Question: anyone know how to do it in excel with steps A B D E F G H 1 ) K L M 2 3 4

anyone know how to do it in excel with steps

anyone know how to do it in excel with steps

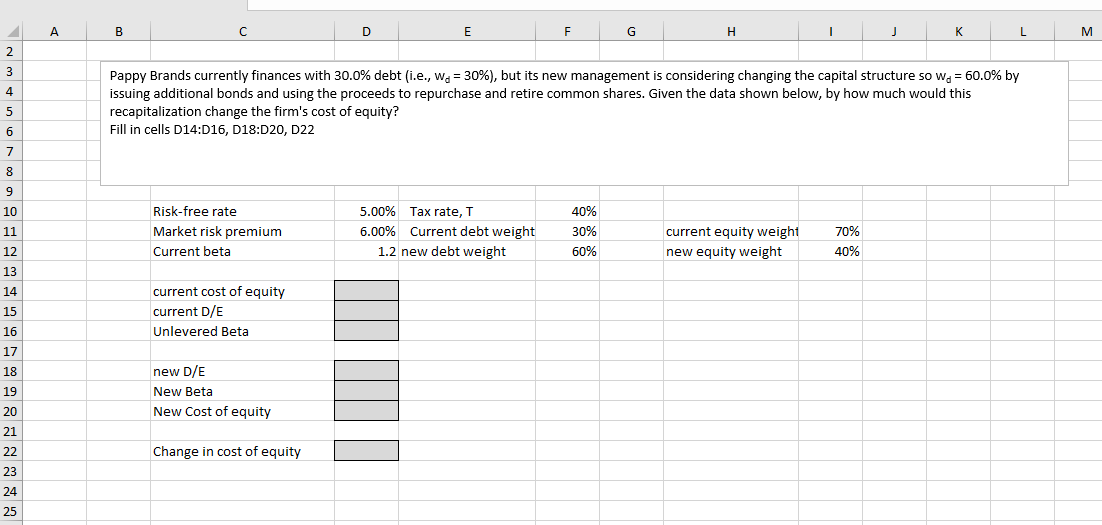

A B D E F G H 1 ) K L M 2 3 4 5 Pappy Brands currently finances with 30.0% debt i.e., W, = 30%), but its new management is considering changing the capital structure so wg = 60.0% by issuing additional bonds and using the proceeds to repurchase and retire common shares. Given the data shown below, by how much would this recapitalization change the firm's cost of equity? Fill in cells D14:016, D18:D20, D22 6 7 8 9 10 11 Risk-free rate Market risk premium Current beta 5.00% Tax rate, T 6.00% Current debt weight 1.2 new debt weight 40% 30% 60% current equity weight new equity weight 70% 40% 12 13 14 15 current cost of equity current D/E Unlevered Beta 16 17 18 19 new D/E New Beta New Cost of equity 20 21 22 Change in cost of equity 23 24 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts