Question: anyone know how to do it? thanks Question 19 (5 points) Franz Gelblum, an analyst following both Zimt and oxbow, is curious how the increased

anyone know how to do it? thanks

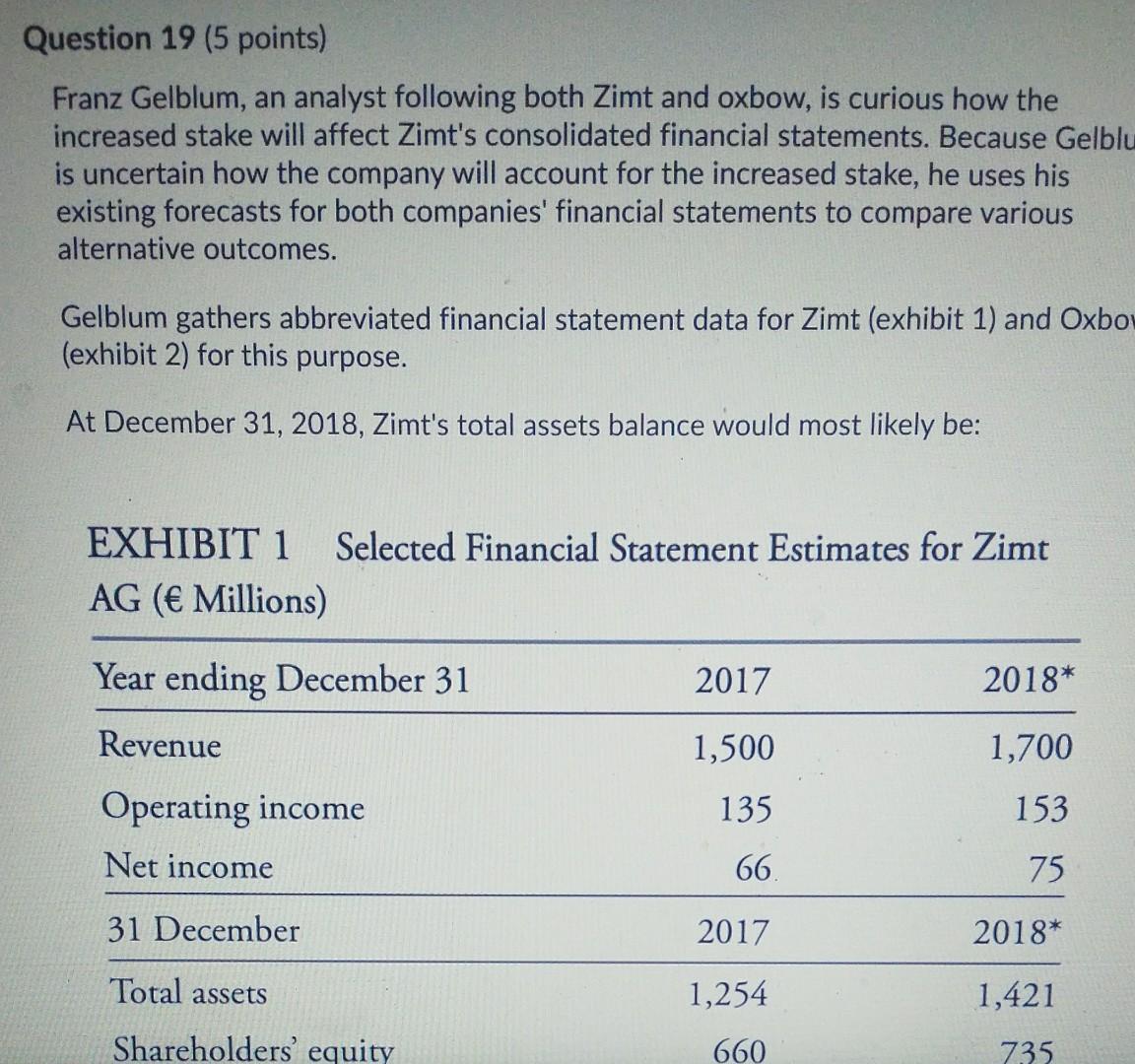

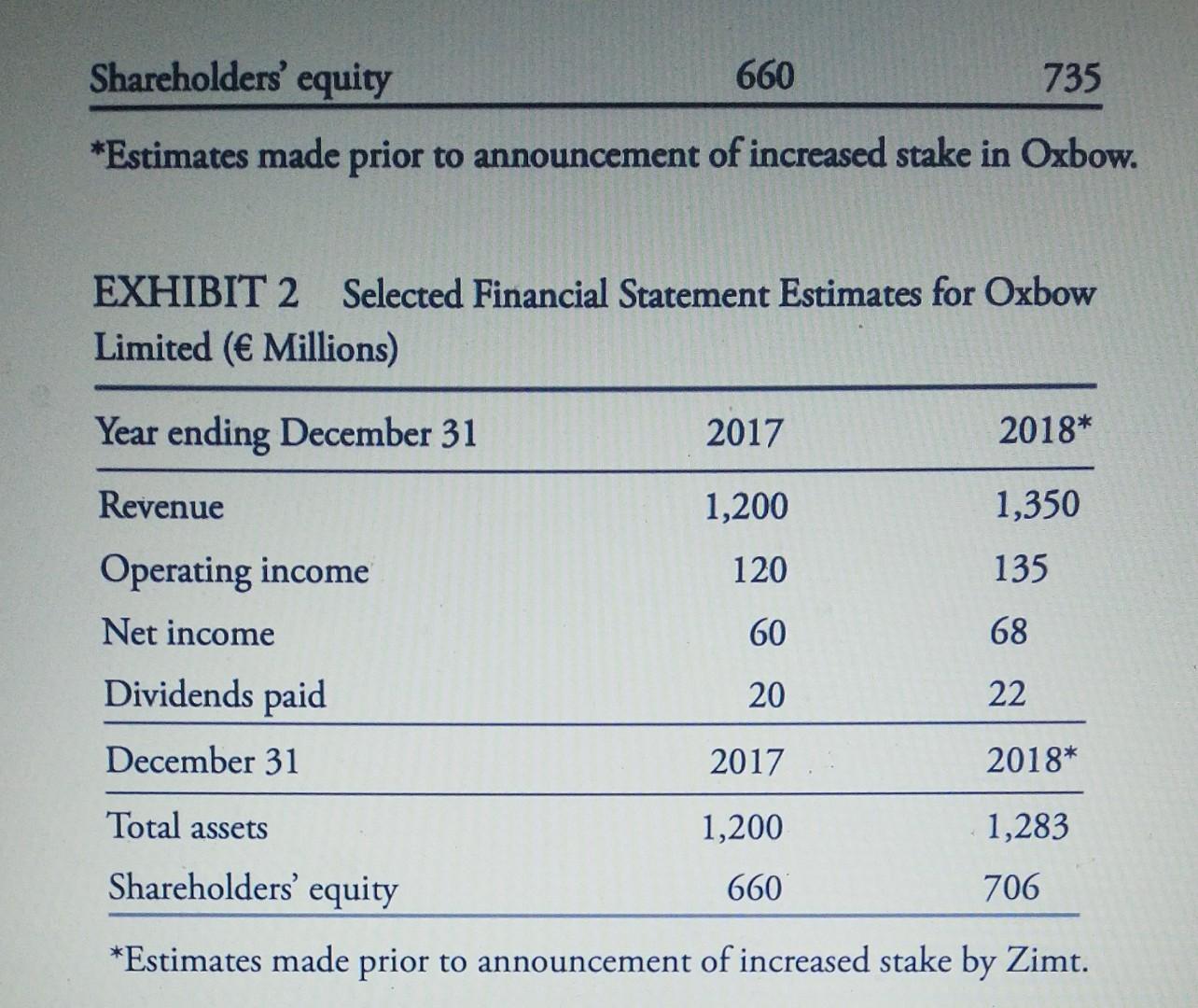

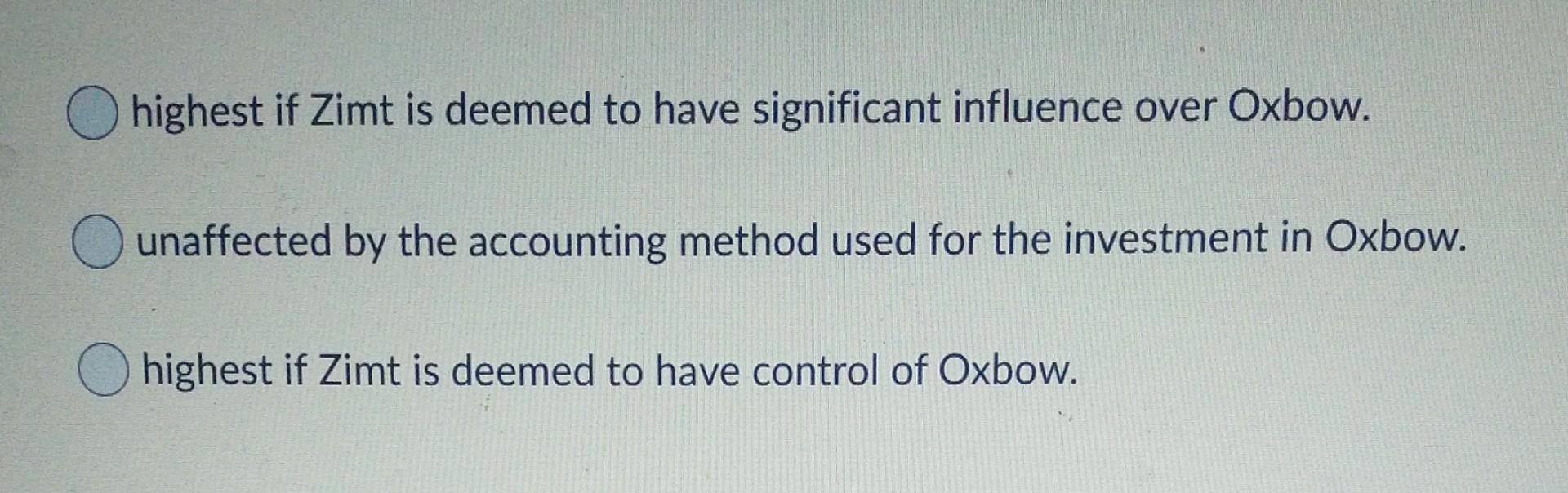

Question 19 (5 points) Franz Gelblum, an analyst following both Zimt and oxbow, is curious how the increased stake will affect Zimt's consolidated financial statements. Because Gelblu is uncertain how the company will account for the increased stake, he uses his existing forecasts for both companies' financial statements to compare various alternative outcomes. Gelblum gathers abbreviated financial statement data for Zimt (exhibit 1) and Oxbo (exhibit 2) for this purpose. At December 31, 2018, Zimt's total assets balance would most likely be: EXHIBIT 1 Selected Financial Statement Estimates for Zimt AG ( Millions) 2017 2018* 1,500 1,700 Year ending December 31 Revenue Operating income Net income 135 153 66. 75 31 December 2017 2018* Total assets 1,254 1,421 Shareholders' equity 660 735 Shareholders' equity 660 735 * Estimates made prior to announcement of increased stake in Oxbow. EXHIBIT 2 Selected Financial Statement Estimates for Oxbow Limited ( Millions) Year ending December 31 2017 2018* Revenue 1,200 1,350 Operating income 120 135 Net income 60 68 Dividends paid 20 22 December 31 2017 2018* 1,200 1,283 Total assets Shareholders' equity 660 706 *Estimates made prior to announcement of increased stake by Zimt. highest if Zimt is deemed to have significant influence over Oxbow. O unaffected by the accounting method used for the investment in Oxbow. O highest if Zimt is deemed to have control of Oxbow. Question 19 (5 points) Franz Gelblum, an analyst following both Zimt and oxbow, is curious how the increased stake will affect Zimt's consolidated financial statements. Because Gelblu is uncertain how the company will account for the increased stake, he uses his existing forecasts for both companies' financial statements to compare various alternative outcomes. Gelblum gathers abbreviated financial statement data for Zimt (exhibit 1) and Oxbo (exhibit 2) for this purpose. At December 31, 2018, Zimt's total assets balance would most likely be: EXHIBIT 1 Selected Financial Statement Estimates for Zimt AG ( Millions) 2017 2018* 1,500 1,700 Year ending December 31 Revenue Operating income Net income 135 153 66. 75 31 December 2017 2018* Total assets 1,254 1,421 Shareholders' equity 660 735 Shareholders' equity 660 735 * Estimates made prior to announcement of increased stake in Oxbow. EXHIBIT 2 Selected Financial Statement Estimates for Oxbow Limited ( Millions) Year ending December 31 2017 2018* Revenue 1,200 1,350 Operating income 120 135 Net income 60 68 Dividends paid 20 22 December 31 2017 2018* 1,200 1,283 Total assets Shareholders' equity 660 706 *Estimates made prior to announcement of increased stake by Zimt. highest if Zimt is deemed to have significant influence over Oxbow. O unaffected by the accounting method used for the investment in Oxbow. O highest if Zimt is deemed to have control of Oxbow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts