Question: anyone know how to do it in step by step A B C D E F G H K L M N 1 2 3

anyone know how to do it in step by step

anyone know how to do it in step by step

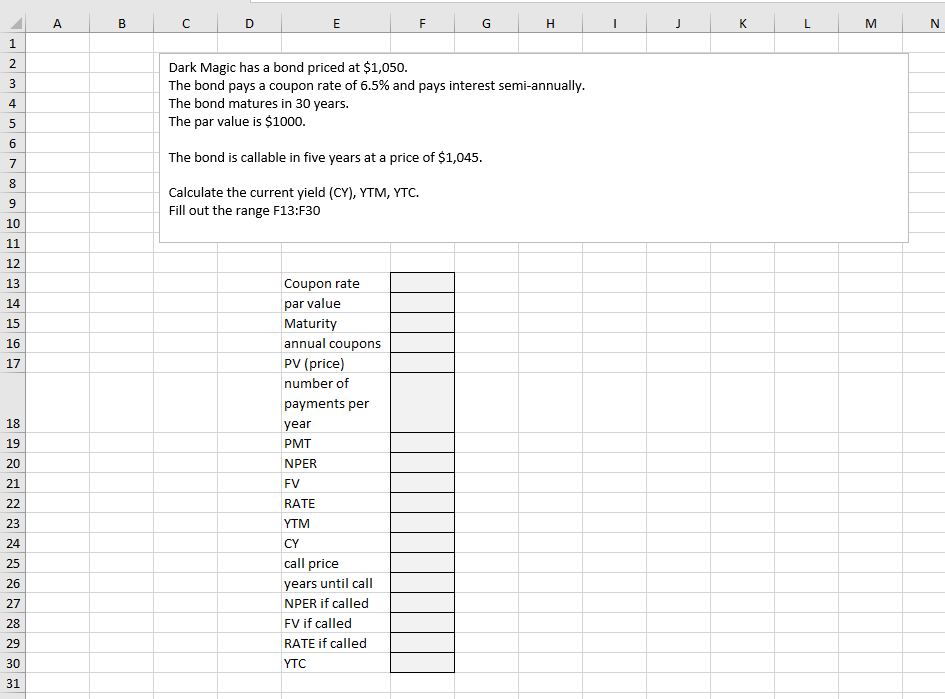

A B C D E F G H K L M N 1 2 3 Dark Magic has a bond priced at $1,050. The bond pays a coupon rate of 6.5% and pays interest semi-annually. The bond matures in 30 years. The par value is $1000. 4 5 6 The bond is callable in five years at a price of $1,045. 7 8 9 Calculate the current yield (CY), YTM, YTC. Fill out the range F13:F30 10 11 12 13 14 15 16 17 Coupon rate par value Maturity annual coupons PV (price) number of payments per year PMT 18 19 20 NPER 21 FV 22 RATE 23 YTM 24 25 26 27 CY call price years until call NPER if called FV if called RATE if called YTC 28 29 30 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts