Question: Anyone know how to do this question in excel or show calculations? 3. Risk Management, Duration, and Converity - 40 points Consider the following three

Anyone know how to do this question in excel or show calculations?

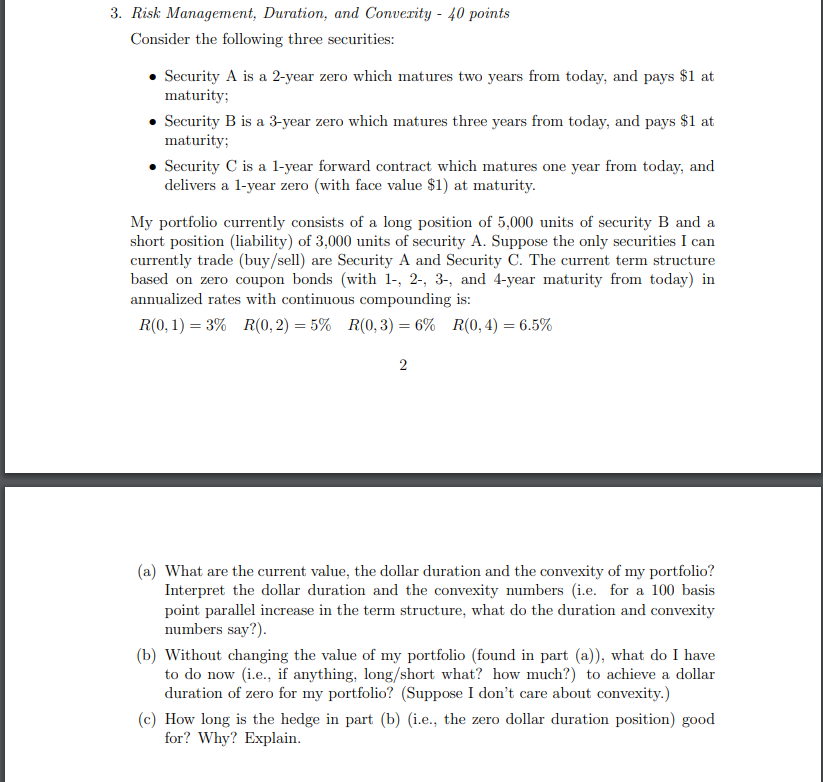

3. Risk Management, Duration, and Converity - 40 points Consider the following three securities: Security A is a 2-year zero which matures two years from today, and pays $1 at maturity; Security B is a 3-year zero which matures three years from today, and pays $1 at maturity; Security C is a 1-year forward contract which matures one year from today, and delivers a 1-year zero (with face value $1) at maturity. My portfolio currently consists of a long position of 5,000 units of security B and a short position (liability) of 3,000 units of security A. Suppose the only securities I can currently trade (buy/sell) are Security A and Security C. The current term structure based on zero coupon bonds (with 1-, 2-, 3-, and 4-year maturity from today) in annualized rates with continuous compounding is: R(0,1)= 3% R(0,2) = 5% R(0,3) = 6% R(0,4) = 6.5% 2 (a) What are the current value, the dollar duration and the convexity of my portfolio? Interpret the dollar duration and the convexity numbers (i.e. for a 100 basis point parallel increase in the term structure, what do the duration and convexity numbers say?). (b) Without changing the value of my portfolio (found in part (a)), what do I have to do now i.e., if anything, long/short what? how much?) to achieve a dollar duration of zero for my portfolio? (Suppose I don't care about convexity.) (c) How long is the hedge in part (b) (i.e., the zero dollar duration position) good for? Why? Explain. 3. Risk Management, Duration, and Converity - 40 points Consider the following three securities: Security A is a 2-year zero which matures two years from today, and pays $1 at maturity; Security B is a 3-year zero which matures three years from today, and pays $1 at maturity; Security C is a 1-year forward contract which matures one year from today, and delivers a 1-year zero (with face value $1) at maturity. My portfolio currently consists of a long position of 5,000 units of security B and a short position (liability) of 3,000 units of security A. Suppose the only securities I can currently trade (buy/sell) are Security A and Security C. The current term structure based on zero coupon bonds (with 1-, 2-, 3-, and 4-year maturity from today) in annualized rates with continuous compounding is: R(0,1)= 3% R(0,2) = 5% R(0,3) = 6% R(0,4) = 6.5% 2 (a) What are the current value, the dollar duration and the convexity of my portfolio? Interpret the dollar duration and the convexity numbers (i.e. for a 100 basis point parallel increase in the term structure, what do the duration and convexity numbers say?). (b) Without changing the value of my portfolio (found in part (a)), what do I have to do now i.e., if anything, long/short what? how much?) to achieve a dollar duration of zero for my portfolio? (Suppose I don't care about convexity.) (c) How long is the hedge in part (b) (i.e., the zero dollar duration position) good for? Why? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts