00 48000 1500.00 $500.00 500000 0.00 240000 43110.00 43110.00 V CF 6.00 0.00 10000 0.00 1550000 20000.00 3.30 0.00 Fir 400 431400 X Select P Dat 2 Aibe For SECTION II Following is a series of adjustments for the entity you have worked on previous Happy Ever After Weddings and Event Catering Service : A] A 1-year insurance policy was purchased March 31, 2021 B] Supplies used, but not recorded, $3,500 C] The equipment, has an estimated 10-year life, with zero salvage value D] 1-year's Interest, at 10%, has accrued, and has not been adjusted E] Unearned Catering Revenue has now been earned - $2,800 F] Salaries for the last week of the year have not been paid - $1,200 of salaries hav accrued, and will be paid in the new year. I G] Many December events were catered, most have been paid for, but a small amount is still outstanding at year-end, and payment will be received in the new year - $1,200 H] The outstanding telephone bills amount to $1,500 Please prepare the journal entries necessary to record all of the above year-end adjustments: ADJUSTING JOURNAL ENTRIES: [Explanations are not necessary]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts